CHICAGO — CBRE has arranged the sale of a 58,803-square-foot office building in Chicago’s Fulton Market for an undisclosed price. The loft-style property, located at 217 N. Jefferson St., was built in 1937 and renovated in 2017. The building rises six stories and includes 40 surface parking spaces. Keely Polcynski and Blake Johnson of CBRE represented the seller, Metonic. A private buyer purchased the asset.

Midwest

OMAHA, NEB. — Marcus & Millichap has negotiated the sale of a two-property multifamily portfolio in metro Omaha for $27.5 million. Built in 2000 and 2001, Northridge and Flatwater total 192 units. The communities are located 10 miles apart and feature a mix of one- and two-bedroom floor plans. Jason Hornik, Greg Parker and Kent Guerin of Marcus & Millichap represented the seller and buyer, neither of which were disclosed.

OMAHA, NEB. — Investors Realty has brokered the sale of a 123,664-square-foot retail property in Omaha for $21.4 million. Located at the intersection of 72nd and Pacific streets, the asset is home to Aldi, Cavender’s and Kohl’s. Ember Grummons of Investors Realty represented the seller, NewStreet Properties. Jason Taylor of Equity Management Group represented the buyer, Caller Properties.

MINOT, N.D. — Kraus-Anderson has completed construction of a 110,000-square-foot Scheels store at Dakota Square Mall in Minot. Designed by R.L. Engrebretson Architecture, the $20.6 million project involved the remodeling of an 85,000-square-foot former Sears store combined with a 25,000-square-foot space for a conference room, classroom and offices. The store offers a selection of sports gear, clothing and shoes. Shoppers can also enjoy Ginna’s Café, which serves soups, sandwiches and coffee, and Fuzziwig’s Candy Factory, which sells homemade fudge.

NAPERVILLE, ILL. — Physician Real Estate Capital Advisors (PRECAP) has arranged the sale of a 19,900-square-foot building in Naperville for $15.2 million. Constructed in 2008 and located at 1243 Rickert Drive, the property is home to Suburban Gastroenterology and Midwest Endoscopy Center. In 2020, the endoscopy center underwent a 6,800-square-foot expansion and renovation. Scott Niedergang of PRECAP represented the seller, a physician partnership, and procured the buyer, a privately held company specializing in healthcare real estate acquisitions.

NEW BRIGHTON, MINN. — Clear Height Properties has acquired Rush Lake Business Park in New Brighton, a northern suburb of Minneapolis. The purchase price was undisclosed. The industrial property consists of two buildings totaling 79,028 square feet that are 87 percent leased. Harrison Wagenseil and Erik Coglianese of Transwestern represented the undisclosed seller. Transwestern will also handle leasing on behalf of Clear Height. The transaction marks the first acquisition in Minnesota for Oak Brook, Ill.-based Clear Height.

Content PartnerFeaturesLeasing ActivityLoansMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

How to Maintain Multifamily Investment Momentum in the Face of Rising Interest Rates

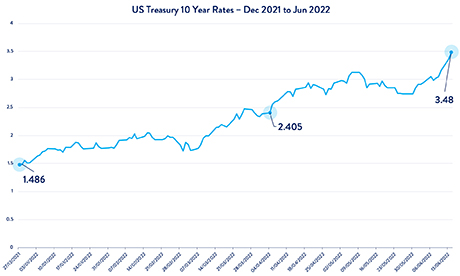

By Melissa Jahnke, associate director of operations, Walker & Dunlop The Federal Reserve raised interest rates by 75 basis points in June and then another 75 basis points in July, sending shockwaves across the commercial real estate industry. Fortunately, there are opportunities and solutions to bypass these potential roadblocks. Specifically, investors in a segment of multifamily housing known as small balance lending (SBL), encompassing five- to 150-unit properties, have several options to realize their aspirations for financing multifamily portfolios. View a higher resolution version of the timeline above here. During a recent webcast “Financing Amid Rising Rates: Best Approaches for $1M-$15M Multifamily Loans,” Walker & Dunlop’s market experts spoke about navigating today’s financing landscape. The expert panel included Allison Williams, senior vice president and chief production officer; Allison Herrera, senior director of SBL; and Tim Cotter, director of capital markets. These experienced professionals have found ways to make deals happen in a wide variety of financing environments and have shared their perspectives and guidance. If you are an owner of five- to 150-unit properties that require loans between $1 million to $15 million, the following will help you navigate today’s financial environment and build your momentum. Step 1: Consider the …

INDIANAPOLIS — Eastern Union has arranged $54 million in acquisition financing for a three-property multifamily portfolio totaling 628 units in Indianapolis. Built in 1980, Lake Marina features 348 units across 28 buildings. Lake Marina Realty LLC was the seller. Country Lake Townhomes is a 184-unit property that was built in 1974. Country Lake Apartments LLC was the seller. Zidan Realty Investments sold the 96-unit Fountainview, which was constructed in 1965. Michael Muller of Eastern Union arranged the 10-year, floating-rate loan with interest-only payments for the first five years. Arbor provided the Fannie Mae loan. The borrower was undisclosed.

CLAWSON, MICH. — Mid-America Real Estate Corp. has brokered the sale of Clawson Center in the northern Detroit suburb of Clawson for an undisclosed price. The fully leased shopping center spans 91,266 square feet. Tenants include Staples, Dollar Tree, Billings Lawn Equipment, Burn Fitness, Cosmoprof, H&R Block, Joe’s Army/Navy, Play It Again Sports and Salon Suites. Ben Wineman and Daniel Stern of Mid-America represented the seller, a Dallas-based family office. Kevin Jappaya, David Jappaya and Preston Rabban of KJ Commercial Real Estate Advisors represented the buyer, a metro Detroit-based private investment group.

INDIANAPOLIS — Industrious, a flexible workspace provider, is opening a new location at 71060 N. Capitol Ave. in the former Stutz Motor Car Co. factory in Indianapolis. SomeraRoad is repositioning the property as retail, office, arts and event space. The new location marks the third for Industrious in the Indianapolis market and is slated to open in December. The workspace will feature 350 seats across 28,000 square feet and include a mix of private offices, shared workspaces, conference rooms and lounge areas.