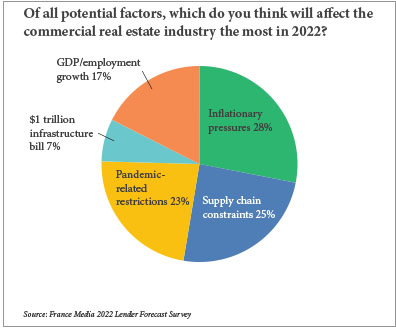

By Matt Valley An overwhelming percentage of direct lenders and financial intermediaries believe the multifamily and industrial sectors provide the most attractive financing opportunities for the lending community today, according to France Media’s 11th annual reader forecast survey. Conversely, the hotel and office sectors offer the least attractive financing opportunities, say survey participants. More specifically, 83 percent of participants in the email survey conducted between Nov. 19 and Dec. 13 indicate that the multifamily sector provides the most attractive financing opportunities, followed by industrial (75 percent), mixed-use (25 percent), retail (17 percent), hotel (14 percent) and office (7 percent). Multiple answers were permitted for this question. On the flip side, 62 percent of respondents believe that the hotel sector provides the least attractive financing opportunities, followed by office (58 percent), retail (27 percent), multifamily (7 percent), industrial (3 percent) and mixed-use (0 percent). Despite the persistence of the COVID-19 pandemic — which as of early January had claimed the lives of more than 830,000 Americans and has hobbled the hotel, office and retail sectors for nearly two years — the real estate fundamentals of the apartment and industrial sectors have remained rock solid. Fueled by strong tenant demand, the national …

Multifamily

Institutional Money, Private Investors Continue to Flock to Inland Empire Multifamily Market

by Jeff Shaw

By Eric Chen, Senior Vice President, CBRE Multifamily has been a well-performing real estate segment during the past 18 months as demand for housing continues to trump supply in most of California. The Inland Empire has been the recipient of much of this demand within the Greater Los Angeles and Southern California regions due to their economic and population growth. Tenants are also in search of more affordable, quality dwellings outside the urban core. Due to the confluence of these factors, multifamily vacancies in the area are at an all-time low of less than 5 percent. This is exasperated by the fact that new developments are at the lowest level across the nation, pushing rent growth to No. 1. This dynamic is, of course, ideal for investors who seek stable, income-producing investments with potential upside and little risk of oversupply. We do expect additional apartment properties to be built in the coming year or two, which will create more investment opportunities and provide more options for tenants who are new to the region or relocating from within. Looking back on this year, we have seen a number of large institutional-sized transactions between $25 million and $100 million, with investors ranging …

GAINESVILLE, FLA. — JLL Capital Markets has secured $37 million for the refinancing of a four-property, 460-unit multifamily portfolio in Gainesville. Elliott Throne, Kenny Cutler and Karim Khaiboullin of JLL worked on behalf of the borrower, American Commercial Realty, to secure the 10-year, fixed-rate Fannie Mae loans. JLL Real Estate Capital LLC, a Fannie Mae DUS lender and a wholly owned indirect subsidiary of Jones Lang LaSalle Inc., will service the loans. The properties include the 141-unit Hammocks by Butler, the 98-unit Hammocks off 6th, the 69-unit Hammocks on 34th and the 152-unit Hammocks on 20th. American Commercial Realty recently completed renovations on all four properties, including updated amenities and new floors, quartz countertops, stainless steel appliances, modern cabinetry and walk-in closets in the units. Community amenities at the portfolio include swimming pools, outdoor grilling stations and fitness centers. The four multifamily communities are located close to Interstate 75, the University of Florida and Shands Medical Center. Three of the four properties are near Butler Plaza, a shopping center development with over 150 stores and restaurants.

SPRINGDALE, OHIO — Milhaus has broken ground on Array, a $43 million apartment development in the Cincinnati suburb of Springdale. The 216-unit project, situated at 11911 Sheraton Lane, will include amenities such as a dog park, resident lounge, communal kitchen, pool, fitness center, conference rooms, coworking spaces and rentable office space. The project team includes architect M+A Architects, interior designer Studio 5 and engineer Bayer Becker. Completion is slated for March 2023.

