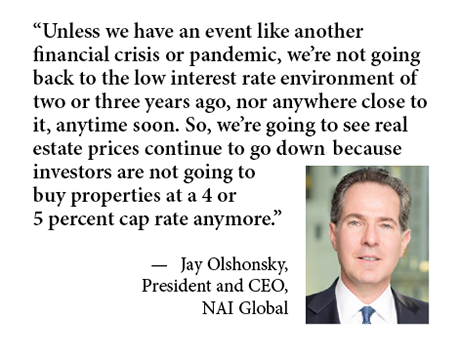

If NAI Global president and CEO Jay Olshonsky had to use one word to sum up the 2023 commercial real estate market, it would be “inactive.” The interest rate-fueled bid-ask spread stifled investment sales of all property types, and in the office sector especially, tenants avoided making any space decisions if they didn’t have to. One month into 2024, not much has changed. From an investment sales perspective, Olshonsky still sees properties offered at capitalization rates between 4 and 5 percent while interest rates are 6 percent or higher, which is prolonging the disconnect between buyers and sellers. Meanwhile, robust job creation well beyond today’s levels is needed to create the leasing demand that will reverse the office sector’s troubles in the new era of hybrid work. But that’s not likely to happen in 2024 as the tech sector, in particular, continues to lay off workers. “I’ve been in the real estate business a long time, and this is a cycle unlike most others,” says Olshonsky. “The biggest problem we have right now is mainly record-high office vacancy just about everywhere — certainly in the large cities — which we’ve never really seen before. On the investment side, lenders cannot …

Midwest

AcquisitionsContent PartnerFeaturesLoansMidwestMultifamilyNAINortheastOfficeRetailSoutheastTexasWestern

CHICAGO — JLL Capital Markets has arranged a $45 million loan for the refinancing of Vue53, a 403-bed student housing property at the University of Chicago. Vue53 offers 267 units in studio, one- and two-bedroom layouts. Amenities include a bike storage facility, business center, study lounges, a fitness center, clubroom and sundecks. Residents also have access to a 24-hour doorman, onsite parking, package storage and handling, and campus shuttle pickup. The property features 27,367 square feet of ground-floor retail space that is anchored by a Target with a Starbucks. Brian Walsh, Dan Kearns, Tara Hagerty and Dave Hunter of JLL arranged the loan on behalf of the borrower, a venture between Blue Vista and Bain Capital Real Estate. A fund managed by Argentic Investment Management LLC provided the loan.

CHICAGO — KeyBank Community Development Lending and Investment (CDLI) has provided $34.3 million in construction and permanent financing through the HUD 221(d)(4) Mortgage Insurance program for the rehabilitation of six affordable housing communities on Chicago’s South Shore. The 6900 Crandon Apartments provides 151 units for elderly and disabled residents subsidized under a project-based Section 8 contract. The remaining five properties provide 126 units for families. Evergreen Real Estate Group is the sponsor. The communities are owned by a Low-Income Housing Tax Credit (LIHTC) partnership created by the Housing and Human Development Corp. (HHDC), a nonprofit public housing facility in Chicago. The project also received LIHTC and tax-exempt bond allocations from the Illinois Housing Development Authority. KeyBanc Capital Markets served as the sole manager and underwriter for the $55.1 million bonds. Improvements will include new cabinets, countertops, flooring, energy-efficient appliances and fixtures for resident units as well as elevator modernization, upgrades to mechanical, electrical and plumbing systems, replacement of roofs and exterior repairs. HHDC serves as the owner-operator and will provide onsite social service coordinators. Leslie Meyers and Robbie Lynn of KeyBank CDLI structured the HUD financing, and Sam Adams of KeyBanc Capital Markets marketed the bonds.

BRISTOL, WIS. — Haribo of America Inc. has signed a full-building industrial lease for 447,216 square feet at Bristol Highlands Commerce Center East in Bristol, a city in Southeast Wisconsin. Chicago-based HSA Commercial Real Estate owns the 68-acre industrial park. The lease marks the largest industrial lease executed in the Southeast Wisconsin submarket last quarter, according to HSA. Haribo, a global manufacturer of gummi products, currently occupies the 157,656-square-foot Building 1 at Bristol Highlands Commerce Center East. The warehousing and distribution operations will move from Building 1 to Building 3 upon completion of the interior build-out in the second quarter. Completed in 2022, Building 3 features a clear height of 36 feet, 73 truck docks and ample employee parking. Once Haribo moves into Building 3, the company’s former space in Building 1 will be available for lease. Haribo also maintains a North American production plant two miles away in Pleasant Prairie. Whit Heitman and Sam Badger of CBRE represented Haribo in the lease. Jeff Hoffman of Cushman & Wakefield | Boerke, Eric Fischer of Cushman & Wakefield and Tim Thompson of HSA represented ownership.

