By Chris Beason, NAI Ruhl Commercial Co. As we move through 2025, the commercial real estate market in the Quad Cities region continues to adjust to tighter capital markets, rising costs and evolving consumer and business preferences. The bi-state region of the Quad Cities includes Moline, East Moline and Rock Island, Illinois; and Davenport and Bettendorf, Iowa, as the main core cities. The Quad Cities is the largest metro area between St. Louis and Minneapolis on the Mississippi River. When you look at the fundamentals like industrial absorption, land sales and retail demand, the Quad Cities continues to outperform expectations. The level of investment we’re seeing from both global tech companies and regional developers shows long-term confidence in the strength and potential of our market. Pivotal year for industrial The Quad Cities market mirrored the national trends with increased development of industrial buildings and rising rental rates. While the new industrial development we have seen locally over the past three years is to be celebrated, there is still a shortage of smaller 10,000- to 50,000-square-foot buildings. This is especially true for companies that desire to purchase real estate. There is significantly more inventory for lease of smaller product available than …

Midwest

FORT WAYNE, IND. — Mid-America Real Estate Corp. has arranged the sale of Covington Plaza, a 182,051-square-foot shopping center in Fort Wayne. Anchor tenants include The Fresh Market, Office Depot, Planet Fitness and The Woodhouse Day Spa. Other tenants include Pet Supplies Plus, Tequila Mexican Cantina, Cap n’ Cork, Christopher James Menswear and Catablu Grille. Ben Wineman, Joe Girardi, Rick Drogosz and Eric Geskermann of Mid-America represented the seller, Broad Reach Retail Partners. Charleston, S.C.-based Ziff Real Estate Partners was the buyer.

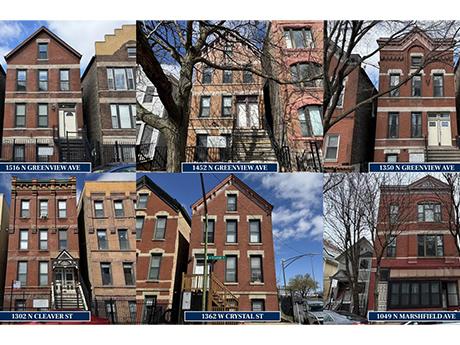

CHICAGO — Marcus & Millichap has brokered the $7.9 million sale of a six-property, 38-unit multifamily portfolio in Chicago’s Noble Square neighborhood. The assets are located at 1516 N. Greenview Ave., 1452 N. Greenview Ave., 1350 N. Greenview Ave., 1302 N. Cleaver St., 1362 W. Crystal St. and 1049 N. Marshfield Ave. The properties feature a mix of one-, two- and three-bedroom units, many of which have been recently renovated. The portfolio also includes 10 income-producing garage spaces. Tyler Preissing and James Ziegler of Marcus & Millichap represented the seller, a private investor, and procured the buyer, a local investment group.

SOUTH ELGIN, ILL. — Lee & Associates of Illinois has negotiated the $6.5 million sale of 84.4 acres of residential land at 325 Umbdenstock Road in South Elgin. John Cassidy, Jay Farnam and Ken Franzese of Lee & Associates represented the seller, Spohr Family Trust. The buyer, Lennar/CalAtlantic Group LLC, was self-represented. The site was previously marketed for an industrial use for more than a decade, according to Farnam. Lee & Associates secured a residential home builder to purchase the site and worked with the village on a land entitlement and approval process.

NAPERVILLE, ILL. — Greenstone Partners has arranged the $6.1 million sale of 1952 McDowell Road, a 55,000-square-foot medical and office building in the Chicago suburb of Naperville. The anchor tenant is Advanced Behavioral Health Services, which occupies the entire third floor and recently extended its lease through 2029. The asset was 86 percent leased at the time of sale. Jason St. John and AJ Patel of Greenstone represented the seller, a Naperville-based office operator. An outside broker represented the buyer, a local investor.

PLYMOUTH TOWNSHIP, MICH. — Bernard Financial Group (BFG) has secured a $1.5 million loan for the refinancing of a 53,314-square-foot office property in Plymouth Township. Adam Ferguson of BFG arranged the loan on behalf of the borrower, Plymouth Commerce Center LP. A life insurance company provided the loan.

JOLIET, ILL. — Peak Construction Corp. will complete two tenant improvement projects at NorthPoint Development’s Third Coast Intermodal Hub Building 1 in Joliet. The first build-out totals 303,053 square feet and features a clear height of 40 feet, 25 dock doors, one drive-in door, 59 trailer stalls, 164 car spaces, 2,500 square feet of office space and two remote restrooms. The second project is an expansion for an existing tenant for whom Peak previously built out its space. The expansion adds 431,627 square feet with a clear height of 40 feet, 49 dock doors, one drive-in door, 97 trailer stalls, 204 car spaces, 5,500 square feet of office space and a remote restroom. Both projects are slated for completion in fourth-quarter 2025. The architect is studioNorth. Peak completed construction of the 1 million-square-foot building in 2024.

CHICAGO — Interra Realty has brokered the sales of two vintage apartment buildings in Chicago’s Lincoln Park neighborhood for a total of $13 million. The properties included 611-13 W. Arlington Place, a 23-unit asset built in 1927 that sold for $7.3 million, and 567-69 W. Arlington Place, a 14-unit building constructed in 1907 that traded for $5.7 million. Colin O’Malley of Interra represented the confidential seller of both properties. Joe Smazal and Mark Dykstra of Interra represented Hayes Properties, the buyer of 611-13 W. Arlington. The confidential buyer of the other property was self-represented. Both assets were fully occupied at the time of sale.

PAPILLION, NEB. — Darland Construction Co. has completed a nearly 60,000-square-foot industrial facility for Mid-States Utility Trailer Sales in Papillion. The project is located just off Highway 50 and I-80 and serves as a regional hub for the semi-trailer dealer. The development features a trailer shop, parts warehouse, driver’s lounge and administrative offices. A notable aspect of the project includes more than 11 acres of exterior paving designed to accommodate the extensive inventory and traffic flow of large semi-trailers. Mid-States Utility operates four locations across Nebraska, Iowa and South Dakota.

VERNON HILLS, ILL. — Fortec has acquired a 15,040-square-foot former ambulance warehouse at 401 W. Sullivan Drive in the Chicago suburb of Vernon Hills. The $1.7 million acquisition is part of a $5 million investment to transform the property into The Nest School-Vernon Hills, an early education center scheduled to open in spring 2026. Fortec has signed a lease with The Nest Schools, a childhood education operator with more than 50 schools nationwide. Construction is scheduled to begin this month, with planned improvements including a full interior renovation, the addition of an outdoor playground and a modern redesign led by New Look Architecture. The property formerly served as a Superior Ambulance headquarters. Fortec is financing the project with a lender partner and expects to complete construction by mid-2026. Northmarq’s Milo Spector represented Fortec in the deal.