DULUTH, MINN. — CBRE has brokered the sale of ENDI Apartments in Duluth, a city in eastern Minnesota. The sales price was undisclosed. The 142-unit luxury multifamily property includes 13,876 square feet of retail space that is fully leased. The development is located at 2120 London Road along Lake Superior. Ted Abramson, Keith Collins and Abe Appert of CBRE represented the seller, Lift Bridge Partners LLC. Endi Plaza LLC was the buyer.

Realty Capital Residential, Lang Partners Receive $54.5M Construction Loan for Tree Farm Lofts in Basalt, Colorado

by Amy Works

BASALT, COLO. — Dallas-based Realty Capital Residential and Lang Partners have secured a $54.5 million construction loan for the development of Tree Farm Lofts in Basalt. JLL Capital Markets arranged the construction financing, which was provided by Andy Kolos of Wintrust’s Denver Commercial Real Estate office. Located within the 40-acre Tree Farm mixed-use development, the six-building community will feature 196 apartments, ranging from 485 square feet to 1,110 square feet, in a mix of studios, one-bedroom, two-bedroom and co-living floor plans. Forty of the apartments will be designated as affordable. Community amenities will include co-working office space, an outdoor terrace with firepits, a resort-style pool, hot tubs, a grill area, clubhouse with a fitness center, pet wash and bike, kayak and ski storage. Construction is underway, with completion scheduled for July 2024.

High Street Residential, PGIM Break Ground on 192-Unit Raintree Multifamily Community Near Phoenix

by Amy Works

SCOTTSDALE, ARIZ. — High Street Residential and its joint venture partner PGIM Real Estate have broken ground on Raintree Multifamily, an apartment community in Scottsdale. Slated for completion in 2023, the five-story residential building will feature 192 apartments. The new development, which will receive a formal name at a later date, is situated next to Trammell Crow Co. and PGIM’s 175,000-square-foot Axis Raintree office building that was completed in January 2021. High Street Residential is a multifamily subsidiary of Trammell Crow. Units at the multifamily property will range in size from junior one-bedrooms to two-bedrooms and feature built-in workstations in select homes, quartz countertops, stainless steel appliances and large outdoor patios. Community amenities will include a sky lounge, an outdoor courtyard, a large amenity park with dog run, work-from-home area with ample individual workspaces, pool, spa, fitness center and pet lounge. ESG Architects is serving as architect and Weitz Co. is serving as general contractor for the residential portion of the development. High Street/Trammell Crow and PGIM purchased the entire 8.24-acre parcel of land in 2019 and began construction on Axis Raintree in October 2019. The office building is complete and available for lease, with CBRE marketing the asset.

SCOTTSDALE, ARIZ. — ABI Multifamily has negotiated the sale of Bella Villas Apartments, a multifamily community in Scottsdale. The property traded for $7 million, or $333,333 per unit. The undisclosed buyer and seller are both based in Arizona. Built in 1960, Bella Villas Apartments features 21 garden-style, two-bedroom/two-bath floor plans with air conditioning/heating, refrigerators and ranges/ovens. Community amenities include onsite laundry, private yards, covered parking and a community swimming pool. Royce Munroe of ABI Multifamily represented both parties in the transaction.

HOUSTON — Chicago-based investment firm 29th Street Capital has purchased Villas at Hermann Park, a 320-unit apartment community located near Texas Medical Center in Houston. Built in 2000, the property offers one-, two- and three-bedroom units with stainless steel appliances, granite countertops and full-size washers and dryers. Amenities include a pool, two conference rooms, a 24-hour fitness center, package pickup room, outdoor grilling and picnic stations and shuttle service to Texas Medical Center. The new ownership plans to implement a value-add program. The seller was not disclosed.

WACO, TEXAS — Northland, a private equity real estate firm based in metro Boston, has acquired The Legend, a 300-unit apartment community located about six miles southwest of downtown Waco. The property, which according to Apartments.com was built on 17 acres in 2015, features one-, two- and three-bedroom units that are furnished with wood-style plank flooring, granite countertops and individual washers and dryers. Amenities include a pool, clubhouse, business center and café, fitness center, grilling and picnic stations and a pet park. The seller and sales price were not disclosed.