CINCINNATI — Ready Capital has closed a $24.8 million loan for the acquisition, renovation and stabilization of a 234-unit multifamily property in the Forest Park submarket of Cincinnati. The undisclosed borrower plans to implement a capital improvement program for the Class B property with plans to renovate unit interiors, property exteriors and common areas. The nonrecourse loan features a three-month term, floating rate and interest-only payments.

Multifamily

SEYMOUR, IND. — Developer TWG is underway on construction of Seymour Lofts, a $10.8 million affordable housing community in Seymour, about 50 miles north of Louisville, Ky. The property’s 50 units will be targeted for families who make an annual salary between $30,000 and $40,000. Project partners include Midwest Support Foundation, Indiana Housing and Community Development Authority, The Federal Home Loan Bank of Indianapolis and the City of Seymour. Amenities will include a playground and clubhouse. Construction began in December, but a timeline for completion was not released.

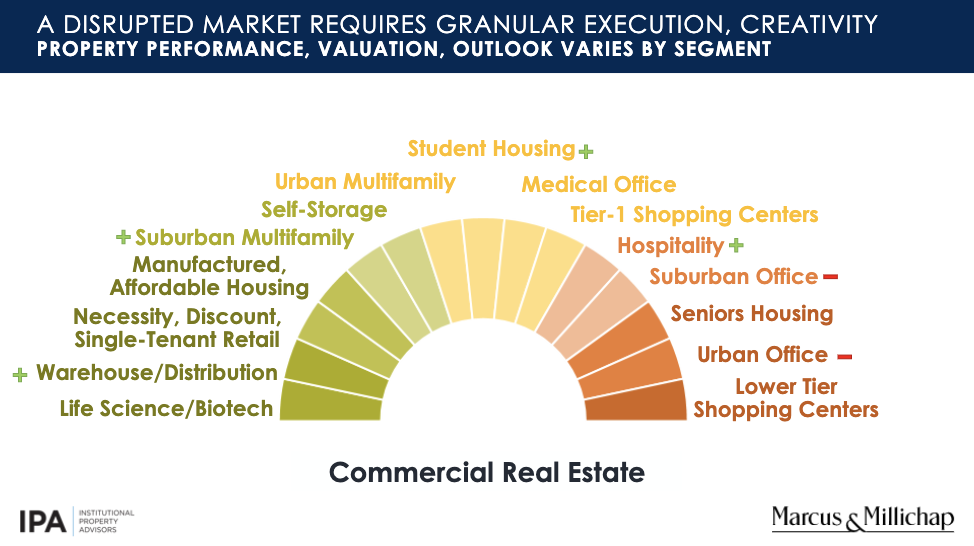

Job losses, shortages of qualified labor in the workforce and the imminent impact of rising interest rates are all real-time threats to the economy, with the first rate increase expected in March. Marcus & Millichap hosted a webcast on Jan. 27 titled “2022 Outlook: The Economy — Inflation — Fed Policy — Real Estate” to discuss how upcoming Fed action and inflation might affect the real estate market. The event’s speakers included Marcus & Millichap President and CEO Hessam Nadji; TruAmerica Multifamily President and CEO Robert Hart; ICSC President and CEO Tom McGee; and Henry Paulson, 74th Secretary of the United States Treasury and former chairman and CEO of Goldman Sachs. Without sugarcoating the challenges ahead, Paulson says if history is any predictor, the next year or so is not going to be easy. “I’m not really optimistic about the core economic recovery,” he said. “I’m pleased with how the business community has responded, but here’s where I’m going to get more somber: Inflation is really serious, and I don’t think any of us can find an example in recent economic history where the Fed has been able to contain inflation like this and have a soft landing.” On a …

