CLOVIS, N.M. — Carson City, Nev.-based Mission Senior Living has acquired Wheatfields Estates Senior Living and Memory Care at 4701 N. Prince St. in Clovis, located in the eastern portion of the state near the Texas border. Wheatfields Estates offers independent living cottages, assisted living, memory care and respite care for seniors. Terms of the transaction were not released. The acquisition brings Mission Senior Living’s portfolio to seven properties in three states, including Three Rivers Estates Senior Living and Memory Care property, currently under construction in Farmington.

Multifamily

HACKENSACK, N.J. — The Kislak Co. Inc. has negotiated the $38.5 million sale of 22 Sussex, an 88-unit apartment building in the Northern New Jersey community of Hackensack. The property consists of 22 studios, 51 one-bedroom units and 15 two-bedroom units. Residences average 883 square feet and feature stainless steel appliances, quartz countertops and individual washers and dryers. Amenities include a fitness center, coworking lounge, rooftop deck and a gaming area. Andrew Scheinerman of Kislak represented the seller and developer, an entity doing business as 22 Sussex Street Urban Renewal LLC, in the transaction. Scheinerman also procured the buyer, Lusia Realty Corp.

CHESTER, PA. — Locally based brokerage firm Starkman Realty Group has arranged the $3.1 million sale of Buckman Meadows, a 42-unit affordable housing building in Chester, a southwestern suburb of Philadelphia. The property was originally constructed in 1917 to house shipbuilders during World War I and subsequently converted to a veterans’ hospital and then an affordable housing complex for veterans in 2015. New Jersey-based Tunic Group purchased Buckman Meadows from an undisclosed partnership. Jason Starkman of Starkman Realty Group represented both parties in the deal.

JLL Arranges Construction Financing for 54-Unit Mountain View Memory Care in California

by Amy Works

MOUNTAIN VIEW, CALIF. — JLL Capital Markets has arranged an undisclosed amount of construction financing for the redevelopment of Italian restaurant Frankie, Johnnie & Luigi Too! into Mountain View Memory Care, a Class A, 54-unit, 60-bed, private-pay memory care community in the Bay Area city of Mountain View. JLL worked on behalf of the borrower, the D’Ambrosio Family, and its operating partner, Calson Management, to secure the construction financing through a local bank. The community will also continue be home to the D’Ambrosio Family’s restaurant, Frankie, Johnnie & Luigi Too! once completed. The community is positioned on 0.85 acres in an affluent residential neighborhood in Silicon Valley. The site is near highways 85, 237 and 101 and will have two accessible bus stops on either end of the community, providing future residents with transportation to nearby retail, dining and entertainment amenities. Bercut Smith, Lillian Roos and Chad Morgan led the JLL Capital Markets debt advisory team representing the borrower.

Affordable HousingArbor Realty TrustContent PartnerDevelopmentFeaturesMidwestMultifamilyNortheastSoutheastTexasWestern

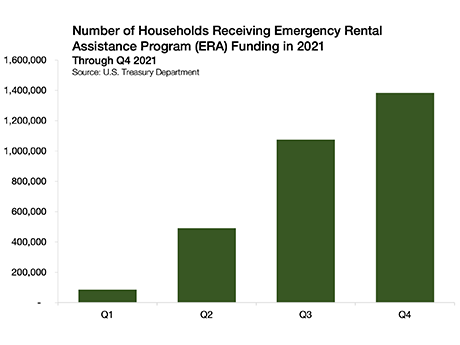

As Affordability Crisis Deepens, Policies and Market Shift to Assist the Underserved

By Omar Eltorai, Arbor Realty Trust To understand the affordable housing market in spring 2022, one needs to first assess how this sector weathered the pandemic and then assess the current state of housing affordability across the country. In-depth findings on these trends are included in the Arbor Realty Trust-Chandan Economics Affordable Housing Trends Report, from which this article is excerpted. Weathering the Pandemic When it comes to the pandemic response, federal policymakers proved effective at defusing a large-scale increase in homelessness from financially insecure households. The Center for Disease Control and Prevention’s (CDC) eviction moratorium, while unpopular among industry advocates, prevented an estimated 1.6 million evictions, according to an analysis by Eviction Lab. After the Supreme Court struck down the federal moratorium in August 2021[1], the wave of evictions that many were forecasting did not immediately materialize. Nationally, tracked eviction filings ticked up but remained well below their pre-pandemic averages, according to Eviction Lab. A key reason why many at-risk renters have remained in their homes is the deployment of funds allocated in the Emergency Rental Assistance Program (ERA) — a funding pool designed to assist households that are unable to pay rent or utilities. The ERA Program was …

LAS VEGAS; SCOTTSDALE, ARIZ.; AND ALBUQUERQUE, N.M. — Kennedy Wilson has acquired three multifamily communities totaling 1,110 units in three separate off-market transactions for $418 million, excluding closing costs. The properties are Palms at Peccole Ranch in Las Vegas, La Privada in Scottsdale and San Miguel del Bosque in Albuquerque. The company invested $255 million of total equity in the three communities, which are expected to generate approximately $15 million of initial annual net operating income to Kennedy Wilson. Beginning immediately, Kennedy Wilson will implement a $19 million value-add asset management plan, including renovating more than 65 percent of existing units, refreshing common areas and enhancing amenities to further grow net operating income.

PHOENIX — Ready Capital has closed on $13.3 million in financing for the acquisition, renovation and stabilization of a 105-unit apartment community in Phoenix’s Midtown submarket. Upon acquisition, the undisclosed borrower will implement a capital improvement plan consisting of interior and exterior upgrades. The nonrecourse, interest-only, floating-rate loan features a 36-month term, two extension options and a facility to provide future funding for capital expenditures.

HOUSTON —Dallas-based private equity firm Trive Capital, in partnership with Dallas-based Aspen Oak Capital Partners, has acquired Alta Med Main, a 338-unit apartment community located near Texas Medical Center in Houston. Built in 2020 by Wood Partners, the property features one- and two-bedroom units and amenities such as a pool, fitness center and coworking space and outdoor grilling areas.

FORT WORTH, TEXAS — Locally based residential developer ONM Living has sold Cottages at Bell Station, a 140-unit multifamily property in Fort Worth. The pet-friendly property offers one-, two- and three-bedroom units that were fully leased at the time of sale. Berkadia brokered the sale of the property. The buyer and sales price were not disclosed.

Electra America and BH Group Buy South Florida Mall for $100.4M, Plan Mixed-Use Redevelopment

by John Nelson

CUTLER BAY, FLA. — Electra America and BH Group have formed a joint venture to purchase Southland Mall, a 808,776-square-foot shopping mall in the Miami suburb of Cutler Bay. The buyers purchased the 80-acre site for $100.4 million with plans to reposition the mall and develop new Class A apartments on the campus. The joint venture is working closely with the Town of Cutler Bay on the redevelopment project. Located at 20505 S. Dixie Highway, Southland Mall was 80 percent leased at the time of sale to more than 100 tenants, including JC Penney, Macy’s, T.J. Maxx, LA Fitness, Regal Cinemas, Old Navy, Sephora, Kay Jewelers and Applebee’s. According to the buyers, Southland Mall is the only enclosed regional mall servicing southern Miami-Dade County through the Florida Keys. Michael Fay, John Crotty, David Duckworth and Brian de la Fé of Avison Young represented Electra America and BH Group in the land deal. The seller(s) was not disclosed. Southland Mall includes a former Sears department store and auto center that were not part of the transaction.