FRIENDSWOOD, TEXAS — A partnership between two locally based firms, Tannos Development Group and Wolfgramm Capital, will develop a 106-acre mixed-use project in Friendswood, a southeastern suburb of Houston. Friendswood City Center will feature an apartment complex with roughly 500 units and a luxury hotel with a convention center that can house up to 500 people. Plans also call for approximately 150,000 square feet of retail and restaurant space and 200,000 square feet of medical and office space. The development will also have a 52-acre public park with more than four miles of walking and jogging trails and a fishing lake with a pier. Various infrastructural improvements are also being made as part of the project. The City of Friendswood is partnering with Tannos and Wolfgramm on Friendswood City Center, which represents more than $750 million in regional capital investment.

Mixed-Use

SARASOTA, FLA. — Publix Super Markets has opened a 48,000-square-foot grocery store at Fruitville Farms, a mixed-use development underway in Sarasota. Benderson Development is the master developer of the public-private partnership, which will feature 600 apartments, 150,000 square feet of retail and restaurants and a new 120,000-square-foot Sarasota County Administration Center. Located at the intersection of Fruitville Road and Lakewood Ranch Boulevard, the new Publix is the first tenant to open at the shopping center within Fruitville Farms.

SAN DIEGO — Marcus & Millichap has arranged the sale of The Arte Building, a mixed-use property in San Diego. Salwan Komo acquired the property from 1111 6th Ave LLC for $7.8 million. The seller operated its coworking business, Expansive, at the 70,602-square-foot building. At the time of sale, Expansive leased back approximately 35,000 square feet, resulting in the property being 80 percent occupied. Ross Sanchez and Nick Totah of Marcus & Millichap’s San Diego downtown office represented the seller and procured the buyer in the transaction. Located at 1111 Sixth Ave., The Arte Building was built in 1913 and extensively renovated in 2017. Amenities at the property include subterranean parking, a rooftop lounge, indoor lounge areas, conference rooms, phone booths and a game room.

Naftali Credit, J.P. Morgan Provide $120M Financing for Mixed-Use Project in Nashville

by John Nelson

NASHVILLE, TENN. — Naftali Credit Partners and J.P. Morgan have provided $120 million in financing for 1111 Church Street, a recently developed multifamily and retail project in Nashville. New York City-based Tidal Real Estate Partners is the borrower. The five-year financing comprises a senior loan from J.P. Morgan and a mezzanine loan from Naftali, which will be used to refinance an existing construction loan and provide bridge financing to a sale or permanent financing. Keith Kurland, Aaron Appel, Jonathan Schwartz, Adam Schwartz, Michael Diaz and Michael Ianno of Walker & Dunlop arranged the financing on behalf of the borrower. Located in the North Gulch neighborhood, the property features 380 multifamily units in studio, one- and two-bedroom layouts, in addition to 52,000 square feet of amenities, 45,000 square feet of retail space and dedicated parking. Amenities include an outdoor pool, fitness center, pickleball court and golf simulators, and a recently opened Puttshack.

THORNTON, COLO. — Indianapolis-based TM Crowley & Associates has partnered with Atlanta-based NLG Capital Management (NLGCM), a division of The Net Lease Group, to develop The Highlands at Thornton, a mixed-use property at the northeast intersection of Quebec Street and 136th Avenue in Thornton. Situated on 23 acres, the project will offer more than 101,925 square feet of retail, commercial and medical office space. CVS Caremark will anchor the development. Lisa Vela and Jay Landt of Colliers will handle leasing efforts for the project.

ATLANTA — CP Group has rebranded CNN Center, an iconic 1.2 million-square-foot office and retail building in downtown Atlanta, to The Center. The property has served as the headquarters for CNN for over 40 years and also features a large food court on the ground level that connects to State Farm Arena, home arena of the NBA’s Atlanta Hawks. The site also includes the Omni Atlanta Hotel at Centennial Park. CP Group plans to overhaul the former CNN Center to become a hub of world-class retail, dining, content creation and entertainment uses. CP Group has tapped Coleman Weatherholtz of Healey Weatherholtz Properties as The Center’s retail leasing agent and Jeff Keppen and Nicole Goldsmith of CBRE to handle office leasing. In 2021, CP Group purchased CNN Center from AT&T, the former parent company of CNN, in a sale-leaseback transaction that expires this year.

