CHICAGO — Bally’s Corp. (NYSE: BALY) has released an updated permanent site plan for its $1.7 billion casino project in Chicago, a redevelopment of the former Chicago Tribune printing plant that will now be developed in a single phase. The property is located at 777 W. Chicago Ave. in the city’s River West neighborhood. Project plans now include a 34-story, 500-room hotel tower situated at the southern end of the 30-acre gaming and entertainment destination. The hotel — which was initially expected to be located elsewhere in the development — will feature a pool, spa, fitness center, sundeck and rooftop restaurant and bar. In addition to the hotel, the Bally’s Chicago Casino will include a 3,000-seat theater, six restaurants, a food hall and a two-acre public park. The casino will comprise 3,300 slot machines, 173 table games and VIP gaming areas. Additionally, a 2,000-foot extension of the riverwalk will connect the property to the riverbank. Design firm HKS prepared the new renderings. In May 2022, Bally’s was selected over competitors including Hard Rock International and Rush Street Gaming as the preferred developer of the project. Bally’s took possession of the land last week, and Brandenburg Industrial Service Co. is now preparing the …

Midwest

CHESTERFIELD, MO. — Keystone Construction Co. will build the new $60 million CarShield Sportsplex AAA Hockey & Futbol facility in the St. Louis suburb of Chesterfield. The development will accommodate the growing CarShield AAA Hockey & Futbol clubs, which serve more than 500 children and 45 teams in metro St. Louis. The 325,000-square-foot facility will offer four indoor turf soccer fields, two indoor ice rinks, team locker rooms, a pro shop, training and fitness spaces, a restaurant, bar, concessions and classrooms. Outside, there will be three turf soccer fields, concessions, a dining patio and children’s playground. Construction is scheduled to begin in October and wrap up in January 2026. The project team includes civil engineer Stock & Associates and architect Gray Design Group.

O’FALLON, MO. — CBRE has brokered the sale of Avenue64, a 316-unit apartment complex in the St. Louis suburb of O’Fallon. The sales price was undisclosed. Built in 2022, the Class A property features a range of floor plans averaging 993 square feet. Amenities include a pool, hot tub, courtyard, coffee bar, fitness center, conference room, community grilling areas and outdoor game area. Hannah Ott, George Tikijian, Matt Bukhshtaber, Cam Benz, Claire Bullard and Ryan Stockamp of CBRE represented the seller, Thompson Thrift. Oregon-based Bonaventure was the buyer.

CHICAGO — Ryan Cos. US Inc. has formed a joint venture with Washington Capital Management Inc. to build a 170,000-square-foot speculative industrial facility at Pullman Crossings in Chicago. Pullman Crossings is a 50-acre industrial park that is part of Pullman Park, a 180-acre mixed-use project being developed by Chicago Neighborhood Initiatives. The new facility marks Ryan’s third phase of Pullman Crossings with the fourth and final phase expected to kick off later this year. The 10-acre site is located in the historic Pullman neighborhood near I-57. The building will feature outdoor eating areas, exterior bike racks, ESFR fire protection and a clear height of 32 feet in the warehouse. Ryan is serving as developer and builder. Bankers Trust Co. is providing construction financing. Completion is slated for the first quarter of 2025. Since 2017, Ryan has developed and built three industrial facilities totaling 685,000 square feet at Pullman Crossings, including a Whole Foods Market distribution center, a SC Johnson warehouse and an Amazon last-mile distribution center.

TROY AND ROCHESTER HILLS, MICH. — JLL Capital Markets has arranged the sale of Anthology of Troy and Anthology of Rochester Hills, two seniors housing communities totaling 184 units in metro Detroit. The sales price was undisclosed. Jay Wagner, Rick Swartz and Jim Dooley of JLL represented the seller and procured the buyer, spearheaded by MedCore Partners. American House Senior Living Communities assumed management of both properties. Anthology of Troy now operates as American House Somerset. The 93-unit community was built in 2017. Anthology of Rochester Hills now operates as American House Hampton Village. The 91-unit property was completed in 2018.

CHICAGO — Expansive, a flexible workspace solutions provider, has opened its newest location at 3838 N. Ravenswood Ave. in Chicago. Co-developed by Landrosh Development and Macon Construction, the apartment and office property is named The Opus Chicago. The building is situated between the Lincoln Square and Roscoe Village neighborhoods and is 1.5 miles from Wrigley Field. The first two floors of the property are dedicated to modern, flexible workspaces. Expansive operates nearly 4 million square feet of workspace for owned properties and landlord partners with over 40 locations across 32 U.S. cities.

