COLUMBUS, OHIO — Woda Cooper Cos. Inc. and co-developer Franklinton Development Association have broken ground on Starling Yard, a 97-unit affordable housing community in the Franklinton neighborhood of Columbus. Located at 120 S. Central Ave., the project involves the adaptive reuse of the vacant Starling Middle School. Woda Cooper secured the site through a purchase agreement with the Board of Education of the Columbus City School District. The school, listed on the Columbus Register of Historic Properties in 2022, was originally built as West High School in 1908. It has been vacant since 2013. In addition to the adaptive reuse component, the project will also include two ground-up buildings with 52 units. All of the property’s units will be reserved for residents who earn 30 to 80 percent of the area median income. Rental rates are projected to range from $400 to $1,295 per month depending on income restriction and size of the unit. Five units will be reserved for those with mobility challenges and two units for those with sight and hearing disabilities. Primary financial support for Starling Yard is the result of a bond issuance and Low-Income Housing Tax Credits allocated by the Ohio Housing Finance Agency (OHFA). …

Midwest

AVON, OHIO — Cronheim Hotel Capital has arranged a $12.5 million loan for the refinancing of the Residence Inn & Emerald Event Center in Avon, a western suburb of Cleveland. Developed in 2016, the hotel offers extended-stay rooms and a flexible space for corporate functions, weddings and other social events. The borrower was a subsidiary of Nimbus Investment Fund LP, an independent affiliate of Emerald Hospitality Associates Inc. A regional bank provided the fixed-rate loan, which features an interest rate below 6 percent.

LAWRENCEBURG, IND. — Revitate Cherry Tree has acquired Tuscany Bay, a 96-unit workforce housing property located in Lawrenceburg, about 26 miles west of Cincinnati. The purchase price was undisclosed. Built in 1999, Tuscany Bay is situated near the newly developed Amazon Air Hub, a $1.5 billion air cargo facility totaling 800,000 square feet. Amenities at the property include an upgraded clubhouse, pool, playground, TV room and fitness center. The acquisition marks the close of the Revitate Cherry Tree Multifamily Fund I LP, which has been utilized to purchase six properties totaling 841 units. According to Revitate Cherry Tree, Tuscany Bay falls into the category of workforce housing that describes communities offering rental prices that correlate with regional income levels, ensuring that working Americans have quality affordable housing available in proximity to their workplace. The community was formerly a LIHTC-regulated property. Revitate Cherry Tree will maintain Tuscany Bay’s relative affordability for residents earning up to 80 percent of the area median income.

BARTLETT, ILL. — Entre Commercial Realty has brokered the sale of a 3.7-acre industrial site for a build-to-suit project in Brewster Creek Business Park in the Chicago suburb of Bartlett. The corporate headquarters facility will be home to a printing and packaging company relocating from Kane County. Mike DeSerto, Cory Kay and Mike Berkowitz of Entre represented the developer, Triumph Construction. JLL represented the buyer. The deal marks the fourth build-to-suit transaction that Entre has completed in Brewster Creek Business Park on behalf of Triumph.

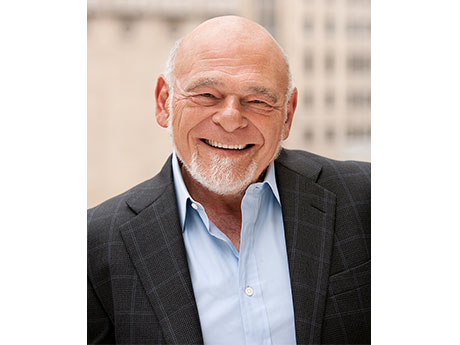

CHICAGO — Sam Zell, the founder and chairman of Chicago-based Equity Residential (NYSE: EQR), has died at the age of 81. An active investor in real estate since the 1960s, Zell helped revolutionize the industry through the popularization of the real estate investment trust (REIT) structure in the 1990s. Zell founded the predecessor company to Equity Residential while a student at the University of Michigan and took it public in August 1993. Under his leadership, Equity Residential grew into a $31 billion apartment owner, developer and operator. Over the years, he invested in and grew businesses in multiple industries, including real estate, manufacturing, retail, travel, healthcare and energy. Zell was an active philanthropist with a focus on entrepreneurial education. He established several entrepreneurship programs, including the Zell Lurie Institute at the University of Michigan, the Zell Fellows Program for entrepreneurship at Northwestern University’s Kellogg School of Management, the Samuel Zell & Robert Lurie Real Estate Center at the University of Pennsylvania’s Wharton School and the Zell Entrepreneurship Program at Reichman University. “The world has lost one of its greatest investors and entrepreneurs,” says Mark Parrell, Equity Residential’s president and CEO. “Sam’s insatiable intellectual curiosity and passion for dealmaking created some …