WHITESTOWN, IND. — CBRE has brokered the $24.5 million sale of Park 130 at Whitestown Building 2, a 356,900-square-foot industrial building in the Indianapolis suburb of Whitestown. The property at 5828 Commerce Drive is triple net leased to Maxxis Tires, a global manufacturer of high-quality tires. Completed in 2019, the building is situated on nearly 22 acres within the larger Park 130 at Whitestown. The property features a clear height of 32 feet, 42 insulated dock doors and two drive-in doors. Kevin Foley, Anthony DeLorenzo, Andrew Morris and Jeremy Woods of CBRE Investment Properties represented the private seller. A private, high-net-worth buyer purchased the asset at a cap rate of 5.6 percent.

BOLINGBROOK, ILL. — Bridge Industrial has acquired a 22-acre site in Bolingbrook within the I-55 submarket. The developer plans to build Bridge Point I-55 Commerce Center, a two-building speculative industrial project totaling 292,011 square feet. Bridge acquired the site from Chicagoland-based Orange Crush LLC, which previously used the facility as an asphalt crushing and transloading facility. Construction is scheduled to begin in the second quarter with completion slated for mid-2025. Dan Leahy of NAI Hiffman represented Bridge in the sale and will serve as the leasing agent for the development.

ST. LOUIS PARK, MINN. — JLL Capital Markets has brokered the $53.4 million sale of Elan West End in the Minneapolis suburb of St. Louis Park. Built in 2020, the 164-unit apartment complex features studios, one-, two- and three-bedroom units averaging 855 square feet. Amenities include a pool and spa, sky lounge, amenity deck, lounge area with golf and hockey simulator, and a fitness center. Located at 1325 Utica Ave. South, the property is situated in The West End, a prominent shopping, dining, industry and entertainment hub in St. Louis Park. Josh Talberg, Mox Gunderson, Dan Linnell, Adam Haydon and Devon Dvorak of JLL represented the undisclosed buyer and seller. Brock Yaffe of JLL arranged $25.5 million in acquisition financing on behalf of the buyer through a life insurance company.

STERLING HEIGHTS, MICH. — Developer Repvblik has opened The Block at Sterling Heights, a 213-unit apartment development in Sterling Heights. The adaptive reuse project transformed the former Wyndham Gardens Sterling Heights hotel into studio and one-bedroom apartments. The multi-million-dollar project began in July 2022. Several months into construction, Repvblik decided to demolish a sprawling section of the building that used to contain the Loon River Café and Sterling Inn Banquet and Conference Center in order to free up more than three acres of street-facing land for future development. Units at The Block range from 315 to 825 square feet. Rents for most apartments range from $795 to $1,300 per month, with large loft apartments renting for $1,500 per month. A significant number of the units will be reserved for those making between 60 and 120 percent of the area median income. Amenities include a fitness center, recreational green space, laundry facility on every floor, mail room, resident lounge and 24-hour emergency maintenance. Future amenities will likely include an outdoor dog park and bike parking. PK Housing and Management is managing the community.

JOLIET, ILL. — CBRE has completed the lease-up of Joliet Marketplace, a 100,000-square-foot shopping center in Joliet. UrgentVet inked the most recent lease for a total of 3,500 square feet. The veterinarian clinic plans to open this spring. The property was formerly occupied by K-Mart and had stood vacant since 2016. IG Capital purchased the asset in 2020 and brought on CBRE’s Sean McCourt, Joe Parrott and Riley McCarron to assist with redeveloping the site. UrgentVet joins Tony’s Fresh Market, Planet Fitness, Tropical Smoothie Café, Charley’s and Ivy Rehab at the center. McCourt and Parrott represented IG Capital in the lease with UrgentVet.

WAUWATOSA, WIS. — Slick City, an indoor slide park concept, has signed a lease to open a 51,958-square-foot location at 1435 N. 113th St. in Wauwatosa. Brett Deter and Scott Revolinski of Founders 3 Real Estate Services represented the undisclosed landlord. The family entertainment space may include a soft play area for younger children, zip lines, trapezes and swings. There are currently three other Slick City locations in the U.S. in Denver, St. Louis and Katy, Texas.