SELLERSBURG AND JEFFERSONVILLE, IND. — Cushman & Wakefield | Commercial Kentucky has brokered the sale of the Southern Indiana 3 Portfolio for an undisclosed price. The portfolio includes three workforce multifamily communities totaling 312 units. The assets include Ashby Apartments and Lakeview Apartments in Sellersburg and Carrington Place Apartments in Jeffersonville. All three communities are located within a 12-minute drive of downtown Louisville. Craig Collins, Austin English, Mike Kemether and James Wilbur of Cushman & Wakefield represented the seller, Salt Lake City-based Shamrock Communities. The buyer was The Clear Blue Co., a Nashville-based real estate firm.

Multifamily

NOBLESVILLE, IND. — JLL Capital Markets has arranged the sale of Outlook Hamilton, a 172-unit luxury active adult community in Noblesville. Delivered in 2023, the property is situated adjacent to Hamilton Town Center and features one- and two-bedroom floor plans. Amenities include a fitness center, sports lounge, theater, great room, courtyard, community garden, dog park and detached garages for rent. Jay Wagner, Rick Swartz, Aaron Rosenzweig, Sam Dylag, Tim Hosmer and Sandis Seale of JLL represented the seller, Capitol Seniors Housing. The team partnered with JLL’s Amanda Friant, Jenny Hull, Holly Hunt, Ken Martin and Nelson Almond. Middle Street Partners and its limited partner, Parse Capital, purchased the asset.

NATICK, MASS. — Local developer Stonegate Group has delivered a 46-unit multifamily project in Natick, a western suburb of Boston. In addition to the apartments, which come in one-, two- and three-bedroom floor plans, the four-story building features four for-sale duplexes and 12,000 square feet of retail space. Finegold Alexander Architects designed the project, and Nauset Construction served as the general contractor. Rents start at $3,200 per month for a one-bedroom, market-rate apartment.

United Group Begins Construction on 152-Unit Active Adult Development in Winter Park, Florida

by John Nelson

WINTER PARK, FLA. — The United Group of Cos. has begun construction on Terracotta Terrace, an active adult community in Winter Park, roughly six miles northeast of Orlando. Upon completion, the property will total 152 units reserved for residents age 55 and older. Residences will include one- and two-bedroom apartments, as well as penthouses. Additionally, the community will feature 12,000 square feet of amenity space. Amenities will include a pool, outdoor bar and kitchen, dog park, bocce ball, shuffleboard courts, fire pits, cabanas, a great room, café and bar area, movie theater, fitness center, yoga studio and a wellness center with a salon, massage studio and sauna. Completion of construction is scheduled for the fourth quarter of 2027. The project team includes Winter Park Construction and Forum Architecture & Design. United Plus Property Management, the management arm of United Group, will operate the community.

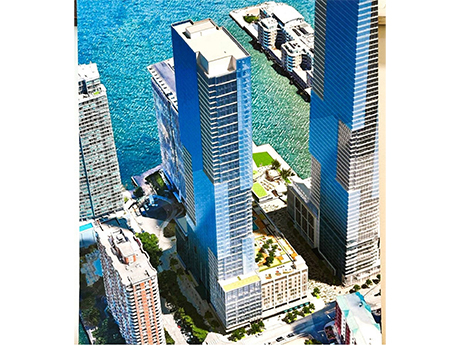

JERSEY CITY — Locally based investment and development firm GN Management has acquired a multifamily development site in Jersey City with plans to construct a 57-story tower. The waterfront site is known as Harborside 9 and is approved for the development of 579 units, as well as 14,800 square feet of retail space and a 555-space parking garage. Fifteen percent (87 residences) will be set aside as affordable housing. Information on floor plans and amenities was not disclosed. Jim Pompa of Coldwell Banker brokered the sale of the site from Panepinto Properties, which recently closed on financing for a 678-unit multifamily project at Harborside, to GN Management. Construction is targeted for a 2027 commencement.

SAN LEANDRO, CALIF. — Sack Capital Partners and Align Finance Partners have closed on structured financing on behalf of Step Up Housing for its $47.4 million acquisition of Woodchase Apartments, an affordable multifamily property in San Leandro. Sack will also provide asset and property management for the property. Located at 2795 San Leandro Blvd., Woodchase Apartments offers 186 studio, one- and two-bedroom floor plans spread across 13 buildings. Originally built in 1976, the community includes 93 loft-style apartments with 19-foot ceiling heights. Institutional Property Advisors represented the undisclosed seller in the deal.

Origin Investments, Confluence Cos. to Develop 298-Unit Brickyard Apartments in Castle Rock, Colorado

by Amy Works

CASTLE ROCK, COLO. — Origin Investments and Confluence Cos. have formed a joint venture to develop Brickyard Apartments in Castle Rock. The 298-unit multifamily community will be part of Confluence’s 31-acre master-planned development, The Brickyard. Situated on 3 acres, Brickyard Apartments will feature 36 studio, 149 one-bedroom, 98 two-bedroom and 15 three-bedroom residences, with rents ranging from $1,600 to $3,150 per month. Community amenities will include a rooftop pool with a hot tub, lounge sauna and cold plunge, a fitness center, private social lounge and kitchen, outdoor terrace area, golf simulator, courtyards with green space, a dog spa and covered parking. Additionally, the property will feature a for-sale 38,300-square-foot commercial condominium.

Quantum Capital Partners Secures $26M Construction Loan for Apartment Project in Rosemead, California

by Amy Works

ROSEMEAD, CALIF. — Quantum Capital Partners has arranged a $26 million construction loan for Prospect Village, an apartment development in Rosemead. Kevin Wong of Quantum Capital secured the financing for the borrower, The Connected Cos., which is developing the property. Located along the Garvey Avenue corridor, Prospect Village will feature a seven-story multifamily complex offering 75 one-, two-, three- and four-bedroom residential units and 6,350 square feet of ground-floor retail space. Designed by Scale Labs Architects, the low-rise structure will feature a cascading terrace deck design at the rear, offering outdoor space and architectural interest. The project is expected to break ground immediately.

CHICAGO — CEDARst Cos. has purchased the Weyland, a seven-story, 132-unit apartment community in Chicago, for $34.6 million. Formerly known as A.M. 1980 Apartments, the property is located at 1980 N. Milwaukee Ave. at the gateway between the city’s Bucktown and Logan Square neighborhoods. Delivered in 2018, the asset features 6,245 square feet of ground-floor retail space and a mix of Class A amenities, including a fitness center, dog run and rooftop deck with views of Lake Michigan and the Chicago skyline. The building was 95 percent occupied at the time of sale. The Weyland marks CEDARst’s second Chicago acquisition of 2025, following the purchase of The Millie on Michigan in July. The company now owns and operates more than 5,000 units in Chicago.

ATLANTA — Jason Nettles, managing director at Northmarq’s Atlanta office, is well-versed on the recent history of U.S. apartment deliveries, knowledge that came in handy for launching discussion among developers at the 16th annual InterFace Multifamily Southeast conference. Nettles moderated a panel of five regional developers, all of whom also share keen awareness of just how much new multifamily product U.S. markets — particularly those in the highly desirable Sun Belt regions — have added in recent years. In these areas, supply growth is both a dominant narrative on the surface of the multifamily development scene and an invisible hand that guides business decisions behind that scene. Massive blips in supply, whether positive or negative, impact key facets of underwriting, including rent growth assumptions and concessions, as well as financing terms on both the debt and equity sides of the capital markets. Those figures and assumptions must then be evaluated against hard costs of development, which as a rule do not decline over time, but rather grow at varying paces. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. All …