WOOD DALE, ILL. — Venture One Real Estate has acquired a 59,150-square-foot industrial building in the Chicago suburb of Wood Dale for an undisclosed price. Constructed in 1974, the property at 955 Lively Blvd. features three docks, three drive-in doors, parking for 60 cars, 5,180 square feet of office space and a clear height of 18 feet. Jay Farnam of Lee & Associates represented the undisclosed seller in the sale-leaseback transaction. Venture One utilized its acquisition fund, VK Industrial VI LP, which is a partnership between Venture One and Kovitz Investment Group.

Midwest

CHICAGO — SVN Chicago Commercial has negotiated a new lease for the former Beacon Tavern restaurant space in Chicago. Lady May, a Garrett Hospitality Group concept, will occupy the space beginning late this year. Lady May is an eatery and cocktail parlor that serves southern coastal fare. Leslie Karr and Lorile Herlihy of SVN Chicago Commercial negotiated the 10-year lease. The 6,700-square-foot property will also include an outpost of Sushi|Bar.

Arbor Realty TrustContent PartnerFeaturesLeasing ActivityMidwestMultifamilyNortheastSoutheastTexasWestern

Arbor: Multifamily Market Well-Positioned to Withstand Economic Headwinds

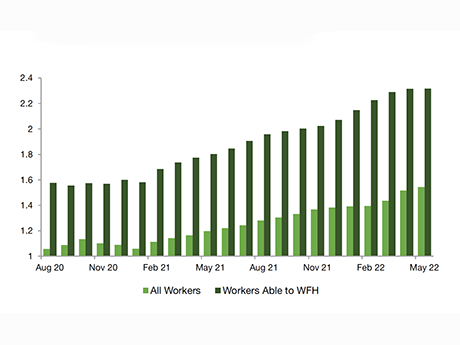

While rising interest rates, inflation and economic volatility have hurt many sectors of the economy, the rental housing market has maintained solid footing, according to Arbor Realty Trust’s Summer 2022 Special Report: Rental Housing Market Exhibits Cyclical Stability, Contains Structural Questions. The report was written by Ivan Kaufman, Arbor’s chairman and CEO, and Sam Chandan, founder of Chandan Economics. In a time of economic uncertainty, renting has become more appealing. Households seeking an affordable place to live, those who are delaying homeownership and others who prefer the flexibility and amenities associated with multifamily units all add to the increasing numbers of potential renters. Less traditional factors may also increase interest in renting, especially outside of tier-one markets. The expansion of work-from-home (WFH) culture is likely to be another reason rental demand is high right now. Meanwhile, the flexibility to work where the cost of living is lower and space is at less of a premium is pushing some renters who work remotely to explore living outside traditional hotspots. Economic Uncertainty Spreads as Interest Rate, Inflation Rise The Arbor Realty Trust report highlights a host of factors that are leading to economic uncertainty. Inflation (and its secondary effects) are contributing to …

TROY, MICH. — DraftKings Inc. and Live! Hospitality & Entertainment are opening the country’s first Sports & Social DraftKings venue at Somerset Collection in Troy this fall. Sports & Social DraftKings will offer a live sports viewing and wagering experience with a 32-foot LED media wall and gameday watch parties. Guests will be able to access DraftKings’ mobile platforms to play fantasy sports and wager on sports, including football, basketball, baseball, golf, MMA, soccer and tennis. The venue will offer a menu with a variety of gameday foods and specialty drinks. The 10,400-square-foot space will be in the standalone building adjacent to Somerset Collection South. The venue will feature a private lounge, dog-friendly outdoor patio, live music and a variety of games. ICRAVE is the project architect. Additional locations are expected to be announced in the coming months. DraftKings is a digital sports entertainment and gaming company. Sports & Social is a dining and entertainment concept developed and operated by Live! Hospitality & Entertainment, a division of The Cordish Cos. Somerset Collection is a retail destination owned by The Forbes Co. and home to 180 stores and restaurants.

MINNESOTA — Marcus & Millichap has arranged the sale of a 24-property self-storage portfolio in Minnesota for an undisclosed price. Nathan Coe, Gabriel Coe and Brett Hatcher of Marcus & Millichap represented the seller, KO Storage, and procured the undisclosed buyer. The portfolio spans more than 700,000 net rentable square feet.

MARION, IOWA — MAG Capital Partners LLC has sold a 48,237-square-foot manufacturing facility in Marion, a northwest suburb of Cedar Rapids. A private West Coast-based partnership purchased the asset for an undisclosed price. Judd Dunning of DWG Capital Group represented both the buyer and seller. The property serves as the corporate headquarters of Advanced Material Processing, which focuses on material processing equipment for the food and beverage, pharmaceutical, nutraceutical and chemical sectors. MAG Capital Partners acquired the property in a sale-leaseback transaction in October 2020.

BRIDGETON, MO. — IMPACT Strategies is beginning work this month on a project to convert a former Bank of America branch building into a medical marijuana dispensary for Proper Cannabis in Bridgeton, a northwest suburb of St. Louis. The 2,500-square-foot project will include renovations to both the building’s interior and exterior. The building marks the third location that IMPACT has built for Proper Brands. The $1 million project is slated for completion in November. Proper Brands also operates locations in Crestwood, Warrenton and South County, Mo.

OAK LAWN, ILL. — Friedman Real Estate has brokered the sale of a 1,500-square-foot auto retail property located at 4819 W. 93rd St. in the Chicago suburb of Oak Lawn. The sales price was undisclosed. Torrey Lewis and Kellen Duggan of Friedman represented the undisclosed seller. N3 Property Advisors was the buyer.

ILLINOIS — Walker & Dunlop Inc. has structured $57.6 million in HUD-insured loans for the refinancing of three skilled nursing facilities in Illinois. Joshua Rosen of Walker & Dunlop led the origination team. The first transaction consisted of a $15.6 million loan for Avantara Park Ridge, a 154-bed community in Park Ridge. Walker & Dunlop also arranged a $28.7 million loan for Moraine Court Supportive Living, a 185-bed community in Bridgeview, and a $13.3 million loan for Aperion Care Elgin, a 101-bed property in Elgin. The borrower was undisclosed.

MCCOOK, ILL. — A joint venture between PCCP and Midwest Industrial Funds is underway on the development of a 245,000-square-foot, Class A industrial facility in McCook. Located at 8701 W. 53rd St., the project will feature a clear height of 36 feet, 40 exterior docks, two drive-in doors, 271 car parking spaces and a 130-foot truck court. Completion is slated for spring 2023. CBRE National Partners advised on the joint venture between the two firms.