CARTERSVILLE, GA. — Advenir Oakley Capital has purchased 28 acres in Cartersville for the development of LEO at Cartersville, a 246-unit build-to-rent residential property. The $65 million project will be situated at the interchange of I-75 and Ga. Highway 20, about 38 miles northwest of Atlanta in Bartow County. Alex Phillips of Cushman & Wakefield represented both the buyer and undisclosed seller in the land transaction. Designed by Birmingham, Ala.-based Nequette Architecture & Design, LEO at Cartersville will feature a mix of one-, two- and three-bedroom cottages ranging in size from 728 to 1,510 square feet. Community amenities will include courtyards with pavilions and grill stations, a central clubhouse with a resort-style pool, fitness center and a dog park. Birmingham-based Capstone Building Corp. is the general contractor for the project, which is set to break ground next month. Advenir Oakley expects LEO at Cartersville to be fully completed by August 2025, with first deliveries scheduled for December 2024.

Multifamily

KNOXVILLE, TENN. — CBRE has brokered the sale of TENN, a 603-bed student housing community located adjacent to the University of Tennessee campus in Knoxville. Jaclyn Fitts, William Vonderfecht, Casey Schaefer and Brett Carr of CBRE represented the seller, Campus Apartments, in the disposition of the property to Schenk Realty. The sales price was not disclosed. The community was developed in 2018 and is located within Knoxville’s Fort Sanders neighborhood at 1830 Cumberland Ave. TENN offers 140 fully furnished units in three-, four- and five-bedroom configurations. Shared amenities include a two-story clubhouse, swimming pool, courtyard grill stations and a fire pit, 24-hour fitness center, computer lab, TV lounge, Zen room, gaming lounge, group study rooms, a coffee station, free tanning, an indoor golf putting green, Amazon hub and ground-floor retail space.

With office vacancy rates in the District of Columbia at 20 percent and climbing, officials believe that converting office buildings to residential space is an important component of revitalizing downtown Washington. These complex projects pose both practical and administerial challenges, however. For developers, one important consideration of such a redevelopment is its real estate tax implications. High hopes District leaders announced earlier this year that they hope to add 15,000 residents to the central business district over the next five years – an ambitious goal. The hope is that bringing residents to live downtown will create a more vibrant neighborhood where people live, work, and dine. The stark reality is that the District of Columbia has one of the lowest return-to-office rates in the country. Actual occupancy in the D.C. metro was only 43 percent in mid-April and drops below 25 percent on Fridays, according to Kastle Systems, which tracks office occupancy. Workers simply aren’t returning to Downtown D.C. While residential conversions may be one piece of the puzzle in addressing D.C.’s downtown woes, converting an office building into a residential property is no small feat. Here are a few important factors relating to real estate taxes to keep in …

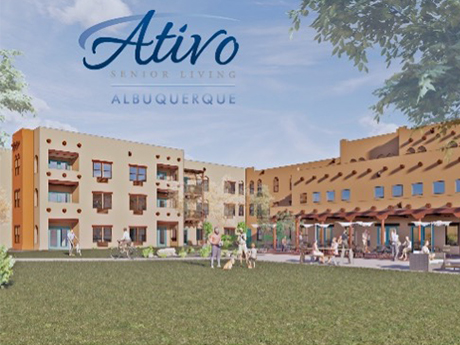

Insight Senior Living Breaks Ground on 144-Unit Ativo of Albuquerque Seniors Housing Community

by Jeff Shaw

ALBUQUERQUE, N.M. — Insight Senior Living has broken ground on Ativo of Albuquerque, a three-story independent living, assisted living and memory care community in Albuquerque. Situated on 6.5 acres, Insight Senior Living will be the operator and Link Senior Development arranged financing. Ativo of Albuquerque will offer 144 apartments. The community is scheduled to open in winter 2024.

TEMPE, ARIZ. — Institutional Property Advisors (IPA) has arranged the sale of and financing for The Gallery, an 88-unit apartment community in Tempe. Living Well Homes sold the property to RSN Property Group for $20.3 million. The Gallery is a two-story, 13-building property built in 1972 on approximately four acres. Amenities include a pool, fitness center and laundry facility. Apartment features include private patios or balconies. The two- and three-bedroom floor plans average 1,013 square feet in size. Cliff David and Steve Gebing, both executive managing directors with IPA, along with Marcus & Millichap’s Paul Bay and Darrell Moffitt, represented the seller and procured the buyer. Brian Eisendrath, Cameron Chalfant, Jake Vitta and Tyler Johnson led the IPA capital markets team.

BUDA, TEXAS — Texas-based private equity firm SPI Advisory has acquired The Bradford, a 264-unit apartment community located in the southern Austin suburb of Buda. Built in 2010 as Trails at Buda Ranch, the property offers one-, two- and three-bedroom units, according to Apartments.com. Amenities include a pool, fitness center and outdoor grilling and dining stations. Patton Jones of Newmark represented the undisclosed seller in the transaction. SPI Advisory will undertake a light capital improvement program at the property. Fritz Waldvogel of Colliers Mortgage originated an undisclosed amount of Fannie Mae acquisition financing for the deal.

BURLESON, TEXAS — Dallas-based developer Corsair Ventures has opened The Riley, a 178-unit multifamily complex in Burleson, a southern suburb of Fort Worth. Designed by HEDK Architects, The Riley offers studio, one-, two- and three-bedroom units with an average size of 880 square feet. Residences are furnished with stainless steel appliances, quartz or granite countertops and private balconies/patios. Amenities include a pool, fitness center, dog spa, wine bar, clubhouse/activity center, game room, coworking offices and package lockers. Rents start at roughly $1,250 per month for a studio apartment.

METUCHEN, N.J. — Baltimore-based Klein Enterprises will undertake a redevelopment project in Metuchen, about 40 miles southwest of Manhattan, that will convert a former industrial site at 212 Durham Ave. into a 272-unit multifamily complex. The yet-to-be-named community will feature studio, one-, two- and three-bedroom apartments, and 15 percent of the units will be reserved as affordable housing. Klein Enterprises recently completed remediation of the site and demolition of the existing structures and expects to deliver the project in fall 2025.

LEVITTOWN, N.Y. — Bellwether Enterprise Real Estate Capital (BWE) has arranged a $26.6 million loan for the refinancing of Village Green, a 103-unit seniors housing property located in the Long Island community of Levittown. Built in late 2020, Village Green offers assisted living and memory care services. Taylor Mokris and Ryan Stoll of BWE originated the financing through a regional bank on behalf of the borrower, an undisclosed regional owner-operator. The loan carried a three-year term, 30-year amortization schedule and 24 months of interest-only payments. The direct lender was an undisclosed regional bank.

ILLINOIS — Greystone has provided $35.7 million in HUD-insured loans for the refinancing of two supportive living facilities in Illinois. The Supportive Living Program in Illinois is an alternative to nursing home care for low-income residents who require mid-range care needs as opposed to skilled nursing. The two properties total 272 units and were built in 2004 and 2005. Eric Rosenstock of Greystone originated the loans on behalf of the borrower, Grand Lifestyles. Both loans feature 35-year terms, 35-year amortization schedules and fixed interest rates.