VERNON HILLS, ILL. — General contractor Focus has completed Everleigh, a 173-unit luxury active adult community in the Chicago suburb of Vernon Hills. Units range in size from 567 to 1,373 square feet, and there are also seven duplex cottages. Amenities include a demonstration kitchen, game room, fitness center, theater, business center and lounge. Designed by Meeks + Partners, the property rises four stories. Monthly rents start at $1,800. The developer, Greystar, launched the Everleigh by Greystar brand in 2017 with a focus on high-quality living for residents age 55 and older. Everleigh properties are now in eight states.

MAPLE GROVE, MINN. — A joint venture between PCCP and Endeavor Development has begun Phase II of Arbor Lakes Business Park in the Minneapolis suburb of Maple Grove. This second phase includes two buildings totaling 406,000 square feet. The buildings will each feature a clear height of 32 feet along with dock doors, drive-in doors, ample car parking and a shared 180-foot truck court. RJ Ryan is the general contractor. First National Bank of Omaha provided the construction loan. Phase I, which encompasses two buildings totaling 443,097 square feet, is slated for completion soon.

INDIANAPOLIS — Skender has moved into a larger Indiana office, located in the Keystone area of North Indianapolis, and more than doubled its workforce in the state to support a host of new projects under construction and in the planning stages. The Chicago-based general contractor’s presence in the region began in early 2020 when Indiana University Health (IU Health) hired Skender to assist with significant expansion and upgrades to IU Health facilities in Indianapolis and around the state. Skender’s Brian Simons relocated to central Indiana to head up local operations with a focus on expanding relationships with clients, architects, brokers and trade partners. Skender now has more than 1 million square feet of construction projects across Indiana, and the firm’s Indiana office is projecting more than 400 percent annual revenue growth in 2023. Projects span the healthcare, municipal, office and industrial sectors.

DES PLAINES, ILL. — Granite Construction has signed a 12,925-square-foot office lease at the O’Hare Offices in the Chicago suburb of Des Plaines. The transaction marks the fourth lease of the year signed at the property, which received earlier commitments from Big Mouth Media, Elara Caring and United Airlines totaling 25,525 square feet. Tony Russo and Ryan Freed of Lee & Associates are the leasing agents for the property on behalf of the landlord, Siete 7 LLC. O’Hare Offices rises five stories and totals 171,000 square feet. Amenities include a fitness center, access to food service and fully customizable office spaces. The landlord recently began a lobby renovation that will wrap up this summer. Granite Construction specializes in the transportation, water infrastructure and mineral exploration markets.

By Ted Branson, Landmark Commercial Real Estate There continues to be strong demand and a resulting shortage of industrial buildings in Wichita from 1,000 to 100,000 square feet for lease or for sale, not dissimilar from the fierce competition for housing, with prospects paying well above market rates just to keep from losing out “again” on an available property. With that, Wichita is seeing vacancies continue near 5 to 6 percent, an increase in average lease rates from $4 to $6 per square foot, and average sales prices increasing from $35 to $50 per square foot. New construction prices carry that considerably higher. That demand for space, and the increasing prices that prospects will pay, often leads to land sales and new construction. Many of the supply chain issues that caused construction to take up to two years have been improved or resolved, and several projects are underway. Developers have built several speculative warehouses, most notably in the new ICT21 Industrial Park, the former location of the Derby Oil refinery. Ron and Marty Cornejo did a masterful job of clearing the site of structural obstacles and rendering pollution issues innocuous, with Conco erecting three first-class, tilt-up concrete, high-bay warehouses, with …