INDIANAPOLIS — Montecito Medical has acquired a 34,369-square-foot medical office building in Indianapolis. The tenant is the Midwest Center for Joint Replacement, which uses the facility for orthopedic clinical care, orthopedic surgeries and physical therapy. The group maintains an additional location in Bloomington, Ind. The seller and sales price were not provided.

Midwest

DOWNERS GROVE, ILL. — Northmarq has arranged a $2.2 million loan for the refinancing of a 7,894-square-foot medical office building in the Chicago suburb of Downers Grove. Illinois Bone and Joint Institute occupies the property at 1034 Warren Ave. Erik Kunz of Northmarq arranged the loan through a life insurance company. The 10-year, fixed-rate loan features a 25-year amortization schedule.

HAMMOND, IND. — Marcus & Millichap has brokered the $1.9 million sale of a two-property retail portfolio in Hammond, about 30 miles southeast of Chicago. The properties are located at 2739 169th Street and 902 Roby Drive. The property on Roby Drive is home to three tenants and a drive-thru and is situated near the Horseshoe Hammond Casino. The property on 169th Street is located near the Purdue University Hammond Campus. Mitchell Kiven and Nicholas Kanich of Marcus & Millichap represented the Indiana-based seller, which was the original developer of both properties. The duo also procured the buyer, a private investor based in the Southwest Chicago suburbs.

Pizzuti Cos. Breaks Ground on 19-Story Coppia Multifamily High-Rise in Chicago’s West Loop

by John Nelson

CHICAGO — The Pizzuti Cos., a private real estate development and management firm based in Columbus, Ohio, has broken ground on Coppia, a 19-story high-rise apartment tower in Chicago. The 298-unit community will be located at 1101 Van Buren St., which is situated at the southern end of Aberdeen Street in the city’s West Loop district. Pizzuti expects to complete Coppia in 2024. The property will sit across from a Target store and next to Chicago Transit Authority’s Racine Avenue Blue Line Station, as well as three blocks west of I-90. Future residents will be near Chicago’s Fulton Market District, the Greektown neighborhood and Illinois Medical District. The name Coppia is Italian for “couple,” which Pizzuti says was inspired by the project having both a transit-oriented setting and the design of the façade, which features geometric figures split by contrasting glass patterns. The design-build team includes architect Goettsch Partners, general contractor Power Construction and property management firm Village Green. The community will feature studio, one-, two- and three-bedroom units with floor-to-ceiling glass and high-end finishes. Coppia will also include penthouses on the top levels, as well as ground-level retail space and contemporary art installations. Coppia’s resort-style amenities will include a …

By Colin Grayson, Lument If you consider multifamily real estate assets to be a good investment, you are in good company. At mid-year, asset managers and private equity firms alone held an estimated $325 billion of levered dry powder set aside for this purpose, enough cash to finance nearly every acquisition closed in the United States in 2021, the highest investment sales volume on record. Despite nearly unanimous support for the asset class, however, multifamily transaction volume in the third quarter slumped year-over-year for the first time since the peak of the pandemic. The mainspring was a sharp rise in mortgage financing costs triggered by high inflation and the Federal Reserve’s commitment to raising rates to bring it under control. Generic rates for 65 percent loan-to-value (LTV) first mortgage debt stood on 5.71 percent at the end of November, representing an increase of 248 basis points since the beginning of the year. Even as financing costs soared, asset pricing changed very little. Initial net cash flow yields of transactions closed in the third quarter of 2022 averaged only 4.6 percent, according to Real Capital Analytics, an increase of 10 basis points from second-quarter 2022 levels. At the same time, cap …

ST. PETERS, MO. — Northmarq has arranged the $70 million sale of Bold on Blvd, a 272-unit luxury apartment complex in the St. Louis suburb of St. Peters. Built in 2022, the property is located at 1100 St. Peters Centre Blvd. The community was roughly 80 percent leased at the time of sale. Parker Stewart, Dominic Martinez and Alex Malzone of Northmarq represented the seller, TWG Development. A private New Jersey-based firm was the buyer. David Garfinkel led a Northmarq team that arranged acquisition financing on behalf of the buyer.

ORLAND PARK, ILL. — Remedy Medical Properties has begun development of a $25 million medical office building in the Chicago suburb of Orland Park. The 42,000-square-foot project is a build-to-suit for Silver Cross Hospital and Premier Suburban Medical Group. Located at the northeast corner of LaGrange Road and 171st Street, the two-story building is slated for completion in early 2024. The property will house numerous primary and specialty care services, comprehensive imaging services, an 18-station infusion center, endoscopy suite and after-hours care. Perry Higa of NAI Hiffman represented Silver Cross Hospital and Premier Suburban Medical Group in purchasing two land sites totaling nearly 11 acres from SSM Health. Leopardo is the general contractor, Jensen & Halstead Ltd. is the architect and Kimley-Horn is the civil engineer.

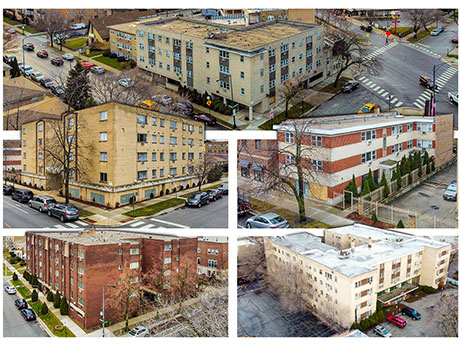

CHICAGO — Kiser Group has brokered the sale of a five-building multifamily portfolio in Chicago for $23 million. The 198 units are located within the West Rogers Park, Bowmanville and Budlong Woods neighborhoods and are largely vacant. Danny Logarakis of Kiser brokered the sale. The seller was a private individual that had owned the properties for more than 40 years. The buyers, Sam Trachtman and Stak Holdings LLC, plan to renovate the kitchens, bathrooms and common areas.

ELY, MINN. — Kraus-Anderson has completed a $21.4 million renovation and expansion project for Ely Public Schools in Ely, a city in Northwest Minnesota. The district is comprised of Ely Memorial High School and Washington Elementary and serves approximately 550 students. Designed by Architectural Resources Inc., the project consisted of a renovation of the two existing schools. Kraus-Anderson added a 39,000-square-foot common area that connects both the schools. The addition houses new classrooms, a gymnasium, media center, music room, metals shop, wood shop and a cafeteria with commercial kitchen equipment. Both schools now feature upgraded HVAC systems. New locker rooms were added to the high school and an early family childhood education area was added to the elementary school.

STERLING HEIGHTS, MICH. — Skin Diva Spa has signed a 2,000-square-foot retail lease at Brookside Village in Sterling Heights, a northern suburb of Detroit. Michael Murphy and Tjader Gerdom of Gerdom Realty & Investment represented the undisclosed landlord. Located at the northwest corner of 15 Mile and Schoenherr roads, Brookside Village has one space remaining available for lease.