NEW YORK CITY — Lendlease has begun preleasing and revealed new renderings for The Riverie, an 834-unit apartment development in the Greenpoint neighborhood of Brooklyn. The project is slated to open in October. Of the total unit count, 30 percent are designated as affordable housing. The development will also feature 13,000 square feet of retail and restaurant space, state-of-the-art amenities and new public greenspace. Spanning an entire city block along the East River, The Riverie features two towers rising 37 and 20 stories, as well as a mid-rise podium with frontages along India, West and Java streets. Residences range from studios to three bedrooms, including select penthouses and townhomes. Marvel was the project architect. INC Architecture & Design handled the interior design, while Crème designed the townhomes. At the core of The Riverie’s sustainability strategy is its vertical closed-loop geothermal system, comprised of 320 boreholes beneath the site. This feature makes it the largest geothermal residential building in New York state and is believed to be the largest high-rise geoexchange system in the country, according to Lendlease. Combined with its fully electric design, The Riverie is expected to reduce annual carbon emissions from heating and cooling by 53 percent when …

Multifamily

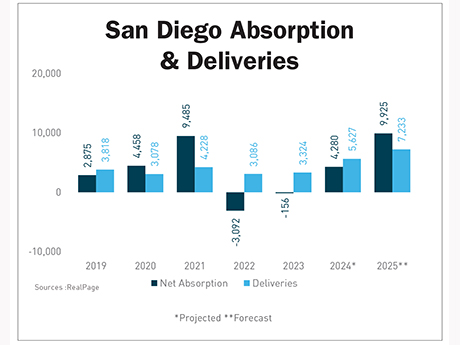

— By Berkadia — San Diego’s apartment market is poised to strengthen in 2025, with demand poised to set a record and fundamentals outperforming most other major California metros. This is a welcome change from 2024, where a slower leasing environment for Class A properties led to more concessions. The big story is demand. More than 9,900 net units are expected to be leased this year, surpassing the previous high of 9,500 in 2021. This figure will also outpace what is likely to be a record year for new deliveries, with 7,233 units slated to debut this year across the metro. By year-end, occupancy is projected to climb to 96.3 percent, up 90 basis points from 2024 and above the market’s 10-year pre-pandemic average. That puts San Diego ahead of Los Angeles, San Francisco-Oakland and San Jose on the occupancy leaderboard. Effective rent is expected to rise 3.1 percent year over year to a projected $2,868, marking a solid improvement from last year’s flat performance. Fundamentals Point to a Solid Year Employment growth remains a tailwind. The metro added 16,200 new jobs between May 2024 and May 2025, pushing total employment to nearly 1.6 million. That economic momentum is supporting …

Centennial Bank Provides $73M Construction Loan for Elysian Apartments in Winter Garden, Florida

by John Nelson

WINTER GARDEN, FLA. — Centennial Bank has provided a $73 million construction loan for Elysian, a 323-unit luxury apartment development in the Orlando suburb of Winter Garden. Robby Barrows and David Druey of Centennial Bank originated the loan on behalf of the borrower, Unicorp National Developments Inc. The locally based developer plans to break ground on Elysian soon and wrap up construction in approximately 18 months. Site clearing is complete and pipe installation is currently underway. Designed by Krieger Klatt Architects, Elysian’s amenities will include a wine bar; fitness center with yoga, Pilates and cycling studios; steam room with a sauna; resort-style pool with cabanas; and a clubhouse with a fireplace and movie theater. Information on the property’s floorplans was not released. The Elysian loan grows the financing relationship between Centennial Bank and Unicorp to more than $500 million.

Joint Venture Acquires 381-Bed Student Housing Community Near Louisiana State University

by John Nelson

BATON ROUGE, LA. — A joint venture between affiliates of Monument Square Investment Group and a New York-based single-family office has acquired University Grove, a 381-bed student housing community located 2.7 miles south of the Louisiana State University (LSU) campus in Baton Rouge. Developed in 2024, the property offers 127 cottage-style units in three-bedroom configurations with bed-to-bath parity. Capital improvements are planned for the property, including upgrades to landscaping and amenity spaces. The community was 98.5 percent leased at the time of sale. The seller and terms of the transaction were not released.

