CHICAGO — Concord Summit Capital LLC has arranged $25.1 million in bridge financing for the acquisition of The Archer, a 68-unit apartment building in Chicago’s Gold Coast neighborhood. The funding enabled an existing limited partner to acquire full control of the asset from the general partner and initiate a renovation of the remaining units. Daniel Eidson and Ben Applebaum of Concord Summit sourced the financing on behalf of the borrower, YK Investments. The nonrecourse loan features a 100 percent loan-to-cost ratio. Located at 1211 N. LaSalle St., The Archer offers one- and two-bedroom layouts.

Multifamily

CHICAGO — Interra Realty has brokered the $5.9 million sale of 6642-6652 N. Clark St., a 42-unit apartment and retail building in Chicago’s Rogers Park neighborhood. The sale also included an adjacent parking lot at 6654 N. Clark St. Brad Feldman of Interra represented the buyer, Imran Khan, and the seller, George Triff. The property, which was fully occupied at the time of sale, features six studios, 28 one-bedroom units, two two-bedroom apartments and six retail units. Constructed in 1928, the three-story building presents a value-add opportunity for the buyer, who plans to renovate units, upgrade building systems and reconfigure some apartments to add bedrooms.

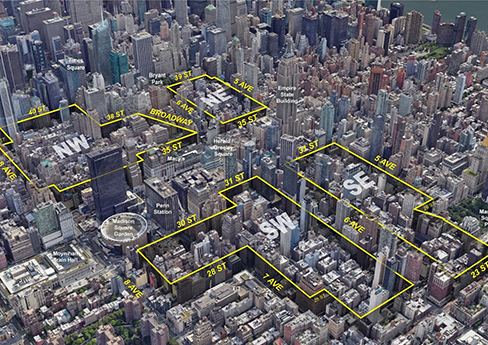

NYC Planning Commission Approves Midtown Manhattan Rezoning Proposal to Add Thousands of New Residences

by Abby Cox

NEW YORK CITY — The New York City Planning Commission has approved the Midtown South Mixed-Use Plan (MSMX), a rezoning initiative that could ultimately facilitate the creation of as many as 9,700 new residences across a 42-block section of Midtown Manhattan. The MSMX plan covers four areas centered around Herald and Greeley Square, located between West 23rd and West 40th streets, as well as Fifth and Eighth avenues. The area today is largely defined by commercial and industrial uses, with current land-use rules restricting new housing development. Midtown South is currently home to more than 7,000 businesses, 135,000 jobs and various public transportation hubs, but the neighborhood has struggled to rebound in the aftermath of the COVID-19 pandemic as hybrid work schedules have become more entrenched. In addition to these commercial vacancies, the submarket is subject to restrictive zoning rules that limit opportunities for New Yorkers to live near their jobs. “For far too long, outdated zoning policies have limited the potential of this well-resourced area to help address New York City’s urgent housing needs,” says Rachel Fee, executive director of the New York Housing Conference, nonprofit affordable housing policy and advocacy organization. “In the midst of a dire housing crisis, …

MCKINNEY, TEXAS — Milhaus, an Indianapolis-based multifamily owner-operator, has broken ground on Atheria at West Grove, a 389-unit multifamily project that will be located north of Dallas in McKinney. The site is located within the 52-acre West Grove master-planned development, and the property will offer one-, two- and three-bedroom apartments with covered balconies/patios. Atheria at West Grove will also feature two-bedroom townhomes with garages. Amenities will include a pool, clubhouse with a golf simulator, covered outdoor kitchen, grilling areas, a pet spa, office workspaces, a billiards and media room, indoor/outdoor fitness center and a one-acre park with pickleball courts, a dog park and an events lawn. Project partners include HEDK Architects, SJL Design Group, Studio Outside, Strategic Construction and engineering firm Winkelmann & Associates. InterBank is financing construction of the project. Leasing is slated to begin next spring.

TOMBALL, TEXAS — BMC Capital has arranged a $24 million bridge loan for Bridgewater Apartments, a multifamily property in Tomball, a northeastern suburb of Houston. According to Apartments.com, the property was built in 1978 and offers 206 units in one- and two-bedroom units, as well as a pool, business center, dog park and a picnic area. Grant Garlock and Noah Laredo of BMC Capital placed the two-year, interest-only loan through an undisclosed life insurance company. The borrower was also not disclosed.

