SALINA, KAN. — Blue West Capital has arranged the $9 million sale of Sunset Plaza in Salina, a city in central Kansas. Dillons, a division of Kroger, anchors the 126,606-square-foot shopping center. The Dillons store was remodeled in 2019 and a fuel center was added in 2020. Originally constructed in 1960, Sunset Plaza was nearly fully leased at the time of sale. Robert Edwards, Zach Wright and Shawn Dickmann of Blue West Capital represented the seller, a Kansas-based private equity real estate company. The property sold at 97 percent of the asking price to a Denver-based buyer completing a 1031 exchange.

Midwest

GAHANNA, OHIO — Marcus & Millichap has brokered the sale of an 8,464-square-foot retail property in the Columbus suburb of Gahanna for $3.7 million. The property, which was 85 percent leased at the time of sale, is home to City BBQ and WesBanco Bank. CJ Jackson, Erin Patton, Scott Wiles and Craig Fuller of Marcus & Millichap brokered the transaction. Both the buyer and seller were private, out-of-state investors. The asset sold at 96 percent of the list price, which equates to a cap rate of 6.5 percent.

INDIANA, OHIO, ILLINOIS AND KENTUCKY — Extra Space Storage Inc. and its subsidiaries (NYSE: EXR) have completed the acquisition of multiple entities doing business as Storage Express, which owns 107 storage properties across Indiana, Ohio, Illinois and Kentucky. The sales price was approximately $590 million. The acquisition includes all Storage Express assets, including trademarks, contracts, licenses, intellectual property and 14 future development sites. The transaction was funded in part by the issuance of $125 million in operating partnership units, with the balance in cash drawn from its credit facilities. Latham & Watkins LLP served as outside legal counsel to Extra Space.

SIOUX CITY, IOWA — JLL Capital Markets has arranged the $27.5 million sale of Lakeport Commons in Sioux City, a city in Northwest Iowa. The 202,880-square-foot shopping center is 95 percent leased. Aldi and Ross Dress for Less recently signed 10-year leases to open at the property. Additional tenants include Five Below, Old Navy, PetSmart, Michaels, Boot Barn, Shoe Carnival, Staples and a separately owned Kohl’s. Amy Sands, Clinton Mitchell, Michael Nieder and Marcus Pitts of JLL represented the seller, The RH Johnson Co. A Midwest-based private investor purchased the asset.

EAGAN, MINN. — Colliers Minneapolis-St. Paul has brokered the sale of The Waters Business Center, a six-property industrial portfolio totaling 325,947 square feet in the Twin Cities suburb of Eagan. The sales price was undisclosed. Constructed between 1999 and 2007, the buildings feature both office and warehouse space. Mark Kolsrud, John McCarthy, Peter Loehrer, Kyle Delarosby, Pia Robertson and Lydia Turczyn of Colliers represented the seller, B9 Polar Waters LLC. Hyde Development was the buyer.

MOUNT PLEASANT, WIS. — In a sale-leaseback transaction, Likewise Partners LLC has acquired a 134,805-square-foot industrial property in the Milwaukee suburb of Mount Pleasant for $6.2 million. Located at 1901 Chicory Road, the building features a clear height of 26 feet. Wrought Washer Manufacturing Inc. was the seller. The company will continue to occupy the entirety of the building for storage and distribution. Travis Tiede and Barry Chavin of Newmark represented Wrought Washer. Raymond Zanca and Scott Modelski of Black Bear Capital arranged acquisition financing. The transaction marks the third acquisition for Likewise in Wisconsin.

COUNCIL BLUFFS, IOWA — NexCore Group has completed development of a new orthopedic medical office building in Council Bluffs, a suburb of Omaha. OrthoNebraska occupies the 23,000-square-foot, build-to-suit project, which is located at 1260 Valley View Drive. OrthoNebraska offers orthopedic services to those with needs related to arthritis, osteoporosis, fractures, dislocations, torn ligaments, sprains, strains, tendon injuries and pulled muscles. Leo A Daly was the project architect and McCarthy Building Cos. was the general contractor. NexCore owns the property in a joint venture with Harrison Street.

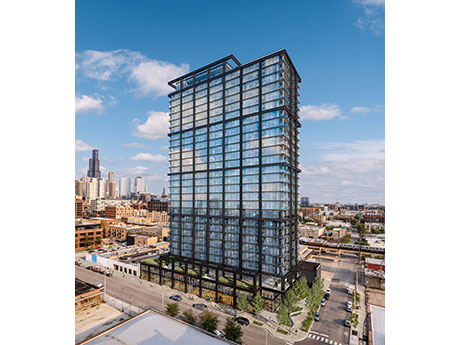

CHICAGO — Sterling Bay has broken ground on 225 N Elizabeth, a $155.6 million apartment development in Chicago’s Fulton Market district. The developer received $91.7 million in construction financing from Citizens and Old National Bank. The 28-story building will feature 350 units, 20 percent of which will be designated as affordable housing. Plans also call for roughly 9,000 square feet of retail space, 95 parking spaces and indoor and outdoor amenities on the third and top floors of the building. Sterling Bay is developing the project in partnership with Ascentris, a Denver-based private equity firm. Chicago-based McHugh Construction is the general contractor and Hartshorne Plunkard is the lead architect. Completion is slated for the second quarter of 2024.

PEORIA, ILL. — Northmarq has arranged the sale of Prairie Vista Apartments in Peoria for $45 million. Built in 2006, the 304-unit multifamily property features 38 buildings as well as a clubhouse, pool house and garages. The units are nearly fully occupied. Parker Stewart, Alex Malzone and Dominic Martinez of Northmarq brokered the sale. Dan Baker of Northmarq originated a $27 million Freddie Mac acquisition loan. The 10-year, fixed-rate loan features five years of interest-only payments followed by a 30-year amortization schedule. California-based Prairie Vista SPE Owner LLC was the buyer.

PLYMOUTH, MINN. — Monument Capital Management, an A-Rod Corp. company, has acquired Talus in Plymouth, just west of Minneapolis. The purchase price was undisclosed. The 192-unit apartment community was built in 1974. Floor plans range from 800 to 1,100 square feet. Amenities include a dog area, walking paths, fitness center, outdoor pool, indoor heated pool, laundry centers, underground heated parking and a newly renovated clubhouse. Monument plans to upgrade units and amenities. Ted Abramson of CBRE represented the seller, Curtis Capital Group. This property is the first acquisition for Monument’s newly launched fund, Monument Opportunity Fund V. Monument now owns or manages eight communities in the Minneapolis market totaling more than 1,000 units.