NEW YORK CITY — Locally based owner-operator The Altmark Group has received a $96 million loan for the refinancing of The Motto, a 24-story apartment building located in the Mott Haven area of The Bronx. Designed by Woods Bagot, The Motto offers 264 units, 80 of which are reserved as affordable housing, in studio, one- and two-bedroom floor plans. Amenities include coworking lounges, a resident sky lounge, rooftop terrace with barbecue grills and fire pits and a fitness center. Brad Domenico, Gideon Gil, Jack Subers and Frank Stanislaski of Cushman & Wakefield arranged the five-year, fixed-rate loan through Morgan Stanley on behalf of The Altmark Group.

NEW YORK CITY — PCCP LLC has provided a $65 million loan for the refinancing of Pearson Court Square, a 197-unit apartment complex in the Long Island City area of Queens. Built in 2014, the transit-served property offers studio, one- and two-bedroom units and amenities such as a resident lounge, coworking space, rooftop sky deck and an outdoor basketball court. The borrower was an affiliate of L+M Development Partners. Pearson Court Square was roughly 98 percent occupied at the time of the loan closing.

JLL Arranges $28.5M Construction Financing for 104-Unit Multifamily Project in Santa Maria, California

by Amy Works

SANTA MARIA, CALIF. — JLL Capital Markets, on behalf of Santa Barbara, Calif.-based Vernon Group, has secured a $28.5 million construction financing for The Lofts, a Class A multifamily property in downtown Santa Maria. The project is a component of Phase I in the Santa Maria Town Center redevelopment, a master-planned expansion initiated by the City of Santa Monica to revitalize the downtown core. The Lofts will feature 104 loft-style apartments ranging from 600 square feet to 1,200 square feet. Located at 201 Town Center East, the existing building will be converted to a courtyard format with double-loaded corridors for apartments. Constructed is slated for completion in June 2027. Matt Stewart, Alex Olson, Ace Sudah, Kyle White and Jacob Michael of JLL represented the borrower in the financing.

MORGAN HILL, CALIF. — Steadfast Senior Living has sold Loma Clara, a 67-unit seniors housing community located in Morgan Hill, for an undisclosed price. LTC REIT was the buyer. Completed in 2018, Loma Clara features 42 assisted living units and 25 memory care units. The property was roughly 92 percent occupied at the time of sale. Units total 529 square feet on average. Amenities at the community include a theater, fitness center, activity and game rooms, a library, outdoor courtyard, physical therapy space and bistro. Discovery Management will continue to operate the property. Aaron Rosenzweig and Dan Baker of JLL arranged the sale on behalf of the seller.

SOUTH LAKE TAHOE, CALIF. — Gantry has secured an $11.7 million construction loan for the development of a 14 for-sale townhome project in South Lake Tahoe. Located at 3708 Lake Tahoe Blvd. and 3709 Osgood Ave., South Lake Tahoe Townhomes will offer 14 for-sale townhomes within walking distance of the lake, stateline casinos and other amenities. Peter Hillakas, Robert Slatt and Keegan Bridges of Gantry represented the borrower, a private real estate investor. The 18-month loan was provided from Gantry’s extensive roster of lenders specializing in construction financing.

ANAHEIM, CALIF. — Marcus & Millichap has arranged the sale of Glencrest Apartments, a multifamily property in Anaheim. A local family sold the asset to a limited liability company for $7.6 million. Glencrest Apartments offers 31 apartments, a swimming pool, two onsite laundry facilities and ample garage parking. Drew Holden, Nick Kazemi and Tyler Leeson of The Leeson Group of Marcus & Millichap represented the seller, while Christian Tait procured the buyer in the deal.