Core Spaces Acquires 486-Bed Student Housing Community Near University of South Carolina

by John Nelson

COLUMBIA, S.C. — Core Spaces has acquired The Nine at Columbia, a 486-bed student housing community located at 1400 Huger St., which is adjacent to the University of South Carolina campus. The property offers 141 units and townhomes in three- to five-bedroom configurations. Shared amenities include a resort-style pool, fitness center, outdoor fire pit, game area, dog park, clubhouse and private workspaces. The seller and terms of the transaction were not released. The Nine at Columbia was fully occupied at the time of sale.

Partnership Opens Phase I, Begins Phase II of Affordable Housing Development in Decatur, Georgia

by John Nelson

DECATUR, GA. — A partnership between Decatur Housing and Preserving Affordable Housing Inc. (PAHI) has officially opened Phase I of Village at Legacy, an affordable housing development in the east Atlanta suburb of Decatur. The partnership also officially broke ground on Phase II. Leasing and move-in activity at Phase I of Village at Legacy is expected to begin in August, with construction on Phase II targeted for completion in spring 2026. Village at Legacy is situated on six acres within Legacy Park, a 77-acre site that once housed the United Methodist Children’s Home. The project represents the first ground-up affordable housing development in Decatur in decades. Phase I is a $27.9 million apartment community comprising 66 units, 40 of which Decatur Housing is supporting with project-based vouchers under its new Housing Assistance Payments (HAP) contract with HUD. The $21.5 million second phase will also comprise 66 units, 20 of which will have project-based vouchers. Decatur Housing was awarded Low Income Housing Tax Credits (LIHTC) by the Georgia Department of Community Affairs to support both phases of Village at Legacy. The City of Decatur and the Decatur Housing Authority are providing additional capital. Other capital partners include Hudson Housing Capital, Advantage …

CHERRY HILL, N.J. — New York City-based Madison Realty Capital (MRC) and Chicago-based Pearlmark have provided $140 million in financing for The Plaza Grande, a 507-unit active adult project located outside of Philadelphia in Cherry Hill. Units are reserved for renters age 55 and above. Amenities include an 18,500-square-foot clubhouse, golf simulator, indoor and outdoor pools, tennis and pickleball courts, a theater, sauna and massage rooms and lounge areas. The borrower, New Jersey-based Procida Funding & Advisors, will use the debt to complete construction and fund lease-up costs.

SOUTH ORANGE, N.J. — New Jersey-based developer Mark Built Homes has completed Mosaic South Orange, a 42-unit multifamily project located about 20 miles west of New York City. Units come in one-, two- and three-bedroom floor plans and range in size from 790 to 1,665 square feet. Residences are furnished with quartz countertops, custom cabinetry, full-size washers and dryers and smart technology, and select residences have private balconies and patios. Amenities include a rooftop deck and clubroom with lounge seating, a fitness center, coworking lounge and indoor and outdoor social spaces. Rents start at $2,995 per month for a one-bedroom apartment.

EDMONDS, WASH. — Waterton has purchased Brackett Apartments, a garden-style multifamily property in Edmonds, a suburb nearly 20 miles north of Seattle, from Intercontinental Real Estate Corp. and TruAmerica Multifamily for an undisclosed price. Located at 9501 244th St. SW, Brackett Apartments offers 386 units spread across 23 three-story residential buildings and two clubhouses across 22 acres. The acquisition brings Waterton’s holdings in the Seattle area to 1,331 units. Waterton plans to implement a value-add renovation program at Brackett Apartments, which was originally built in 1987. The program will add stainless steel appliances, new cabinet fronts and hardware, quartz countertops and new backsplashes, vinyl plank flooring and carpet, as well as new fixtures, hardware, blinds and refreshed paints. The one-, two- and three-bedroom apartments already include in-unit washers/dryers and wood-burning fireplaces. The pet-friendly community features an outdoor pool and open-air hot tub, grilling stations, a fitness center, dog park, miniature golf course and wellness studio. Waterton plans to improve exterior aesthetics and landscaping, as well as reposition common area amenities. Eli Hanacek, Kyle Yamamoto, Mark Washington and Natalie Kasper of CBRE represented the sellers in the deal.