By Steve Nosrat, Principal, Avison Young As we prepare to close out 2021, Las Vegas continues to thrive, maintaining its place as one of the fastest-growing multifamily markets in the nation. Clark County’s population grew by 2 percent — nearly 40,000 — ranking it among the top 10 metros with at least 750,000 residents. This has further increased the already high demand for multifamily properties. Annual job growth in Las Vegas has outperformed the national average for five straight months, with leisure and hospitality jobs driving most of the recovery. Housing demand and rents are hitting all-time highs all over the Valley. Home values have risen 23 percent annually, and apartment rents are up 22 percent. Vacancy rates are down to just 3.8 percent, compared to the national index of 4.5 percent. This has spurred investors on, causing them to feel more secure with Las Vegas’ long-term outlook. Apartment sales passed $1 billion in the second quarter of 2021, which has only happened twice before in Las Vegas history. The 12-month sales volume has passed $3.1 billion and is trending positively for 2022, according to CoStar. The apartment market gained significant momentum during the third quarter. Cap rates have compressed, and …

MIAMI — Fifield Cos. has broken ground on Avida Aventura, a 266-unit apartment project in Miami. The construction timeline and development costs were not disclosed. The eight-story property will offer studio, one-, two- and three-bedroom floorplans ranging from 470 to 1,400 square feet. Each unit will include a balcony. Community amenities will include a 20,000-square-foot rooftop entertaining deck with a heated pool, shaded cabanas, dining areas, grills, sauna and a spa; dog spa; fitness center; two resident lounges with dining and coworking and hosting areas; and a dedicated coworking space. Located at 19401 W. Dixie Highway, the development is situated near the new Aventura Brightline rail station and Aventura Mall. The property is also 16.7 miles from downtown Miami and 14.8 miles from Fort Lauderdale. Fifield Cos. has partnered with CrowdStreet, Sencorp and Bank OZK for the project. MSA Architects designed the building, ID & Design International is handling interior design and Current Builders is the general contractor.

GREENSBORO, N.C. — Ready Capital has closed a $3.1 million loan for the renovation and stabilization of an unnamed, 56-unit multifamily property in Greensboro. The “bridge-to-Freddie-Mac loan” will be used to repatriate equity to the sponsor and fund capital improvements to unit interiors and property exteriors. The non-recourse, interest-only, floating-rate loan features a 24-month term, two extension options and is inclusive of a facility to provide future funding for capital expenditures and interest shortfalls. Additionally, the unnamed borrower will have the ability to execute a refinancing for the property via Ready Capital’s Freddie Mac SBL Loan program.

SAN ANTONIO — Arlington-based 180 Multifamily Properties has acquired Casa Luna and Casa del Encanto, two properties totaling 679 units that are located across the street from one another on San Antonio’s north side. According to Apartments.com, the properties offer studio, one- and two-bedroom units and amenities such as a pool, soccer field, playgrounds, outdoor grilling and dining stations and onsite laundry facilities. The seller and sales price were not disclosed. The new ownership plans to implement a capital improvement program and combine the properties into a single community that will be known as Palatia Apartment Homes.

SAN ANTONIO — Madison Realty Capital, a private equity real estate firm based in New York City, has provided a $53 million construction loan for The Josephine, a 261-unit multifamily project that will be located just outside of downtown San Antonio. The Josephine will feature studio, one-, two- and three-bedroom units that will be furnished with stainless steel appliances and quartz countertops. Amenities will include a pool, fitness center and outdoor activity areas. About half the residences will be designated as affordable housing, although information on specific income restrictions was not disclosed. The borrower is locally based developer LYND Co.

COLUMBUS, OHIO — Ready Capital has closed a $54.3 million loan for the acquisition, renovation and stabilization of a two-property multifamily portfolio in metro Columbus. The portfolio totals 454 units. The undisclosed borrower plans to implement a capital improvement program to renovate unit interiors and property exteriors as well as perform various common area upgrades. The nonrecourse loan features a three-month term, floating rate and interest-only payments.

MONONA, WIS. — Berkadia has negotiated the $10.3 million sale of Fairway Glen in Monona near Madison. The 56-unit, garden-style apartment community was built in 2014. Amenities include a community room, fitness room and underground parking. Ralph DePasquale, Pete Evans, Jack Maloney and Richard Evans of Berkadia represented the seller, Madison-based developer 5001 Monona Drive LLC. Wisconsin-based Spaulding Group was the buyer. The property was 97 percent occupied at the time of sale.