BELLEVILLE, MICH. — Marcus & Millichap has brokered the $5.4 million sale of Van Buren Plaza in Belleville, a southwest suburb of Detroit. The 43,765-square-foot retail center is located at 11824 Belleville Road and was 94 percent occupied at the time of sale by a mix of local, regional and national tenants. Alex Perez and Chris Garavaglia of Marcus & Millichap represented the buyer, a limited liability company. Seller information was not provided.

Midwest

KANSAS CITY, MO. — Banksia is opening a 5,300-square-foot restaurant at 1111 Main, the largest office building in Kansas City, according to owner Copaken Brooks. The Australian-inspired café and bistro is relocating from its existing downtown location at 105 W. 9th St. The new restaurant is slated to open this spring. Copaken Brooks is performing the owner’s representative services for Banksia’s build-out. Banksia will offer patio seating, a full bar, coffee, breakfast, lunch and dinner service as well as private event spaces. Tiffany Ruzicka of AREA Real Estate Advisors represented the tenant, while Erin Johnston of Copaken Brooks represented ownership.

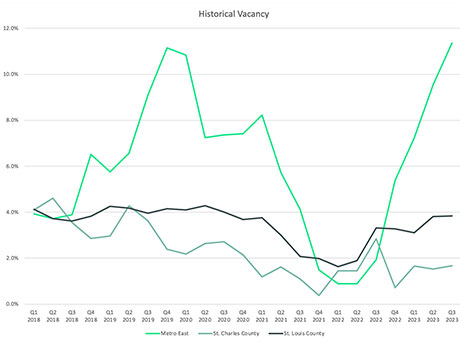

By Matt Hrubes and Joshua Allen, CBRE St. Louis is located at the crossroads of the U.S. at the intersection of I-55 (north/south) and I-70 (east/west), making it a prime location for industrial real estate users and developers alike. The Greater St. Louis area is separated by the Mississippi and Missouri rivers, giving it a natural division of industrial submarkets. Each side of the Mississippi River tells a different story as it relates to industrial real estate. Metro East To the east of the Mississippi River is the Metro East industrial submarket, which was the first in the area to offer real estate tax abatement, resulting in larger industrial developments ranging in size from 500,000 square feet to over 1 million square feet. Over the last decade, this area has seen some of the largest speculative developments in the region from national developers such as Panattoni, NorthPoint and Exeter, as well as local developers like TriStar. Absorption had been at all-time highs with groups like Amazon, World Wide Technology, Geodis, Sam’s Club, P&G and Tesla leasing space as buildings were being completed. That is, until 2023 when a wave of space became available either through sublease, speculative development completions or …

AURORA, ILL. — Developers Atlantic Residential and Focus have completed Lumen Fox Valley, a 304-unit luxury apartment complex that repositioned a portion of the Fox Valley Mall in Aurora. Evanston-based Morgante Wilson Architects (MWA) completed the interiors of the property. MWA will also complete the interiors of Lucca Fox Valley, which will replace a former department store with 323 luxury apartment units as part of the second phase of the mall’s redevelopment. Lumen Fox Valley repurposed a vacant Sears store at the mall. MWA designed all common spaces and amenities, including a two-story lobby and lounge, private dining room, clubroom, game room, fitness and yoga studio, and pet spa. MWA also selected the unit finishes for kitchens, baths and flooring, and designed and furnished the model units. Torti Gallas + Partners and HKM Architects + Planners were the project architects. Focus was the general contractor, and USAA Real Estate provided financing. Monthly rents at Lumen Fox Valley start around $1,717. Residents can now earn a free month of rent on select one- and two-bedroom units if they move in by the end of February, according to the property’s website.

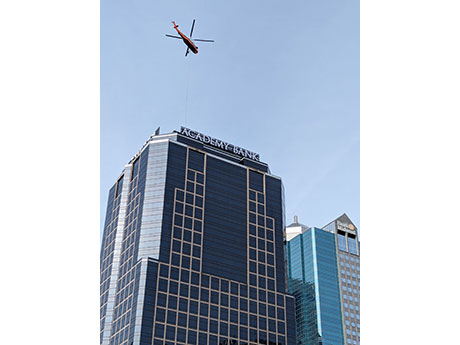

KANSAS CITY, MO. — Academy Bank, a full-service community bank and family-owned subsidiary of Dickinson Financial Corp., has opened a new retail branch within the lobby of 1201 Walnut, a 29-story office tower owned by Copaken Brooks in downtown Kansas City. The bank also moved its corporate headquarters to three contiguous floors of the building totaling roughly 50,000 square feet. Additionally, the property now features Academy Bank signage. Of Academy Bank’s 71 branches, 23 are located throughout metro Kansas City. Sister bank Armed Forces Bank will maintain its headquarters in Fort Leavenworth, Kan.

