Due diligence — particularly land surveying — can be a slow, cumbersome process if a project lacks strong guidelines based on the owner or developer’s particular needs. It can be easy to overprepare for the wrong site or underprepare for the succession of steps needed for the right site. REBusiness spoke to two land surveying experts, Billy Logsdon, divisional director of surveying, and Tom Teabo, associate and regional survey manager. Both work for Bohler, a land development consulting and site design firm, and both have strong insights on how to incorporate each step in the due diligence process elegantly within a well-planned approach. Due diligence such as American Land Title Association (ALTA) surveys and gathering topographic information can be time-consuming and expensive steps — making it beneficial to fit their timing into the larger project in a way that reflects the client’s needs — from the purchase of land to development completion. Logsdon and Teabo highlight the importance of streamlining the survey process and getting owners and developers better results based on their desired outcomes, often starting with the information already available about the site early in the process. REBusiness: What is slowing down survey due diligence, in your experience, and do …

Midwest

BohlerContent PartnerFeaturesIndustrialMidwestMixed-UseMultifamilyNortheastRetailSoutheastTexasWestern

SUN PRAIRIE, WIS. — Heyday has opened the first phase of Heyday Sun Prairie, a 170-unit build-to-rent community in the Madison suburb of Sun Prairie. Homes feature attached garages with electric vehicle charging outlets, private patios, keyless entry and green spaces. Monthly rents range from $1,700 for one-bedroom homes to $2,800 for three-bedroom homes. New leases include a six-month membership to nearby Sun Prairie Athletic Club. Daniel Management Group is the property manager.

ETNA, OHIO — CRG and an affiliate of its capital partner, LXP Industrial Trust, have begun development of a 250,020-square-foot speculative distribution center in Etna, an eastern suburb of Columbus. The project is known as Building D at The Cubes at Etna 70, a 305-acre industrial park near I-70. Building D will feature a clear height of 36 feet, 62 trailer stalls, 32 dock positions and a 60-foot speed bay. The property offers a 15-year, 100 percent tax abatement. Contegra Construction is the general contractor, and Lamar Johnson Collaborative is the architect. The industrial park has three remaining pad-ready sites. The Cubes is a North American industrial brand owned and developed by CRG.

MINNEAPOLIS — Lupe Development and Wall Cos. have opened The Flats at Malcolm Yards, a 143-unit affordable housing community in Minneapolis. A grand opening celebration will take place Thursday, Aug. 17. The project is the latest addition to the new Malcolm Yards neighborhood, following The Market, an urban food hall, and The Station, a 210-unit market-rate apartment project. The Flats features a mix of studios, one- and two-bedroom units, all of which are reserved for residents who earn 60 percent or less of the area median income. Amenities include underground parking, a fitness center, business center, coffee bar and sky lounge with views of the Minneapolis skyline. The development is situated near the Green Line LRT station and the University of Minnesota transitway. The project received funding support from the City of Minneapolis Affordable Housing Trust Fund and the Minnesota Department of Employment and Economic Development as well as Hennepin County’s Affordable Housing Incentive Fund, Transit Oriented Development Program and Environmental Response Fund. Other investors include Allianz Life and R4 Capital, which was the tax-exempt lender.

KANSAS CITY, MO. — Hunt Midwest has broken ground on a 203,899-square-foot industrial build-to-suit project for Community Wholesale Tire at Hunt Midwest Business Center in Kansas City. The facility will feature a clear height of 32 feet, 60 trailer parking spaces, 190 vehicle parking spaces and a 190-foot-deep truck court. Completion is slated for the end of the year. The project team includes civil engineer Olsson and Associates, general contractor GPS-KC and H2B Architects. Austin Baier and Mike Mitchelson of CBRE represented Hunt Midwest. Located just east of I-435, Hunt Midwest Business Center totals 2,500 acres. Community Wholesale Tire maintains facilities in nine states across the Midwest, serving more than 4,500 tire dealers.

