WOODRIDGE, ILL. — Krusinski Construction Co. has completed the build-out of a 66,000-square-foot interior warehouse space on behalf of J&P Warehousing and Tardella Foods in the Chicago suburb of Woodridge. J&P Warehousing is a third-party logistics firm and will serve its food-and-beverage client, Tardella Foods, out of the Woodridge facility at 2250 W. 75th St. Krusinski previously completed construction of the building, a 100,400-square-foot facility, on behalf of developer Molto Properties. The interior build-out included minor office modifications, installing a demising wall to separate the J&P Warehousing space from the adjacent 34,400-square-foot tenant space. Krusinski also separated gas and electrical services to accommodate the multi-tenant property. Additional project elements consisted of installing tenant-specific electrical and HVAC equipment, including a charging station for electric pallet jacks and an air compressor. Harris Architects designed the building.

Midwest

PORTAGE, WIS. — Brisky Net Lease has brokered the $3.6 million sale of a Festival Foods-occupied retail property in Portage, a city in central Wisconsin. The single-tenant, net-leased grocery asset is located at 2915 New Pinery Road along US Highway 51. Brian Brisky of Brisky Net Lease represented the seller, a REIT. The buyer was also a REIT. Festival Foods, a family-owned company, operates roughly 40 locations in Wisconsin.

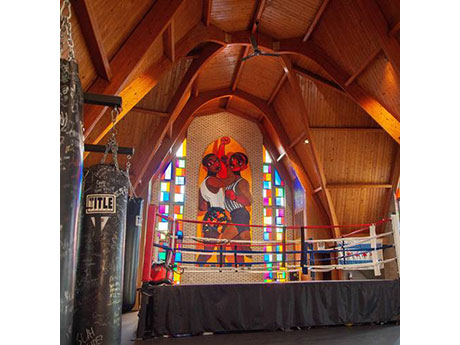

CHICAGO — Summit Design + Build has begun Phase III of interior renovations for The Bloc, a nonprofit in Chicago. The Bloc is a boxing club that also provides training, tutoring and mentorship to guide youth toward academic, social and athletic achievements. Summit has completed two phases of renovations, including major upgrades to the building’s mechanical systems, a full kitchen remodel and other finishes of the space. The third phase includes flooring upgrades, electrical repairs and the reconfiguration of restroom plumbing, fixtures and layouts. Future Film is the architect.

SOUTHGATE, MICH. — Embers Coffee Co. has signed a 4,500-square-foot retail lease at Southgate Shopping Center in Southgate, a southwest suburb of Detroit. Embers will serve coffee roasted by Rootless Coffee of Flint, Mich. The coffee shop is slated to open this fall at 13627 Eureka Road. Greg Hornby of Friedman Real Estate represented the tenant in the lease. The landlord was undisclosed.

CHICAGO — Related Midwest has broken ground on 400 Lake Shore, a multifamily project in the Streeterville neighborhood on the Near North Side of Chicago. Situated on a waterfront site where Lake Michigan meets the Chicago River, the two-tower development will occupy the last undeveloped parcel at the location. 400 Lake Shore’s first phase will feature a 72-story, 858-foot tower. The building will feature 635 apartments, with 20 percent of the residences (127 units) designated as affordable housing. Units will include studio, one-, two- and three-bedroom apartments. Related Midwest’s in-house contracting company, LR Contracting Co., will build the first phase of the project with BOWA Construction. Skidmore, Owings & Merrill designed the development, with building interiors designed by MAWD. Stantec is serving as the architect of record. Related will also lead the development of a 3.3-acre park — with a $10 million commitment from the company — and an extension of the Chicago Riverwalk, in conjunction with the construction of the first tower. Dubbed DuSable Park, the park will comprise a portion of the 4.5 acres of public space included in the 400 Lake Shore project, which will also feature a plaza with amenities, two-story podium and public art. The …

ST. LOUIS — Locally based Good Developments Group is redeveloping a former industrial manufacturing site in St. Louis into Crunden Martin, a 500,000-square-foot mixed-use project. The property will serve as the initial phase of the 100-acre, $1.2 billion Gateway South Advanced Building Collaboration District, which is scheduled to break ground in the third quarter. Tom Ray of CBRE will market the space for lease. Phase I redevelopment plans include revitalizing the site’s seven conjoined buildings into a mixed-use workspace featuring prototyping spaces, offices, food-and-beverage retail, production facilities and other amenities designed for construction-focused tenants. Gateway South will feature more than 1.5 million square feet of light manufacturing facilities across a mixed-use neighborhood south of the Gateway Arch. Crunden Martin is slated for completion in the second quarter of 2026.

CHICAGO — Concord Summit Capital LLC has arranged $10 million in mezzanine financing for the construction of a luxury apartment complex in Chicago. Daniel Eidson, David Larson and Keegan Burger of Concord Summit arranged the financing, which included a senior loan with a C-PACE component. The project will feature amenities such as a fitness center, lounge, game room, private event space, outdoor pool and ground-floor coworking spaces. The lender and borrower were not disclosed.

WAUKESHA, WIS. — Mid-America Real Estate Corp. has brokered the sale of Silvernail Plaza, a 116,135-square-foot shopping center in the western Milwaukee suburb of Waukesha. The sales price was undisclosed. Major tenants at the property include grocer Metro Market and Dollar Tree. Outlots Wendy’s, Arby’s and Firestone were included in the sale. Rick Drogosz, Dan Rosenfeld and Scott Satula of Mid-America represented the seller, United Properties. Essential Growth Properties was the buyer.

OAK LAWN, ILL. — Interra Realty has arranged the $3.1 million sale of a multifamily portfolio in Oak Lawn, a southwest suburb of Chicago. Each of the three buildings on Mansfield Avenue houses eight units. At the time of sale, the buildings were 96 percent occupied. Michael Duckler of Interra represented the seller, a private investor. The seller replaced water tanks, added new windows, repaired roofs and completed painting and carpeting.

OSCEOLA, IND. — Marcus & Millichap has negotiated the sale of McKinley Penn Self-Lock Storage in Osceola, a city in northern Indiana. The 33,380-square-foot self-storage facility is located at 10386 McKinley Highway. The 164-unit, two-building property features new roofs, updated security features and a new insomniac kiosk. Sean Delaney of Marcus & Millichap represented the buyer and seller, both of which were limited liability companies. Josh Caruana assisted in closing the transaction as the broker of record in Indiana.