PORTLAND, TEXAS — McLeod Cobb Investments will develop Portland Town Center, a $100 million multifamily and retail project that will be located near Corpus Christi in South Texas. Plans for Portland Town Center currently call for 200,000 square feet of retail space that will be anchored by a 128,500-square-foot Target store, as well as 300 multifamily units. The design team includes Osborn & Vane Architects Inc. and Terra Associates Inc, and Arch-Con Corp. is the general contractor. Plains Capital Bank provided construction financing for the 45-acre project. Construction is scheduled to begin in November.

Multifamily

BOSTON — Urban Edge, in partnership with the Massachusetts Department of Housing & Community Development (MDHCD), will develop a 65-unit affordable housing project at 1599 Columbus Ave. in Boston. The property will house one-, two- and three-bedroom units that will be reserved for renters earning up to 30 and 60 percent of the area median income, as well as 3,200 square feet of retail space. Utile Inc. is the project architect, and Bald Hill Builders is the general contractor. Completion is slated for spring 2024. MassHousing provided financing for the project.

CHICAGO — Mansueto Office Inc. is reimagining the 100-year-old building at 2300 N. Lincoln Park West in Chicago into a luxury apartment community. Named the Belden-Stratford, the renovated 16-story property will be home to 209 units with floor plans that range from studios to three-bedroom penthouses. Pre-leasing is underway, with first move-ins anticipated in winter 2023. Amenities will include onsite restaurant Mon Ami Gabi, a rooftop deck, fitness center, yoga studio, pet spa, wine storage, resident lounge, Luxer package service and valet and concierge services. The building first opened in 1923 as a hotel. Solomon Cordwell Buenz is the project architect, Vinci Hamp Architects Inc. is the historic architect, Bulley & Andrews is the general contractor and Waterton is the property manager.

CHICAGO — CBRE has negotiated the sale of a 14,378-square-foot development site at 863 N. Orleans St. in Chicago’s River North neighborhood for $4.2 million. Tom Svoboda of CBRE represented the seller, BlitzLake. The buyer, Draper and Kramer Inc., plans to build a multifamily project at the transit-oriented development site.

ZANESVILLE, OHIO — Fairfield Homes Inc., in partnership with Muskingum Behavioral Health, has opened Pearl House Zanesville in Zanesville, about 50 miles east of Columbus. The property features 34 units for individuals and families recovering from drug or alcohol addiction. Residents receive support services, treatment and a full-time case worker provided through Muskingum Behavioral Health. Amenities include outdoor recreational spaces and a community room. Rent is based on income. Gorsuch Construction was the general contractor.

CHICAGO — Kiser Group has arranged the sale of an 18-unit multifamily property at 7224 N. Rockwell St. in Chicago’s Rogers Park neighborhood for $2.7 million. The property has been partially renovated and houses four dorm units for the Hebrew Theological College. The building comprises a mix of one-, two- and three-bedroom units. Danny Logarakis of Kiser brokered the sale. The buyer, a local investor, also recently purchased another building nearby with 40 units.

WASHINGTON, D.C. — Redbrick LMD has received a $142.5 million construction loan for the development of The Douglass, a 750-unit residential project in Washington, D.C.’s Bridge District. Brian Gould of Chatham Financial arranged the loan through Citizens Bank on behalf of Redbrick. The Douglass will feature 40,000 square feet of retail space, and about 80 of the apartments will be reserved as affordable housing. The Douglass will be the first building constructed in the Bridge District, which comprises eight acres. Upon completion, the 2.5 million-square-foot project will be developed as a mixed-use neighborhood with a focus on sustainability and wellness. The Douglass is designed to target net zero carbon from operations and to meet or exceed International Future Living Institute (IFLI) and LEED Platinum standards.

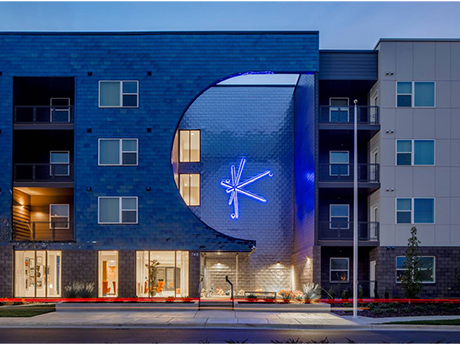

HUNTSVILLE, ALA. — Doster Construction Co., in partnership with Chicago-based developer Heartland Real Estate Partners, has completed the development of Constellation, an apartment community located in downtown Huntsville. Designed by Chicago-based Built Form Architects, Constellation features 219 luxury units in studio, one-, two- and three-bedroom layouts. Construction on the development, which is now open for leasing, began in late 2020. Rental rates at Constellation range from $1,117 to $3,709 per month, according to Apartments.com.

SCOTTSDALE, ARIZ. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of SeventyOne15 McDowell, an apartment property in Scottsdale. The asset traded for $150 million, or $547,445 per unit. The buyer and seller were not disclosed. Completed in 2022, SeventyOne15 McDowell features 274 apartments, a swimming pool and spa, private cabanas, a rooftop lounge with fire pits, two-story fitness center, direct-access parking garage, rooftop deck, electric charging stations and 24-hour parcel package concierge. Alliance Residential developed the property. Steve Gebing and Cliff David of IPA represented the seller and procured the buyer in the transaction.

LOS ANGELES — South Bay Partners has completed construction of The Variel of Woodland Hills, a luxury independent living, assisted living and memory care community in the Woodland Hills neighborhood of Los Angeles. The property features 215 independent living units, 94 assisted living units and 27 memory care units. Momentum Senior Living is the operator. VTBS Architects designed the buildings, while Rodrigo Vargas Design handled the interiors. W.E. O’Neil Construction was the general contractor. The site is located near Warner Tennis Center, grocery stores and Kaiser Permanente Woodland Hills Medical Center, a 264-bed hospital. The project was originally announced in 2018, and construction began just before the COVID-19 pandemic hit in early 2020.