MT. PLEASANT, WIS. — St. John Properties Inc. has signed leases with three office tenants for more than 30,000 square feet at Mt. Pleasant Commerce Center in Mt. Pleasant, about 30 miles south of Milwaukee. The U.S. General Services Administration will relocate approximately 25 to 30 employees from 4020 Durand Ave. in Racine to 10,150 square feet in Mt. Pleasant by year’s end. Power transmission equipment manufacturer Twin Disc Inc., based in Racine, signed a lease for 15,482 square feet and will relocate its engineering division with roughly 45 employees by year’s end. Wisconsin Early Autism Project and Total Spectrum signed a lease for 5,536 square feet for its fifth location in metro Milwaukee. The group will take occupancy in October. Greg Fax represented St. John Properties on an internal basis.

BATAVIA, ILL. AND JACKSONVILLE, FLA. — German discount grocer Aldi has entered into a definitive agreement to acquire Winn-Dixie and Harveys Supermarket as part of a larger divestiture of Jacksonville-based parent company Southeastern Grocers to various entities. Financial terms of the transaction were not disclosed. The Southeast-focused acquisition includes approximately 400 Winn-Dixie and Harveys locations across Alabama, Florida, Georgia, Louisiana and Mississippi. Aldi, which maintains its U.S. headquarters in Batavia, Ill., first established its presence in the Southeast in the mid-1990s and has since invested $2.5 billion in the region. Most recently, Aldi opened its 26th regional headquarters and distribution center in Loxley, Ala., to help support new stores in the region. The retailer plans to open 20 new locations in the area by the end of the year. Jason Hart, CEO of Aldi, says the acquisition supports Aldi’s long-term growth strategy across the country. The grocer plans to open 120 new stores this year to reach a total of more than 2,400 stores by year’s end. Aldi will evaluate which Winn-Dixie and Harveys locations will be converted into Aldi stores. The stores that are not converted will continue to operate under the Winn-Dixie and Harveys brands. Deutsche Bank served …

CHICAGO — Luxury Living has begun leasing efforts for The Medallion, a newly redeveloped boutique apartment building in Chicago’s Lakeview neighborhood. JSM Venture owns the property, which is located at 3121 N. Broadway St. JSM Venture implemented a two-story addition and rooftop deck on top of a five-story parking garage. The building now features 72 apartment units. The property is also home to Intelligentsia Coffee. Monthly rents start at $1,875 for studios and $2,195 for one-bedroom floor plans. Select units are available in accordance with the City of Chicago’s Affordable Requirements Ordinance.

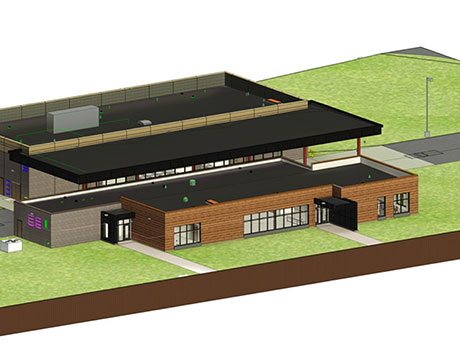

FOREST LAKE, MINN. — Kraus-Anderson has broken ground on the Northern Environmental Center, an $11.4 million environmental and yard waste center in Forest Lake, about 27 miles northeast of St. Paul. Designed by HCM Architects, the 30,000-square-foot county facility will serve northern Washington County. The project will include loading docks and covered drop-off areas, as well as an adjacent yard waste drop-off and pickup areas. Completion is slated for May 2025.

AURORA, OHIO — The Staubach Co. Inc. has sold a retail property occupied by CVS Pharmacy in Aurora, a southeast suburb of Cleveland, for $5.4 million. The 10,125-square-foot building is located at 118 W. Garfield Road. Woody’s Columbus Properties LLC was the buyer.