DEARBORN, MICH. — Syndicated Equities has acquired Carhartt’s corporate headquarters and global design facility in Dearborn for an undisclosed price. The property, which is located at 5750 Mercury Drive, rises two stories and totals 58,722 square feet. The building is situated across the street from Ford’s global headquarters. Carhartt uses the facility for selecting fabrics and designs for new apparel. Syndicated acquired the property in a Delaware Statutory Trust ownership structure to accommodate investors completing 1031 exchanges along with accredited individual investors.

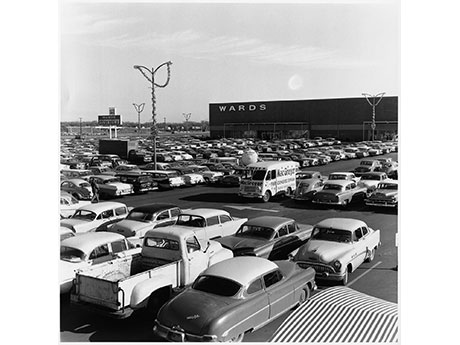

BLOOMINGTON, MINN. — Kraus-Anderson Realty & Development has begun to demolish the former Toys ‘R’ Us and Herberger’s buildings at Southtown Shopping Center in the Minneapolis suburb of Bloomington. Located at the corner of I-494 and Penn Avenue South, the shopping center opened in November 1960 and included a two-story, 150,000-square-foot Montgomery Wards, the largest in the retailer’s chain of 550 stores nationwide. The center also opened with 44 other shops, including Musicland, Red Owl, Walgreens and Texaco. The property has undergone numerous additions and renovations since then. Kraus-Anderson is demolishing the large vacant space on the northeast side of the center, often referred to as the old Herberger’s (originally Montgomery Wards) and Toys ‘R’ Us space. The demolition phase is expected to take approximately 12 weeks and is slated for completion at the end of March. The rest of the shopping center will remain open. Future plans regarding tenants or new uses were not released.

HILLIARD, OHIO — Colliers has brokered the sale of Northwest Corporate Plaza, a 221,736-square-foot light industrial portfolio in Hilliard, a northwest suburb of Columbus. The two-building portfolio is situated on 18 acres along Leap Road directly west of I-270 and near I-70. The buildings are home to seven tenants, including Micro Center, Yokowo Manufacturing of America, E-Cycle and Mectron North America. Alex Cantu, Alex Davenport and Shane Woloshan of Colliers represented the seller, Transwestern Investment Group. Diamond Properties was the buyer.

DAYTON, MINN. — CRG has completed The Cubes at French Lake, a 1 million-square-foot speculative industrial development in Dayton, a northwest suburb of Minneapolis. The project marks the largest speculative industrial project to date in Minnesota, according to CBRE. Dan Swartz, James DePietro and Austin Lovin of CBRE are marketing the property for lease. The facility features a clear height of 40 feet, 652 parking spaces, 231 trailer parking spaces, 100 dock doors, four drive-in doors, 60-foot speed bays and a 185-foot-depth concrete truck court. The 65-acre project is located approximately 35 miles from the Minneapolis-Saint Paul International Airport and offers convenient access to I-94 via the Dayton Parkway exchange. CRG’s integrated partner Lamar Johnson Collaborative served as the architect and its parent company, Clayco, was the design-builder. Construction began in 2022.

CLEVELAND — KeyBank Real Estate Capital has promoted Dan Heberle to president of the Cleveland-based financial services company. A banking executive with more than 30 years of industry experience, Heberle succeeds Angela Mago, who has led the business since 2014 and was recently appointed to chief human resources officer of KeyCorp. Heberle reports to Randy Paine, president of Key Institutional Bank. As president of KeyBank Real Estate Capital, Heberle is responsible for Key’s real estate finance and community development and investment businesses. He leads a team of more than 900 professionals, providing advice and capital solutions including acquisition, construction and interim financing; revolving credit facilities and loan terms; permanent mortgages; tax credit equity; commercial real estate loan servicing; and cash management services. Previously, Heberle served as head of KeyBank’s Institutional Capital Group. He joined KeyBank in 1998 as a relationship manager with the company’s REIT group and has since held various leadership responsibilities.