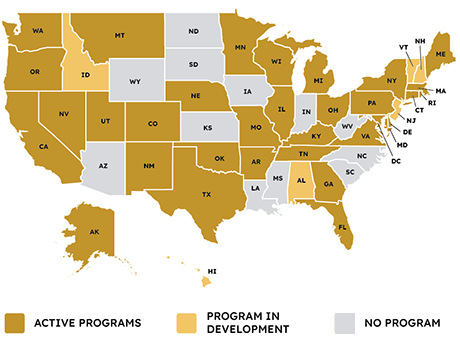

It may have taken more than a decade, but after starting out as a niche financing vehicle to create more energy-efficient and resilient buildings, the commercial property assessed clean energy (C-PACE) program has arguably achieved mainstream acceptance. Roughly 40 states and Washington, D.C., now either offer or are developing C-PACE programs. Over the last year alone, Georgia, Hawaii, New Mexico, Minnesota and Idaho passed legislation enabling or substantially improving the financing tool, points out Rafi Golberstein, CEO of PACE Loan Group, a direct lender of C-PACE headquartered in Minneapolis, Minn. What’s more, he adds, New Jersey and North Carolina are among states that in the coming months are expected to advance bills authorizing the use of C-PACE, or PACE for short. Given the current partisanship within the country, one of the most revealing characteristics of PACE’s growing appeal has been its ability to cross the political aisle, Golberstein observed. PACE’s popularity in particular has ascended over the last several months as developers have sought fresh capital to enhance their financial flexibility in a rising interest rate environment. “PACE is really turning out to be a bipartisan issue, as many state lawmakers are realizing that it is a great financing tool …

KANSAS CITY AND ST. LOUIS — Pearlmark has provided a $15.5 million mezzanine debt investment for the refinancing of a 10-property industrial portfolio in metro Kansas City and St. Louis. The warehouse and light industrial assets total 1.9 million square feet and are fully leased. Five properties are located in metro Kansas City and five are in metro St. Louis. The assets were constructed between 1994 and 2021. Pearlmark made the investment on behalf of Pearlmark Mezzanine Realty Partners V LP. An entity managed by Argentic Investment Management LLC provided the senior loan. SparrowHawk owns the portfolio. Brian Walsh of JLL arranged the financing on behalf of SparrowHawk. Mark Witt led the transaction on an internal basis for Pearlmark.

PACE Loan Group Originates $7.1M C-PACE Loan for Construction of Senior Living Facility in Minnesota

ST. FRANCIS, MINN. — PACE Loan Group has provided a $7.1 million C-PACE loan for the construction of Vista Prairie at Eagle Pointe, a 134-unit senior living community in St. Francis, a northern suburb of Minneapolis. The 20-year loan complements a $30 million qualified tax-exempt loan on the project using Series 2023A Bonds with Sunrise Bank as the senior lender. Located at 23440 Ambassador Blvd., the property will feature 49 independent living units, 43 assisted living units, 24 memory care units and eight care suites. Completion is slated for 2025. Total project costs are estimated at $47.6 million. The PACE proceeds will be used to finance energy conservation and renewable energy measures, including the building envelope, Energy Star windows, HVAC, high-efficiency plumbing and lighting systems and controls. The renewable and energy conservation measures are expected to save $368,613 annually with payback in 20 years. Vista Prairie Communities is both the property manager and services provider for the project. Additional project partners include Pope Architects and Bauer Design Build.

CHICAGO — Interra Realty has brokered the sales of two multifamily properties in Chicago. The first transaction was an eight-unit building at 5130 S. Greenwood Ave. in the Hyde Park neighborhood that sold for $2.9 million. The second was a 17-unit property at 6251 N. Talman Ave. in the West Ridge neighborhood that sold for $2.2 million. Brad Feldman of Interra represented the Greenwood buyer, a local private investor, and the seller, Barnett Capital. Feldman also procured the buyer of the Talman property, a local private investor. Feldman and colleague Kevin Rahmanim represented the seller, a local family-owned limited liability company. Greenwood was built in 1911 and rehabbed in 2020. The building was fully occupied at the time of sale. Talman was built in 1955 and was fully occupied at the time of sale. The buyer plans to renovate all units and add a bedroom to select units.