AKRON, OHIO — Green Harvest Capital LLC has purchased a nearly 64,000-square-foot historic warehouse in Akron with plans to convert the property into roughly 50 apartment units. The historic Akron Soap Co. building was formerly occupied by WhiteSpace Creative. Completed in 1893, the factory was built to manufacture soap and was later utilized by Pioneer Cereal Co. and Pockrandt Paint Co. The facility sat vacant for several years until White Hot Properties LLC purchased it in 2013 and converted the building into office space. Nichole Booker of SVN Summit Commercial Real Estate Advisors brokered the sale. The sales price was undisclosed.

Midwest

HOFFMAN ESTATES, ILL. — Kinema Fitness has opened FitLab, a 31,680-square-foot fitness facility, at Bell Works Chicagoland in Hoffman Estates. FitLab offers personal training, health coaching, nutrition consultation, state-of-the-art equipment and a range of group fitness classes. NPZ Style+Décor designed the space. Bell Works Chicagoland is the redevelopment of the former AT&T campus. Somerset Development is the owner and developer.

ST. PAUL, MINN. — Kraus-Anderson has completed the interior buildout of the new office for Pope Design Group in St. Paul. The design firm, formerly known as Pope Architects Inc., now occupies a 16,760-square-foot office at the historic Case Building located at 767 N. Eustis St. The open floor plan was designed to maximize collaboration among employees. Kraus-Anderson and Pope have worked together on hundreds of projects over the past 50 years.

CHICAGO — Chicago-based JLL Capital Markets has arranged an $85 million loan for the acquisition of a 12-building industrial portfolio totaling 814,888 square feet across California, Georgia, Maryland and Minnesota. MDH Partners acquired the fully leased portfolio. Chris Drew, Maxx Carney, Jimmy Calvo, Robert Carey, Brock Yaffe and Eric Boucher of JLL arranged the five-year, floating-rate loan with Truist. Mark Hancock of Truist Commercial Real Estate served as the lead on the transaction for Truist.

LOMBARD, ILL. — Barings has provided a $67 million, three-year loan for the recapitalization of The 450, a newly constructed apartment complex in the Chicago suburb of Lombard. Amenities at the 256-unit property include a fitness center, yoga studio, business center, package room with cold storage, heated underground parking, pet park, pool and electric car charging stations. Emerald Isle Investment Partners advised the borrower, a joint venture between UrbanStreet Group and Atlas Residential. The three-year loan includes funding to complete lease-up.

ZIONSVILLE, IND. — The Cooper Commercial Investment Group has negotiated the $7.3 million sale of The Avenue at Bennett Farms, a two-building retail property in the Indianapolis suburb of Zionsville. The 12,969-square-foot development is home to Tropical Smoothie Café, Restore Hyper Wellness, Capriotti’s Sandwich Shop, Hand & Stone Massage, Garbanzo Mediterranean Fresh, Classic Cleaners and a freestanding Java House. Dan Cooper of Cooper Group represented the seller, a Midwest-based developer. He also procured the buyer, a Midwest-based private investment group. The asset sold at roughly 99 percent of the list price and a 5.9 percent cap rate.

CHICAGO — Five Iron Golf, an indoor golf simulation experience, has signed a lease to open a new location in Chicago’s Lincoln Park. Located at 1000 W. North Ave., the 13,150-square-foot space will serve as Five Iron Golf’s third location in Chicago. Sharon Kahan and Amy Sider of CBRE represented the tenant in the lease transaction. The duo also represented Five Iron Golf in its other two leases in The Loop and River North.

ADDISON, ILL. — Brown Commercial Group Inc. has brokered the sale of a 28,810-square-foot industrial building in Addison. The property is located at 25 W. Official Road. Mike Antonelli of Brown represented the buyer, Pat Mooney Saws, a distributor and importer of metal sawing machinery, accessories and saw blades. The building is across the street from the headquarters of Pat Mooney Saws. The seller and sales price were undisclosed.

Affordable HousingArbor Realty TrustContent PartnerDevelopmentFeaturesMidwestMultifamilyNortheastSoutheastTexasWestern

As Affordability Crisis Deepens, Policies and Market Shift to Assist the Underserved

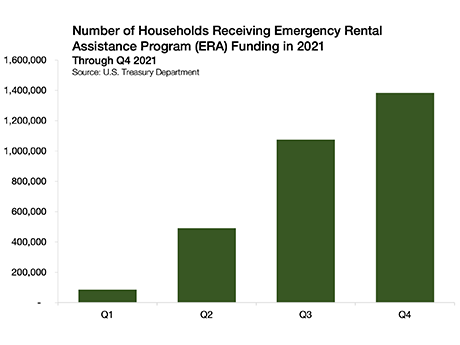

By Omar Eltorai, Arbor Realty Trust To understand the affordable housing market in spring 2022, one needs to first assess how this sector weathered the pandemic and then assess the current state of housing affordability across the country. In-depth findings on these trends are included in the Arbor Realty Trust-Chandan Economics Affordable Housing Trends Report, from which this article is excerpted. Weathering the Pandemic When it comes to the pandemic response, federal policymakers proved effective at defusing a large-scale increase in homelessness from financially insecure households. The Center for Disease Control and Prevention’s (CDC) eviction moratorium, while unpopular among industry advocates, prevented an estimated 1.6 million evictions, according to an analysis by Eviction Lab. After the Supreme Court struck down the federal moratorium in August 2021[1], the wave of evictions that many were forecasting did not immediately materialize. Nationally, tracked eviction filings ticked up but remained well below their pre-pandemic averages, according to Eviction Lab. A key reason why many at-risk renters have remained in their homes is the deployment of funds allocated in the Emergency Rental Assistance Program (ERA) — a funding pool designed to assist households that are unable to pay rent or utilities. The ERA Program was …

MISSOURI AND ILLINOIS — Berkadia has arranged the sale of The Saint Louis Five, a five-property multifamily portfolio totaling 716 units in Missouri and Illinois. The sales price was undisclosed. The properties include: the 360-unit Norwood Court Redfield Apartments in St. Louis; the 120-unit Delrado Apartments in Florissant, Mo.; the 100-unit Senate Square in St. Louis; the 112-unit Caroline Place Apartments in St. Louis; and the 24-unit Chesapeake Apartments in Marion, Ill. Andrea Kendrick, Ken Aston and Bobby Mills of Berkadia represented the seller, Missouri-based Baumann Property Co. Inc. New York-based David Stern Management was the buyer.