MENASHA, WIS. — NAI Pfefferle has negotiated the sale of a 25,269-square-foot industrial facility located at 1725 Racine Road in Menasha near Appleton. The sales price was not disclosed, but the asking price was $1.7 million. Teresa Knuth of NAI Pfefferle brokered the transaction. Buyer and seller information was not released.

Wisconsin

LANSING, MICH. — Lansing-based Cinnaire has closed a $340 million Low-Income Housing Tax Credits (LIHTC) fund — the largest investment fund in the organization’s 32-year history — that will finance 33 affordable housing developments across 11 states. The financing will provide 2,455 units for more than 5,400 individuals and generate more than $844 million in local economic activity, according to Cinnaire. Specifically, Fund 43 will support developments such as Haven on Main in La Crosse, Wis., and Wellspring Recovery in Farmington Hills, Mich. Haven on Main will total 70 units with 59 affordable housing apartments and 11 market-rate units. Eighteen units are reserved for individuals with intellectual and developmental disabilities, veterans and those experiencing chronic homelessness. Half of the apartments are designed to support independent living for adults on the autism spectrum. Full supportive services will be provided by CouleeCap in partnership with Invista and Haven for Special People. Wellspring Recovery will feature 72 affordable housing units, including 60 floor plans that will be permanent supportive housing (PSH) dedicated to individuals recovering from opioid addiction. The PSH units will be housed in a separate building divided by a natural green space and supported by project-based rental assistance from Michigan State …

WEST ALLIS, WIS. — Colliers has arranged the $4.5 million sale of a six-tenant retail center in the Milwaukee suburb of West Allis. The 14,000-square-foot property is home to tenants such as AT&T, Tropical Smoothie Café and HuHot. The private seller purchased the asset about three years ago and needed to dissolve a partnership. Colliers represented the seller and procured the buyer, Curbline, a $500 million fund that made its first acquisition in Wisconsin.

WISCONSIN DELLS, WIS. — HALL Structured Finance (HSF) has provided a first lien construction loan totaling $41.1 million for the Dellshire Resort in Wisconsin Dells, a city in southern Wisconsin. HSF partnered with Nuveen Green Capital, which provided an additional $27.8 million in C-PACE financing. Adrienne Andrews and Jeffrey Bucaro of JLL arranged the financing on behalf of the borrower, Uphoff Ventures LLC. Dellshire Resort will be a 208-room Medieval-themed hotel and represents the initial phase of a 40-acre master-planned resort and attraction development. The four-story hotel will feature a 222-seat restaurant, six pools, a swim-up pool bar, 9,500-square-foot arcade and family entertainment center, ATV rentals and approximately 6,500 square feet of meeting and event space. A 60-foot-tall fire-breathing dragon sculpture will mark the hotel’s entrance, complemented by costumed knights and dragon-themed interactions throughout the property. Located approximately 55 miles northwest of Madison, Wisconsin Dells is known as the “Waterpark Capital of the World,” boasting the highest concentration of indoor and outdoor waterparks globally, according to HSF. The local economy is heavily tourism-driven, drawing more than 4 million visitors annually. Completion of the Dellshire Resort is slated for the second quarter of 2026. Pyramid Global Hospitality will manage the asset. …

MILWAUKEE, PORT WASHINGTON, SLINGER AND WEST BEND, WIS. — EquiCap Commercial has brokered the sale of the StorSafe of Wisconsin Portfolio, a 258,450-square-foot self-storage portfolio in Wisconsin. The five properties, totaling 1,454 units, are located in Milwaukee, Port Washington, Slinger and West Bend. Jesse Luke and Scott Rihm of EquiCap brokered the transaction. An out-of-state buyer purchased the portfolio within 97 percent of the list price. The deal closed within 75 days of going under contract.

OSHKOSH, WIS. — NAI Pfefferle has brokered the sale of a 21,000-square-foot flex industrial building located at 2080 W. 20th Ave. in Oshkosh. The sales price was undisclosed, but the asking price was $1.6 million. John Roberts of NAI Pfefferle brokered the transaction. Buyer and seller information was not provided.

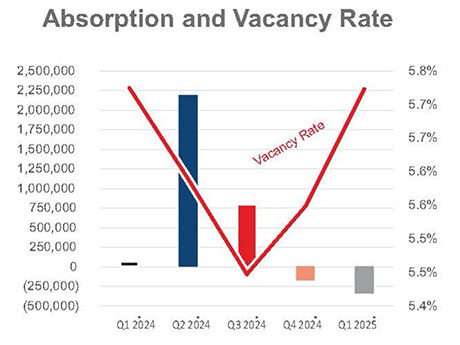

By James Barry III, The Barry Company The Southeast Wisconsin industrial real estate market has been having a very good run for the past several years. Vacancy rates have continued to stay at historically low levels, absorption of space has declined a bit, but remains consistent, and rental rates and sale prices have climbed steadily upwards. According to the latest statistics gathered by the Commercial Association of Realtors – Wisconsin (CARW), the overall vacancy rate for industrial space in Southeast Wisconsin is 5.7 percent, well below the historic “natural” vacancy rate of 7 to 8 percent (see chart above). Certain major submarkets have astonishingly low vacancy rates: 1.3 percent in Waukesha County, 0.5 percent in Sheboygan County and 0.6 percent in Walworth County. These submarkets have almost no industrial space available, and any newly available space tends to be snatched up very quickly at premium lease rates or sale prices. Given the lack of available industrial land in many of Southeast Wisconsin’s submarkets and the lack of new speculative construction, this low vacancy environment promises to continue for the foreseeable future. South I-94 Corridor The major exception to this low vacancy rate scenario in Southeast Wisconsin is the South …

ELLSWORTH AND BALDWIN, WIS. — Marcus & Millichap has arranged the $5.8 million sale of a 49-unit multifamily portfolio in western Wisconsin. The portfolio includes 25 units across five buildings in Ellsworth and two buildings in Baldwin with 24 units. Scott Anderson of Marcus & Millichap represented the seller and procured the buyer. Both parties were Wisconsin-based investors.

EAU CLAIRE, WIS. — Marcus & Millichap Capital Corp. (MMCC) has secured a $10.1 million loan for the refinancing of Alto Station Apartments in Eau Claire within western Wisconsin. The newly built apartment community is pre-leasing now and is slated to open in 2026, according to the property’s website. The 88-unit building is located at 325 Main St. and features a mix of studio to two-bedroom floor plans. Amenities include a fitness center, clubhouse, rooftop terrace and bike storage. Robert Bhat of MMCC arranged the loan with a local credit union on behalf of the private buyer. The loan features an interest rate of 6.75 percent and a 75 percent loan-to-cost ratio.

BROOKFIELD, WIS. — FedEx has renewed its 1,925-square-foot retail lease at Shoppers World of Brookfield in the Milwaukee suburb of Brookfield. Last Mile Investments (LMI) owns the property, which is home to tenants such as Great Clips, Potbelly, AT&T, Aspen Dental and the upcoming Tropical Smoothie Café. Ryan Toppel of FedEx Real Estate represented FedEx, while Tyler Murphy and Sean Quinn represented LMI on an internal basis.