CRYSTAL AND NORTH SAINT PAUL, MINN. — StorageMart has acquired two self-storage facilities in Crystal and North Saint Paul for an undisclosed price. Both properties will undergo comprehensive updates to align with StorageMart’s standards. Together, the facilities offer 1,564 units and 159,282 square feet of rentable climate-controlled space. Unit sizes range from five-by-five units to 15-by-40 units.

Midwest

CHICAGO — Quantum Real Estate Advisors Inc. has brokered the sale of a 38-unit multifamily property in Chicago for $2.7 million. The courtyard building is located at 4126 W. 24th Place in Little Village. Clay Maxfield of Quantum represented the seller, which had owned the asset for 25 years. The property sold to a local owner with multiple assets in Chicago and the surrounding suburbs.

NEW HAVEN, IND. — Red Bull has signed a seven-year, 33,909-square-foot industrial lease at 10821 Rose Ave. in New Haven, just east of Fort Wayne. The building is part of the larger Cedar Oak industrial development. Chad Voglewede and Bill Drinkall of Bradley Co. represented the landlord, Cedar Oak Venture.

CHICAGO — A. Lange & Söhne, a German luxury watch manufacturer, has signed a lease for 1,409 square feet of retail space at The Shops at Tribune Tower in Chicago. The retailer’s location will be positioned on Michigan Avenue on the corner overlooking Pioneer Court, which was redeveloped by CIM Group and Golub & Co. The area between Tribune Tower and the neighboring Apple store features space for locals and visitors to gather and shop. The A. Lange & Söhne boutique is slated to open in 2024 and will join the Musuem of Ice Cream, Foxtrot Market, Blue Bottle Coffee, Rowan and Krewe. The Shops at Tribune Tower consists of 50,000 square feet of retail space that anchors the ground floor of the 36-story, 740,000-square-foot Tribune Tower. CIM Group and Golub & Co. transformed the property into 162 luxury condos.

JOLIET, ILL. — PENN Entertainment has broken ground on the $185 million Hollywood Casino Joliet at RockRun Collection in Joliet. The casino will anchor RockRun Collection, a 1 million-square-foot mixed-use development that is under construction. Cullinan Properties is the owner and developer for the 310-acre project. The land-based casino will feature approximately 850 slots and 44 live table games, including a baccarat room, retail sportsbook, bars and restaurants, and an approximately 10,000-square-foot event center with meeting areas. There will also be roughly 1,330 parking spaces. PENN expects to create 450 construction jobs and 515 permanent jobs at Hollywood Casino Joliet. The development will take about 24 months to construct. RockRun Collection is slated to include 570 apartment units, 500 hospitality rooms, 150,000 square feet of office space, 500,000 square feet of retail and restaurant space, an outdoor amenity area and entertainment space.

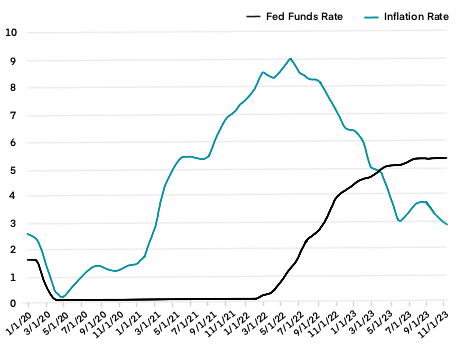

CHICAGO — An analysis from Origin Investments (Origin) predicts a tumultuous 2024, with concerns of a recession and elevated interest rates likely to continue. Despite this, the Chicago-based real estate fund manager expects next year to bring unique opportunities for multifamily investors to secure protected positions in the capital structure and enhance investment returns. “The volume of variable-rate bank loans — made when the Secured Overnight Financing Rate was 0 percent and the 10-year Treasury note yield was below two percent — coming due in 2024 will create a generational opportunity in senior debt and preferred equity investments,” explains David Scherer, co-CEO of Origin. “Despite uncertainties, it remains a mistake to stay out of the multifamily investment market in 2024.” Origin predicts that rent growth will stabilize to historic norms in 2024. The analysis theorizes that the negative rent growth some markets — such as Austin, Texas — experienced in 2023 was likely due to oversupply, and will reverse by January 2025. The report also indicates that long-term demand and absorption of apartments and rental homes is likely to remain strong for several years, as the U.S. is facing a shortage of between 5.5 million and 6.8 million housing units. …

BELLWOOD, ILL. — Evergreen Real Estate Group has completed Bellwood Senior Apartments, an 80-unit affordable seniors housing community in Bellwood, a western suburb of Chicago. The $31.5 million project replaces a former Walgreens store that had been vacant for nearly five years. The four-story development offers 76 one-bedroom and four two-bedroom apartments for seniors age 62 or older with incomes at or below 60 percent of the area median income (AMI). Evergreen says the building is 40 percent leased and will reach full occupancy in the next few months. Weese Langley Weese Architects designed the project. F.H. Paschen served as general contractor on the development. Financial partners for Bellwood Senior Apartments include the Illinois Housing Development Authority as the tax credit issuer (both Low-Income Housing Tax Credits and Illinois Affordable Housing Tax Credits) and subordinate funds provider; the Village of Bellwood, which provided a TIF loan; Bank of America, which is the investor and construction loan lender; Hudson Housing Capital, which syndicated the tax credits; Cook County, which provided HOME funds; and the ComEd Energy Efficiency Program.

NORTH JACKSON, OHIO — Newmark has negotiated a 211,443-square-foot industrial lease at 500 S. Bailey Road in North Jackson, about 60 miles southeast of Cleveland. A large solar manufacturing company signed a long-term lease to occupy the entire building. Terry Coyne of Newmark represented ownership, STAG Industrial Inc., which is renovating the building. The property features 201,476 square feet of manufacturing/warehouse space, 9,967 square feet of office space, a clear height of 35 feet, 19 loading docks, one drive-in door and a 245-car parking lot.

CHICAGO — Interra Realty has brokered the $9.6 million sale of a 28-unit apartment building in Chicago’s Lincoln Park neighborhood. Located at 1900-16 N. Lincoln Ave., the property features a mix of studio, one- and two-bedroom units. The building, constructed in 1906, underwent a capital improvement program for new appliances, countertops, cabinets and floors. Joe Smazal of Interra represented the buyer, Chicago-based ICM Properties. He also represented the local private seller. The property was fully occupied at the time of sale.

WARRENSVILLE HEIGHTS, OHIO — Industrial Commercial Properties (ICP) has acquired the research and development (R&D) campus of The Sherwin-Williams Co. in Warrensville Heights, an eastern suburb of Cleveland. The purchase price was undisclosed. The 105-acre property includes several buildings. Sherwin-Williams has entered into a short-term sale-leaseback agreement with ICP, which plans to repurpose some of the smaller commercial structures on the site while it finalizes redevelopment plans for the R&D building and adjacent acreage. The property will soon be vacated by Sherwin-Williams, which is building a new R&D center in Brecksville and a new headquarters in downtown Cleveland.