PALATINE, ILL. — Marcus & Millichap has arranged the $5 million sale of Palatine Center, a 46,095-square-foot office property in the Chicago suburb of Palatine. Located at 865-909 E. Wilmette Road, the three-building property was fully leased at the time of sale to five tenants. Roughly 85 percent of the tenants have occupied the building for 17 to 27 years. A specialized school occupies 69.6 percent of the space. Tammy Saia and Tami Andrew of Marcus & Millichap represented the seller, a private investor. The duo also secured the buyer, a Texas-based limited liability company.

Midwest

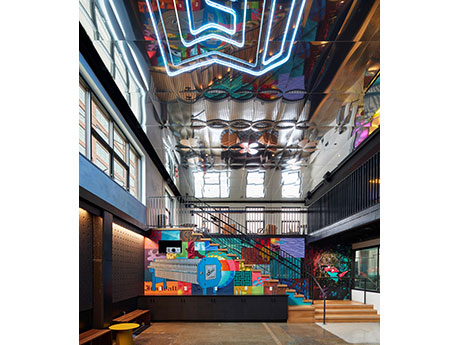

MINNEAPOLIS — Kraus-Anderson has completed a $2 million renovation of the 7,000-square-foot headquarters and taproom for Modist Brewing Co. in Minneapolis. The project included new event space, a quality control lab and employee workplaces. The Minneapolis studio of Perkins & Will designed a two-story event space, mezzanine and catwalk that can accommodate 120 people for corporate and private events. The design aesthetic is “punk rock chic” and includes bold colors, neon sculpture lights, dichroic glass that changes colors, glitter concrete epoxy flooring and mirrored ceilings.

BROOKFIELD, WIS. — Wingspan Development Group has opened The Ruby at Brookfield Square, a 231-unit luxury apartment complex in the Milwaukee suburb of Brookfield. The property is nearly 30 percent leased, and first move-ins began in early October. The community, which features two four-story buildings connected by a skybridge, is the first new Class A rental property in Brookfield since 2019, according to Wingspan. Located adjacent to Brookfield Square Mall, the complex features a mix of floor plans ranging from 381 to 1,407 square feet. Amenities include a resort-style pool, dog park, fitness center, yoga studio, pet spa, entertainment lounge, golf simulator, business center and package room. Monthly rents start at $1,595, according to the property’s website.

TOLEDO, OHIO — iBorrow has provided a $12.7 million loan to finance the sale-leaseback of a 208,968-square-foot industrial facility in Toledo. The property was previously owned by a subsidiary of Stellantis, a manufacturer of brands such as Jeep, Chrysler and Dodge. To facilitate the transaction, iBorrow customized the financing package to accommodate potential re-leasing activities, including a future funding component for light capital expenditures and other costs, and incorporated the ability for the borrower to refinance with long-term debt in the future. The building supports warehousing and logistics operations for a 3 million-square-foot Stellantis manufacturing facility, which is also located in Toledo. The property features a clear height of 34 feet, 102 truck doors and roughly 292 parking spaces. The single-tenant facility is fully leased. The borrower is an owner and operator of industrial real estate properties nationwide.

CHICAGO — Logistics company Spot has opened a 31,000-square-foot office at 24 E. Washington St., also known as the Marshall Field & Co. Building, in Chicago. The landmark property is home to Macy’s and the Tiffany Dome Ceiling. Spot, which previously occupied a temporary space within the building, now occupies the 11th floor of the building. Allen Rogoway, Michael Marrion and Tim O’Brien of Cresa represented Spot in the lease, while Jack O’Brien and Caroline Colnon of Telos represented ownership, Brookfield Properties. The project team for the office build-out included architect Lamar Johnson Collaborative, general contractor Bear Construction, furniture vendor Office Revolution and property manager JLL. Spot has more than 600 employees across its locations in Indianapolis, Charlotte, N.C., Tempe, Ariz., Tampa, Fla. and Chicago.

MOUNT CLEMENS, MICH. — Woda Cooper Cos. Inc. has completed Edison Crossing, a $10.5 million affordable housing community in Mount Clemens, a northern suburb of Detroit. The 30-unit property features 11 units that are designated as Permanent Supportive Housing units with a preference for veterans. The entire development is restricted for residents who earn up to 80 percent of the area median income. The four-story building features amenities such as a multipurpose room, playground, picnic tables, onsite management center and additional space for coordination of supportive services by Macomb Community Action. Financing for the project was supported by the allocation of Low-Income Housing Tax Credits by the Michigan State Housing Development Authority. R4 Capital invested in the tax credits to provide equity financing. Comerica Bank provided a construction loan, and RiverHills Bank provided a permanent mortgage. Additionally, the city approved a Payment in Lieu of Taxes. Hooker DeJong Inc. was the project architect, and Greentech Engineering Inc. was the civil engineer. Woda Construction Inc. served as general contractor. Woda Management & Real Estate is handling leasing and property management.

AURORA, OHIO — Advanced Innovative Manufacturing (AIM) has acquired a 105,124-square-foot industrial building located at 200 Francis Kenneth Drive in Aurora, a southeast suburb of Cleveland. The purchase price was undisclosed. AIM is transforming the former steel coil storage facility into a state-of-the-art manufacturing complex and expects to relocate from its current facility in Aurora in summer 2024. Eliot Kijewski of Cushman & Wakefield | CRESCO Real Estate represented AIM in the transaction. George Pofok of Cushman & Wakefield | CRESCO Real Estate represented the seller, Brennan Investment Group.

NORMAL, ILL. — JLL Capital Markets has brokered the sale of The Edge on Hovey, a 481-bed student housing community located adjacent to Illinois State University in Normal. The sales price was undisclosed. Built in 2004, the property features two-, three- and four-bedroom units averaging 1,470 square feet. The fully furnished units feature private walk-in closets, bed-bath parity and nine-foot ceilings. Amenities include a lobby, cyber lounge, fitness center, private study rooms, high-speed internet and controlled building access. Recently renovated, the community still presents the opportunity for value-add interior upgrades, according to JLL. The Edge also features a parking garage with 549 spaces and a 5,586-square-foot retail space. Scott Clifton, Teddy Leatherman, Kevin Kazlow, Jack Goldberger and Grace Picchiotti of JLL represented the seller, an entity of Blue Vista Capital Management. FPA Multifamily was the buyer.

WHITEHALL, WIS. — Kraus-Anderson (KA) has completed construction of Gundersen Tri-County Hospital, a new hospital and renovated clinic for Gundersen Health System in Whitehall, a small town in western Wisconsin. The new facility replaces the current 60-year-old hospital serving Whitehall, Blair, Independence and surrounding communities. KA also renovated the 17,000-square-foot clinic. Designed by Groth Design Group, the two-story, 68,000-square-foot hospital features 31 private patient rooms, a trauma center and helipad landing zone. Additionally, the project features an ER, imaging, lab, pharmacy, surgical, dietary, rehabilitation and transitional care offerings. A new ambulance and maintenance building is also on the site.

STREAMWOOD, ILL. — Marcus & Millichap has arranged the $10.2 million sale of Westview Center in Streamwood, a northwest suburb of Chicago. The 114,735-square-foot shopping center is fully occupied. Tenants include AutoZone, Dollar Tree, Oak Street Health, Chuck E. Cheese, American Freight and H&R Block. Austin Weisenbeck and Sean Sharko of Marcus & Millichap represented the seller, a limited liability company. Mark Ruble, Chris Lind and Brennan Clegg of Marcus & Millichap represented the buyer, a Midwest-based private investment group. The asset sold for 96 percent of the list price.