CINCINNATI — A joint venture between affiliates of Midland Atlantic Properties and Next Realty has acquired Waterstone Center, a 160,000-square-foot shopping center in Cincinnati. The purchase price and seller were undisclosed. The fully leased property is home to Best Buy, Ross Dress for Less, Michaels, Old Navy, Petco and Verizon. BWE arranged acquisition financing through Goldman Sachs.

Midwest

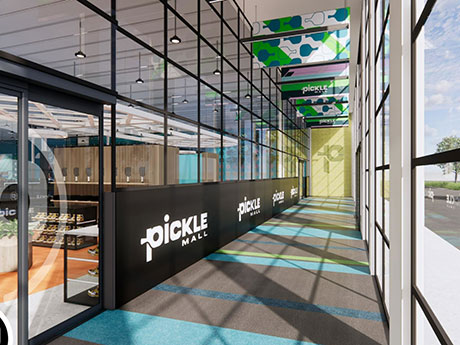

VERNON HILLS, ILL. — Picklemall Inc. has leased 46,000 square feet at 5555 Town Line Road in the Chicago suburb of Vernon Hills. The site will serve as a flagship location for the startup, which aims to establish 50 pickleball facilities nationwide within the next two years. Transwestern’s sports and entertainment group, led by Tim Katt and Larry Serota, is the exclusive real estate provider for Picklemall. Led by CEO West Shaw and backed by billionaire financier and Major League Pickleball founder Steve Kuhn, Picklemall is an indoor pickleball concept that capitalizes on vacant mall space. Picklemall’s Vernon Hills location takes the space formerly occupied by Toys “R” Us. The build-out of the facility is slated for completion in the first quarter of 2024.

CHICAGO — Quantum Real Estate Advisors Inc. has brokered the $3.8 million sale of an 11-unit multifamily building in Chicago’s West Town neighborhood. The property at 835 N. Wolcott Ave. was renovated in 2020. Quantum represented the out-of-state buyer, which completed a 1031 exchange. The seller was undisclosed.

BURBANK, ILL. — Time Equities Inc. (TEI) has purchased Burbank Plaza, a 28,000-square-foot retail strip center in Burbank, a southern suburb of Chicago. The purchase price was $3.1 million. Currently 91 percent leased and anchored by Family Dollar, the property is home to various tenants such as a dry cleaner, nail salon and phone store. One 2,500-square-foot space is available for lease. Ami Ziff, Jonathan Kim, Grant Scott and Eli Smith represented TEI on an internal basis. Adam Foret of CBRE represented the private seller.

OWATONNA, MINN. — Kraus-Anderson has completed a new $99 million high school in Owatonna, about 65 miles south of Minneapolis. The project is part of a $112 million district bond referendum, which voters passed in November 2019. Construction began in May 2021. Designed by Wold Architects and Engineers, the three-story school totals 317,000 square feet and accommodates 1,600 students. In addition to classrooms, there are industrial arts labs, tech shop spaces, an 825-seat auditorium and a large commons and cafeteria space in the center of the building. Additionally, the school features a main gymnasium and auxiliary gymnasium with walking track, a 3,451-seat football stadium, eight tennis courts, two grass multipurpose fields, two synthetic turf multipurpose fields, two softball fields, two baseball fields and a full track. Located on 90 acres with parking for 890 vehicles, the development also includes four storage buildings for athletics.

MICHIGAN CITY, IND. — StorSafe is expanding its self-storage facility in Michigan City by 10,665 square feet with an additional 82 climate-controlled units. The project also includes a new onsite water management system to collect and clean stormwater coupled with a loading dock for semi-trucks and moving vans. After the expansion, the facility will include 384 climate-controlled units. The property is located at 2600 S. Franklin St. in Northwest Indiana. StorSafe, established in 2021, offers mobile technology, advanced management software, online tools, facility automation and state-of-the-art security equipment.

Principle Construction to Build 22,245 SF Maintenance Facility for Alvil Trucking in Elgin, Illinois

ELGIN, ILL. — Principle Construction Corp. is building a 22,245-square-foot warehouse for Alvil Trucking in Elgin. The trucking company will use the building at 2450 Millennium Drive for maintenance and repairs of its fleet. The project will feature a clear height of 24 feet, 48 parking spaces, six docks and two drive-in doors. Harris Architects is the project architect, and Jacob & Hefner is the civil engineer. The project marks the second building that Principle has constructed for Alvil.

GENEVA, ILL. — Bullfrog International, a designer and manufacturer of a high-end line of hot tubs, has signed a 10,200-square-foot lease at Randall Square shopping center in Geneva. The lease marks the third location for Bullfrog in the Chicago market in the last few months. Rick Scardino, Michael Petrik and Sean Bishop of Lee & Associates represented the tenant. Branden Reedy and Jimmy Danaher of CBRE represented the landlord, an entity doing business as In Retail Fund Randall Square LLC. The shopping center totals 250,000 square feet and is located near Randall Road and Fabyan Parkway.

DETROIT — Interior Environments has inked a 6,117-square-foot office lease at the Burns & Wilcox building, which is located at 119 State St. in Detroit. Steve Eisenshtadt, Andrew Bower and Jordan Friedman of Friedman Real Estate represented the undisclosed landlord. The tenant has launched the nation’s first minority-owned office furniture dealership, according to Friedman.

ELKHART, IND. — Industrial Commercial Properties (ICP) has acquired Concord Mall in Elkhart, about 15 miles east of South Bend. ICP plans to redevelop the 600,000-square-foot shopping mall and adjacent outparcels into a mixed-use business park. Concord Mall was originally built in 1972 and has been suffering vacancies in recent years. Early this year, JC Penney unveiled plans to close its store at the mall, leaving Hobby Lobby as the sole anchor tenant. Hobby Lobby will continue to operate at the location. A timeline for construction was not provided.