TALLAHASSEE, FLA. — A joint venture between Charles Street Development and ACRES Realty Funding has received $63 million in construction financing for Renegade Apartments, a 153-unit student housing development in Tallahassee. The community will be located blocks from Florida State University’s campus at 501 Chapel Drive. Bayview Asset Management originated the financing, funding the debt stack through its wholly owned subsidiaries Bayview PACE and Oceanview Life and Annuity Co. The project’s design-build team includes Humphreys & Partners, HPA Design Group and Ruscilli Construction Co. Renegade Apartments is scheduled for completion in 2024 and will be leased and managed by Asset Living.

Multifamily

RICHMOND, VA. — Berkadia has brokered the sale of Laurel Pines Apartments, a 120-unit, garden-style multifamily property located at 4123 E. Wood Harbor Court in Richmond. Drew White, Carter Wood and Cole Carns of Berkadia represented the seller, Colorado-based Four Mile Capital, in the transaction. The buyer, Colorado-based Highlands Vista Group, purchased the property for an undisclosed price. Matt Schildwachter of Berkadia’s Denver office arranged a 10-year, fixed-rate, Freddie Mac loan on behalf of Highlands Vista. Laurel Pines features one-, two- and three-bedroom floor plans with private patios or balconies. Community amenities include a swimming pool, clubhouse, fitness center, laundry facilities and a playground.

Scannell Properties, Pittman Investors Begin Phase I of Pittman Farms Project in Zionsville, Indiana

ZIONSVILLE, IND. — Scannell Properties and Pittman Investors are beginning Phase I development of a project situated on the Pittman Farms site in Zionsville, a northern suburb of Indianapolis. The project site’s red barn has long served as an unofficial entry into Zionsville at US-421 and Sycamore Street. The first phase of construction includes land preparation and infrastructure for the entire development, as well as a three-building, 400-unit apartment complex. Amenities will include a golf simulator, saltwater pool, fitness lab, work-from-home space, pet spa, dog park and an outdoor pavilion reminiscent of the Pittman Farms barn. Phase I is expected to open in the second quarter of 2025. The design team includes Indianapolis-based Delv architects, American Structurepoint, Lynch Harrison Brumleve, Circle Design Group, Context Design, Infinysis and BKV. Indianapolis-based Shiel Sexton Co. will serve as construction manager. Project lenders include Merchants Capital, through its parent company Merchants Bank of Indiana, as well as Lake City Bank and the National Bank of Indianapolis.

ST. PAUL, MINN. — Marcus & Millichap has brokered the sale of a multifamily portfolio in St. Paul for $2.2 million. The portfolio consists of twin 10-unit properties, both of which rise two stories and were constructed in 1949. Abe Roberts, Evan Miller and Chris Collins of Marcus & Millichap represented the seller and procured the buyer, neither of which were disclosed.

Dwight Capital Provides $32.8M HUD Refinancing for Pimlico Apartments in Pullman, Washington

by Amy Works

PULLMAN, WASH. — Dwight Capital has closed a $32.8 million HUD refinancing for Pimlico Apartments, a multifamily property in Pullman. Situated on 17 acres, the community consists of 30 three-story buildings offering a total of 361 apartments, an onsite management office and parking. The community was completed in two phases, with Phase I delivered in 2014 and Phase II in 2016. Keith Hoffman and Jack Tawil of Dwight Capital originated the transaction for the borrower, Corporate Pointe Developers. The loan benefitted from a Green Mortgage Insurance Premium Reduction set at 25 basis points because Pimlico Apartments is Energy Star certified.

TEMPE, ARIZ. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of Eden Apartments, a multifamily community in Tempe. Living Well Homes sold the asset to Rise48 Equity for $26.5 million, or $236,607 per unit. Built in 1980, Eden Apartments features 112 apartments spread across eight two-story buildings. Each residence features an in-unit washer/dryer connection and a private balcony or patio. Community amenities include a swimming pool, fitness center, laundry facility, picnic area and courtyard. Cliff David and Steve Gebing of IPA represented the seller and procured the buyer in the transaction. The IPA Capital Markets team led by Brian Eisendrath and Cameron Chalfant arranged acquisition financing for the buyer.

LAWTON, OKLA. — NAS Investment Solutions, a Los Angeles-based investment firm, has purchased Willowpark Apartments, a 160-unit multifamily complex located on the southwestern outskirts of Oklahoma City. According to Apartments.com, Willowpark Apartments was built in 1985 and offers amenities such as a pool, fitness center and onsite laundry facilities. The property consists of 10 two-story buildings on a 6.4 acre site. Units have an average size of 603 square feet. The seller and sales price were not disclosed.

BASKING RIDGE, N.J. — New Jersey-based developer Garden Communities has completed the second phase of The Enclave at Dewy Meadows, a 198-unit multifamily project in the Northern New Jersey community of Basking Ridge. Phase I of the project comprised 90 units, and the latest phase added another 108 apartments. Residences come in one-, two- and three-bedroom floor plans and include individual washers and dryers, as well as private balconies/patios in select units. The amenity package comprises a pool, courtyards, fitness center, two lounges, business center, dog park, card room and a children’s play area. Rents start at $2,700 per month for a one-bedroom unit.

NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has negotiated the $6.7 million sale of a 22-unit multifamily property in the Pelham Bay area of The Bronx. The seven-story building offers one-, two- and three-bedroom units, includes 11 parking spots and was fully occupied at the time of sale. Daniel Mahfar, Jason Gold and Victor Sozio of Ariel Property Advisors brokered the deal. The buyer and seller were not disclosed.

Arbor Realty TrustBuild-to-RentContent PartnerDevelopmentFeaturesLeasing ActivityMidwestMultifamilyNortheastSingle-Family RentalSoutheastTexasWestern

Arbor Report Finds Rental Housing Insulated from Economic Contraction, Risk Factors Endure

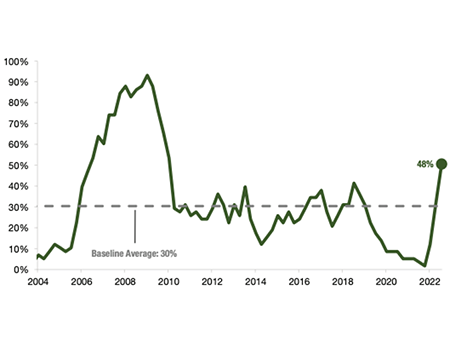

— By Ivan Kaufman, founder, chairman and CEO of Arbor Realty Trust, Inc.; and Sam Chandan, a professor of finance and director of the Chen Institute for Global Real Estate Finance at the NYU Stern School of Business Rental housing is uniquely positioned to withstand tremendous economic headwinds. Although some observers point to the slowdown in apartment rent growth as a sign of growing weakness, this trend is a cyclical feature that is not reflective of any structural change in the profile of demand or supply. It is normal to expect a period of slowing rent growth while there is uncertainty in the economic outlook. In-depth findings on these trends, plus a thorough economic outlook for 2023 and a complete breakdown of risk factors, are detailed in Arbor Realty Trust Special Report Spring 2023: Navigating a Corrective Environment, from which this article is excerpted. While no asset class is immune from the challenges of higher interest rates, the presence of amortization, which spreads out a loan into a series of fixed payments over time, makes the multifamily sector less likely to see mounting distress. All Department of Housing and Urban Development (HUD)-conforming multifamily loans are fully amortizing. Moreover, Fannie …