HOWELL, MICH. — Metro Infusion Center has leased the remaining 1,458 square feet at Shops at Westbury in Howell, about 30 miles north of Ann Arbor. Michael Murphy and Bill McLeod of Gerdom Realty & Investment represented the undisclosed landlord. Todd Schultz of Schultz Real Estate represented the tenant. Metro Infusion Center, a provider of infusion therapies for complex chronic conditions, now operates 15 locations across the state of Michigan.

Midwest

MANHATTAN, KAN. — Scorpion Biological Services, a subsidiary of Heat Biologics Inc., is building a new 500,000-square-foot biomanufacturing facility in Manhattan. The $650 million project will create 500 new jobs in the area within the next seven years, according to Gov. Laura Kelly. The facility will support the development of vaccines that enable an accelerated response to global biological threats. The company also intends to provide commercial level development, manufacturing and bioanalytical testing services at every stage for biopharmaceutical products on a fee-for-service basis to the global healthcare industry. The project came together as a result of partnerships between the Kansas Department of Commerce, Kansas State University, Kansas State University Innovation Partners, the City of Manhattan, the Manhattan Chamber of Commerce, Pottawatomie County, Pottawatomie County Economic Development Corp., Manhattan Area Technical College, Evergy, CRB and Realty Trust Group. A timeline for construction was not provided.

BLOOMINGTON, MINN. — Mesa West Capital has provided an $85 million loan for the acquisition of Hampshire Hill, a 534-unit multifamily property in the Minneapolis suburb of Bloomington. Located at 10660 Hampshire Ave., the community was 96 percent occupied at the time of loan closing. The property was built in 1987 and partially renovated in 2019. Murray Kornberg of Colliers arranged the loan on behalf of the borrower, Minneapolis-based multifamily investment firm Bader Diamond Funds.

NORTH RIVERSIDE AND ELMHURST, ILL. — Mid-America Real Estate Corp. has brokered the sale of two shopping centers in suburban Chicago for an undisclosed price. North Riverside Plaza is a 384,707-square-foot regional shopping center in North Riverside. Tenants include Kohl’s, Burlington, Best Buy, Petco, Michaels and a new grocery store that is currently under construction. Elmhurst Crossing is a 347,505-square-foot, grocery-anchored shopping center in Elmhurst. Major tenants include Whole Foods Market, Kohl’s, At Home and Petco. Ben Wineman and Kathryn Sugrue of Mid-America represented the longtime owner and seller, Canada-based Federal Construction. Brixmor Property Group was the buyer.

MENOMONEE FALLS, WIS. — Founders 3 Real Estate Services has arranged the $4.3 million sale of a 70,000-square-foot industrial building in Menomonee Falls, a northwest suburb of Milwaukee. The property is located on Woodale Drive. Bob Flood of Founders 3 represented the seller, Kohl’s Inc. Dynamic Tool Corp., which builds plastic injection molds for the packaging, personal care and healthcare industries, was the buyer.

WARREN, MICH. — Family Dollar has signed a 10,500-square-foot retail lease to open a store at Village Plaza in Warren, about 20 miles north of Detroit. Located at the northwest corner of 13 Mile and Mound roads, Village Plaza spans roughly 100,000 square feet. Michael Murphy and Bill McLeod of Gerdom Realty & Investment represented the landlord, Shango Enterprise Group. Scott Sonenberg of Landmark Commercial Real Estate Services represented Family Dollar.

BOURBONNAIS, ILL. — Maverick Commercial Mortgage Inc. has arranged $63.2 million in permanent financing for Tri-Star Estates, a mobile home park in Bourbonnais, about 50 miles south of Chicago. The property, which consists of 853 pad sites across 157 acres, was developed in three phases beginning in 1965. The current owner acquired Tri-Star in April 2012 when 380 homes were occupied. Today, 810 homes are occupied. Amenities include a basketball court, three playgrounds and a 7,500-square-foot clubhouse with a pool and fitness center. PGIM Real Estate provided the Freddie Mac loan. The 10-year, fixed-rate loan features five years of interest-only payments followed by a 30-year amortization schedule. Proceeds from the loan paid off the existing lender, provided cash to the borrower and paid for closing costs.

FENTON, MO. — U.S. Capital Development has selected IMPACT Strategies to build two new speculative industrial buildings at Fenton Logistics Park in Fenton, a southwest suburb of St. Louis. Building 6A will span 125,000 square feet, while Building 6B will total 160,000 square feet. Completion of both buildings is slated for the fourth quarter of this year. IMPACT is also handling site development for earthwork, utilities, parking lots and landscaping. Fenton Logistics Park is the redevelopment of a former Chrysler plant that will span more than 2.5 million square feet upon full buildout.

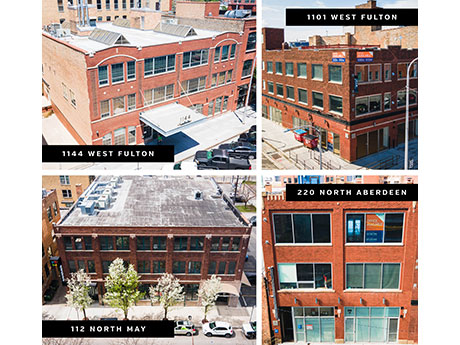

CHICAGO — SVN | Chicago Commercial has brokered the sale of a portfolio of office and retail buildings in Chicago’s Fulton Market district for $33.5 million. The portfolio comprises four buildings totaling more than 76,000 square feet as well as deeded parking spaces that can hold up to 58 cars. Scott Maesel, Drew Dillon, Chad Schroedl, Adam Thomas and Logan Parsons of SVN | Chicago Commercial’s Urban Team represented the seller. Buyer and seller information was not provided.

CRESTWOOD, ILL. — Entre Commercial Realty has arranged the sale of a 20,273-square-foot industrial building in Crestwood, a southwest suburb of Chicago. The sales price was undisclosed. The property features five drive-in doors and an outdoor storage yard. The building is fully leased to two tenants. Jeff Locascio and Chris Wilbur of Entre represented the seller, TFZ Enterprises. Matthew Lee of Darwin Realty/CORFAC International represented the buyer, Commercial Business Properties LLC.