ST. PAUL, MINN. — Colliers Mortgage has provided an $18.3 million HUD 221(d)(4) loan for the substantial rehabilitation of Sherman Forbes Housing in St. Paul. The Section 8 multifamily property features 104 one- and two-bedroom units. Amenities include onsite laundry, a playground, community patio and leasing office. In addition to the HUD-insured first mortgage, the project will utilize 4 percent Low Income Housing Tax Credits and tax-exempt bonds. Colliers Securities LLC, an affiliate of Colliers Mortgage, underwrote the bonds. The 40-year loan features a 40-year amortization schedule. Sherman Forbes Housing Partners LLC, an affiliate of Vitus Group LLC, was the borrower.

Midwest

CHICAGO — Kiser Group has brokered the sale of a four-building, 53-unit multifamily portfolio in Chicago for $4 million. Situated in the city’s Chicago Lawn neighborhood, the portfolio features seven one-bedroom units, 34 two-bedroom units, 10 three-bedroom residences, one four-bedroom apartment and one five-bedroom unit. All are fully occupied. John George and Joe Bianchi of Kiser brokered the sale. Buyer and seller information was not provided.

SHELBY TOWNSHIP, MICH. — The Dufresne Spencer Group LLC dba Ashley HomeStore has signed a lease for 48,700 square feet of retail space in Shelby Township, a northern suburb of Detroit. Dufresne Spencer Group is the largest Ashley Furniture licensee globally, owning and operating more than 163 Ashley retail stores, 29 distribution centers and three corporate offices. The Shelby Township store is slated to open in the fourth quarter. Brian Whitfield of Colliers Detroit represented the tenant in the lease.

MINNEAPOLIS — CBRE has arranged the $225 million sale of the office component of RBC Gateway Tower, a newly constructed mixed-use development located at 250 Nicollet Mall in Minneapolis. The portion acquired by San Francisco-based Spear Street Capital includes 525,000 square feet of office space, a ground-floor office lobby and 296 below-grade parking spaces. Ryan Watts, Tom Holtz, Brandon McMenomy, Steven Ward, Greg Greene and Harrison Wagenseil of CBRE represented the seller, United Properties, in the transaction. The office portion of the property was 99 percent leased at the time of sale to six tenants including RBC Capital Markets, United Properties and Pohlad Cos. The 1.2 million-square-foot tower also includes the 222-room Four Seasons Hotel Minneapolis — Minnesota’s first five-star hotel, according to CBRE — and 34 luxury Four Seasons Private Residences on the uppermost floors. Three restaurants are also on-site, including a full-service restaurant and bar, Mara, and Socca Café. “RBC Gateway Tower is a crown jewel in the Gateway District, with unmatched location and amenities,” says Watts of CBRE. “Premier properties like this offer exceptional workspaces that cater to the needs of modern employees, making them highly desirable as companies adapt to new workplace trends.” Minneapolis-based United Properties …

Content PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesLoansMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates’ Second-Quarter 2023 Economic Review by Sector

Lee & Associates’ newly released 2023 Q2 North America Market Report outlines industrial, office, retail and multifamily outlooks trends in the United States. This sector-based review of commercial real estate trends for the second quarter of the year examines the difficulties facing each property type and where opportunities in the landscape may be emerging. Troubles with absorption dogged each sector, with the exception of retail, throughout the first half of 2023. Scheduled deliveries for industrial, office and multifamily indicate this trend will continue throughout much of the United States for the foreseeable future. Lee & Associates has made the full market report available here (with further breakdowns of factors like vacancy rates, market rents, inventory square footage and cap rates by city). The summaries from each sector below provide high-level considerations of the overall outlook and challenges in the market. Industrial Overview: Industrial Growth on Track for Least Gain in Years In a reversal from the ballooning logistics capacities required during the pandemic, demand for industrial space has slowed across North America. After continuously rebuilding inventories from the fall of 2021 through the third quarter of last year, many retailers and wholesalers are taking a breather, pausing further inventory accumulation out of caution over …

INDIANAPOLIS — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of Marwood Plaza in Indianapolis for an undisclosed price. The Kroger-anchored shopping center totals 107,080 square feet. The property was originally developed in 1972 and completely refurbished in 2021. Kroger occupies 42 percent of the property’s gross leasable area. Bill Rose, Erin Patton, Scott Wiles and Craig Fuller of IPA represented the seller, Citivest Commercial, and procured the buyer, Core Marwood Plaza LLC. The shopping center was 93.5 percent occupied at the time of sale. Tenants include Buyer’s Market, Laundry & Tan Connection, Chase Bank, Los Patios Mexican restaurant, China One restaurant and H&R Block.

ELGIN, ILL. — Seefried Properties has broken ground on a two-building speculative industrial development in Elgin. The 465,360-square-foot project is slated for completion in the third quarter of 2024. The buildings will feature clear heights ranging from 32 to 36 feet, 185-foot-deep truck courts and 236 trailer parking spaces. The project team includes Harris Architects, FCL Builders and Spaceco as civil engineer. Jason West and Doug Pilcher of Cushman & Wakefield are marketing the project for lease.

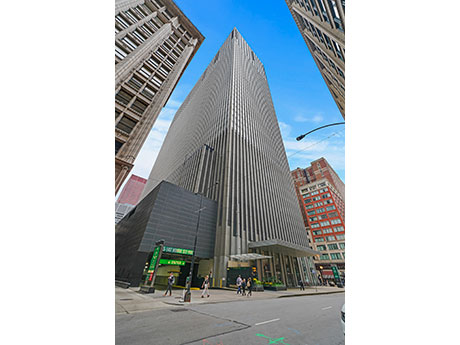

CHICAGO — Analytics8, a consulting firm that specializes in data strategy implementation, has signed a 13,355-square-foot office lease at 55 East Monroe in Chicago for its new U.S. headquarters. The firm is more than doubling its current 6,000-square-foot space at 150 N. Michigan. Victor Sanmiguel of Bespoke Commercial Real Estate represented Analytics8. Michael Lirtzman, Marina Zelenkova and Michelle Levy of Colliers represented the landlord, PGIM Real Estate. Rising 49 stories and totaling 1.2 million square feet, 55 East Monroe is situated in the city’s East Loop submarket. Amenities include a 3,400-square-foot conference center, 10,000-square-foot fitness center and the 10,000-square-foot Forum 55 food hall. More than 90,000 square feet of leases have been signed at the property within the last seven months. PGIM has unveiled plans to upgrade the building’s common areas, including the lobby, conference center and other amenity spaces in 2024.

FOREST PARK, ILL. — Interra Realty has brokered the $1.8 million sale of a 15-unit apartment building in the Chicago suburb of Forest Park. Located at 102 Rockford Ave., the three-story property was constructed in 1979. There are five studios and 10 one-bedroom units, all of which were fully occupied at the time of sale. Patrick Kennelly and Paul Waterloo of Interra represented both parties in the transaction. The buyer completed a 1031 exchange.

ALSIP, ILL. — SVN Chicago Commercial has negotiated the lease renewal for a roughly 45,000-square-foot warehouse located at 12600 S. Hamlin Court in Alsip. The Hines Building Supply division of US LBM is the tenant and has occupied space at the property since 2010. The new lease term is five years. Karen Kulczycki of SVN Chicago represented the undisclosed landlord, while CBRE represented the tenant. The property is situated on nearly five acres and features rail service.