PHOENIX — Wespac Construction has completed work on three mixed-use buildings at Culdesac Tempe, a car-free, mixed-use development at 2025 E. Apache Blvd. in Tempe, just east of Phoenix. Situated on 17 acres, Culdesac Tempe will feature 44 apartments and 24,000 square feet of retail space. The site underwent extensive clearing, grading and utility installation. Additionally, a 2,500-square-foot restaurant shell and tenant improvement were constructed for Cocina Chiwas, a full-service restaurant. Key features include a 6,700-square-foot fitness facility and the 4,700-square-foot Market Building that spans three levels and features 16 apartments. DAVIS and Opticos designed the project, which Culdesac owns and developed.

Gantry Secures $7.1M in Financing for Auteur Wines Facilities in Healdsburg, California

by Amy Works

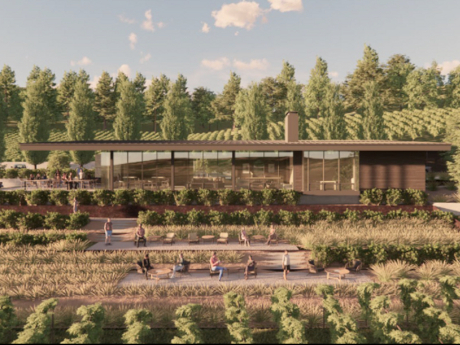

HEALDSBURG, CALIF. — Gantry has arranged a $7.1 million construction-to-permanent loan for the build-to-suit development of dedicated facilities for Auteur Wines, a vintner-founded winery specializing in Pinot Noir and Chardonnay. Located at 10520 Wohler Road in the Sonoma County city of Healdsburg, the project will include a production winery, tasting room and vineyard on 8.2 acres. Jeff Wilcox and Andrew Ferguson of Gantry’s San Francisco production office represented the borrower, a private real estate investor. The 20-year, construction-to-permanent, fixed-rate loan was provided through one of Gantry’s banking relationships and features an initial interest-only period transitioning to an 18-year amortization.

Construction Resources to Open Design Center at Westside Paper Development in Atlanta

by John Nelson

ATLANTA — Construction Resources, a distributor of home improvement products, plans to open a new design center at Westside Paper, a mixed-use development located at 950 W. Marietta St. in Atlanta’s West Midtown district. The center, which is set to open early next year, will be the first location to feature all of Construction Resources’ products in a single location. Westbridge and FCP co-developed and own Westside Paper, which is an adaptive reuse of a 70-year-old paper mill. Brad Pope of JLL represented Construction Resources in the lease transaction, and Shelbi Bodner with Bridger Properties represented the landlord. Other tenants at Westside Paper include El Santo Gallo, Pancake Social, Elsewhere Greenhouse, Bar Driver, Northern China Eatery, Ancestral Bottle Shop & Market and King of Pops.

ATLANTA — GID has welcomed the first residents at Windsor Brompton and Windsor Avery, two apartment communities underway within the $2 billion High Street mixed-use development in Atlanta. Located in the city’s Central Perimeter submarket, the two apartment communities total 598 units. Windsor Communities, GID’s property management division, operates both properties. More than 100 leases have been signed at the communities prior to delivery. Apartments at Windsor Brompton and Windsor Avery come in 16 different floor plans comprising studio, one-bedroom and two-bedroom configurations. Monthly rental rates start at $1,538, according to the property website. Amenities include a fitness and yoga studio, pool and sundeck, catering kitchen and private dining room, coworking spaces, an outdoor dog run and dog wash, outdoor gaming lawn, bike lounge and a bike repair station. Residents will also have direct access to High Street’s lineup of shops and restaurants, which will include Puttshack, Jaguar Bolera, Nando’s PERi-PERi, Velvet Taco, Allen Edmonds, Skin Spirit, The Hampton Social, Agave Bandido, Cuddlefish, Ben & Jerry’s and Sugar Coat.