CHAMPAIGN, ILL. — Marcus & Millichap has brokered the $150 million sale of a student housing portfolio comprising over 50 properties near the University of Illinois Urbana-Champaign campus in Champaign. The transaction represents the highest-ever portfolio sales price for Champaign County, according to Marcus & Millichap. The portfolio totals nearly 1,100 units. The newest property was constructed three years ago, while the oldest is more than 50 years old. Scott Harris and Bryan Kunze of Marcus & Millichap represented the seller, Campus Property Management, and procured the buyer, Fairlawn Capital. The buyer plans to reposition a number of the assets through unit upgrades and amenity additions.

Midwest

ST. LOUIS — Draper and Kramer Inc. has begun pre-leasing Moda at The Hill, a 225-unit apartment development in The Hill neighborhood of St. Louis. Residents can begin moving in this summer. The four-story building offers units that range in size from 600 to 1,200 square feet. Monthly rents start at $1,270. Amenities include a fitness center, game room, coworking spaces, grilling stations, fire pits, pool and hot tub. Moda at The Hill is part of a larger 11-acre master plan led by Draper and Kramer that includes single-family homes by McBride Homes and a community park.

JANESVILLE, WIS. — Northmarq has arranged a $28.1 million loan for the refinancing of Village Green Apartments in Janesville, about 40 miles south of Madison. The 406-unit multifamily property is located at 3121 Village Court. Mark Ebersold of Northmarq arranged the 10-year loan, which features two years of interest-only payments and a 30-year amortization schedule. A CMBS lender provided the fixed-rate loan. The borrower was undisclosed.

MAPLEWOOD, MINN. — Arizona Partners has acquired Birch Run Station in the Minneapolis suburb of Maplewood. The purchase price was undisclosed. The 279,343-square-foot shopping center is home to tenants such as Burlington, Jo-Ann and Dollar Tree. CBRE represented the seller, Voya Investment Management.

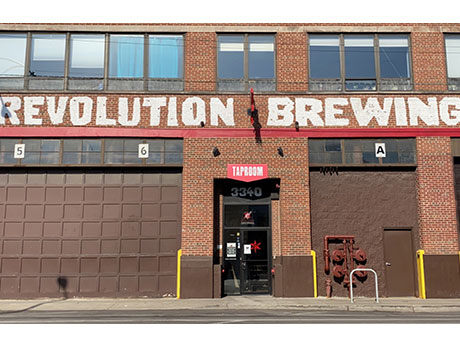

CHICAGO — Revolution Brewing, the largest independently owned brewery in Illinois, has purchased a 128,422-square-foot industrial property located on North Kedzie Avenue in Chicago. The purchase price was undisclosed. The building features clear heights ranging from 18 to 24 feet, 14 docks and one drive-in door. Mike Senner and Alex Kritt of Colliers represented the seller, a private investment group.

BOLINGBROOK, ILL. — M&J Wilkow and Bixby Bridge Capital have acquired The Promenade Bolingbrook in the Chicago suburb of Bolingbrook. The seller and sales price were undisclosed. The open-air lifestyle center spans 779,000 square feet. Some of the tenants include Macy’s, Bass Pro Shops, Binny’s Beverage Depot, Ulta and DSW. The shopping center opened in 2007. M&J Wilkow and Bixby also own Outlets of Maui in Hawaii together.

BATTLE CREEK, MICH. — NAI Wisinski of West Michigan has arranged the sale of Minges Creek Plaza in Battle Creek for an undisclosed price. The 72,000-square-foot shopping center was fully leased at the time of sale to tenants such as Jo-Ann, Biggby Coffee, Xfinity, Supercuts, Tropical Smoothie Café, The UPS Store and LA Insurance. Jodi Milks of NAI Wisinski represented the seller, which purchased the center in 2013 following a foreclosure and made property improvements. NAI Wisinski will handle property management and leasing for the new owner.

ST. LOUIS — Marcus & Millichap has negotiated the sale of a Chipotle-occupied retail property in St. Louis for $3.1 million. The 2,415-square-foot building, located at 3547 Hampton Ave., features a “Chipotlane” drive-thru. Chipotle opened for business at the location in 2020. Brennan Clegg, Chris Lind and Mark Ruble of Marcus & Millichap represented the seller, a limited liability company. The buyer was not disclosed.

WAUNAKEE, WIS. — Greywolf Partners Inc. has brokered the $2.4 million sale of a 26,000-square-foot industrial building in Waunakee, a northern suburb of Madison. The property, which is located at 904 Bethel Circle, features 3,900 square feet of office space, multiple overhead doors, three dock doors and a clear height of 21 feet. Steve Turner of Greywolf represented the undisclosed buyer. The seller was also not provided.

CARMEL, IND. — Treated Lumber Outlet LLC has signed a lease for a 13,000-square-foot industrial building in the Indianapolis suburb of Carmel. The property, located at 4511 W. 99th St., features 11,700 square feet of warehouse space and 1,300 square feet of office space. Building features include two dock doors, one drive-in door, column spacing and a clear height of 24 feet. Conrad Jacobs of Avison Young represented the landlord, Jadam Property Group. The tenant expects to take occupancy in June.