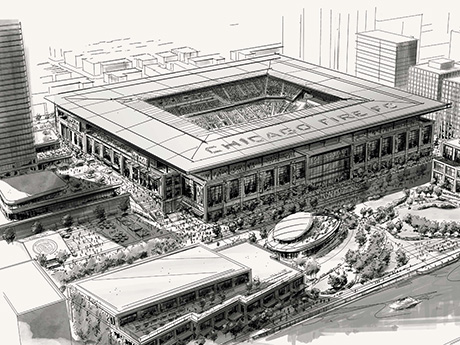

CHICAGO — The Chicago Fire FC, a Major League Soccer (MLS) franchise, has unveiled plans for a new, privately funded soccer stadium in downtown Chicago. The Wall Street Journal reports the project would cost roughly $650 million to execute. The club and its owner and chairman, Joe Mansueto, plan to debut the new stadium in spring 2028, along with a surrounding entertainment district. “Soccer is the world’s game, and a world-class city like ours deserves a world-class club — with a world-class home to match,” says Mansueto, who purchased the club in 2018. “This new home will serve as a catalyst for job creation, economic development and vibrant community life.” The Chicago Fire did not release financial terms of the development, but Mansueto says that no public funds will be used in the development of the venue, which is designed to seat approximately 22,000 fans for matches. The stadium’s seating capacity can also be expanded for concerts or other community events, according to the project’s website, DearChicago.com. The venue will be situated along the Chicago River just south of Roosevelt Road. The stadium will serve as an anchor of The 78 as it is anticipated to be Chicago’s 78th neighborhood. The …

Midwest

CHICAGO — Q Investment Partners (QIP) and Melrose Ascension Capital (MAC) have opened Straits Row, an 18-story rental tower combining traditional apartments with co-living units in Chicago’s South Loop. Located at 633 S. LaSalle St. within the historic Printers Row neighborhood, the 132-unit building offers 358 private, fully furnished residential spaces. Singapore-based QIP sponsored the development and collaborated with MAC as its Chicago-based, local partner to co-develop the project. QIP acquired the site from PMG and The Collective. Straits Row represents QIP’s flagship residential development in the United States and builds on its Straits-branded student housing and co-living communities in the United Kingdom. Straits Row provides a range of options from studios to four-bedroom layouts. In the co-living units, residents share a kitchen and living space while enjoying private bedrooms and bathrooms. Residents have access to 15,000 square feet of amenity and social spaces across two levels. The ground-level Printers Room serves as a coworking lounge with private study rooms, lounge seating, an outdoor patio and coffee bar. On the penthouse level, amenities include a resident lounge, fitness and wellness center, private dining area and pool deck. Throughout the building, a curated art program features pieces that pay tribute to …

GARDNER, KAN. — Brinkmann Constructors has broken ground on Crossroads Commerce Center Phase I, a 467,000-square-foot warehouse in Gardner, a southwest suburb of Kansas City. Panattoni Development Co. is the developer. Located on a 24-acre site, the project marks the first phase of an eight-building, master-planned industrial park. Gray Design Group is the architect.

CICERO, ILL. — Interra Realty has arranged the $2.6 million sale of a 24-unit property in the Chicago suburb of Cicero. Constructed in 1918, the asset features 22 two-bedroom apartment units and two retail spaces. Of the total apartment units, 14 are duplexes. Michael Duckler, Patrick Kennelly, Paul Waterloo and Nathan Zito of Interra represented the confidential buyer and seller. The transaction marks Cicero’s largest so far in 2025 by total dollar amount and unit count, according to data from CoStar.

MENASHA, WIS. — NAI Pfefferle has negotiated the sale of a 25,269-square-foot industrial facility located at 1725 Racine Road in Menasha near Appleton. The sales price was not disclosed, but the asking price was $1.7 million. Teresa Knuth of NAI Pfefferle brokered the transaction. Buyer and seller information was not released.

BLOOMINGTON, ILL. — AXIS 360 Commercial Real Estate Specialists has brokered the $1.5 million sale of a 13,840-square-foot office building located at 421 Detroit Drive in Bloomington. The buyer, Wilber Group, is an insurance subrogation and claims recovery services provider. The property will serve as Wilber’s third campus in the Bloomington-Normal area. Laura Pritts of AXIS 360 represented the undisclosed seller, while Meghan O’Neal-Rogozinski of AXIS 360 represented Wilber.

CHESTERFIELD, MO. — Locally based developer The Staenberg Group has begun Phase I of a 4.5 million-square-foot mall redevelopment project in Chesterfield, a western suburb of St. Louis. According to local news sources, including The St. Louis Business Journal, the mixed-use project is valued at roughly $2 billion. Known as Downtown Chesterfield, the project is a re-imagining of the former site of the Chesterfield Mall, demolition of which is now complete save for the department store buildings of former anchors Macy’s and Dillard’s. The first phase of new development will involve grading the site and installing infrastructure, creating a 3.3-acre central park and building utilities and streets. At full build-out, Downtown Chesterfield will feature up to 2,363 residential units, including 1,000 to be developed as part of Phase I. Residential buildings will include retail and restaurant space, and the Macy’s building will be repurposed to support retail and office uses. The Dillard’s store will be modernized and upgraded and could re-open in advance of the 2026 holiday shopping season. “This is more than just tearing down a mall — it’s laying the foundation for the future of Chesterfield,” said Michael Staenberg, president of The Staenberg Group. “You’ll drive in off Clarkson …

CHICAGO — Kiser Group has negotiated the $5.7 million sale of a fully occupied apartment building in Chicago’s Edgewater neighborhood. A former condo deconversion, the property features a mix of one-, two- and three-bedroom units and presented a value-add opportunity. All units were equipped with individual/central HVAC systems and varying levels of finishes from renovations completed roughly 20 years ago. Jacob Price and Katie LeGrand of Kiser brokered the transaction. The buyer owns apartments nearby.

EDEN PRAIRIE, MINN. — Brisky Net Lease has brokered the $5.7 million sale-leaseback of an industrial property located at 7975 Wallace Road in the Twin Cities suburb of Eden Prairie. Max Mantey of Brisky represented the seller, 360 Wall Systems. The tenant has a new 10-year triple-net lease with zero landlord responsivities and annual rent increases. The primary tenant, 360 Wall Systems, occupies the majority of the building, complemented by Hagen Automotive, a subtenant that has occupied space for more than 30 years. 360 Wall Systems is a specialty contractor that has worked on apartment buildings, medical offices and industrial buildings in the Twin Cities.

ARLINGTON HEIGHTS, ILL. — Marcus & Millichap has arranged the $3.4 million sale of 2015 S. Arlington Heights Road in the Chicago suburb of Arlington Heights. The 8.3-acre land property is located about a half mile north of the I-90 interchange. Richard Kozarits, Eric Bell and Jordan Callaway of Marcus & Millichap represented the seller, a trust, and procured the buyer, a national commercial real estate investor and developer. The buyer plans to pursue approvals for a new ground-up development.