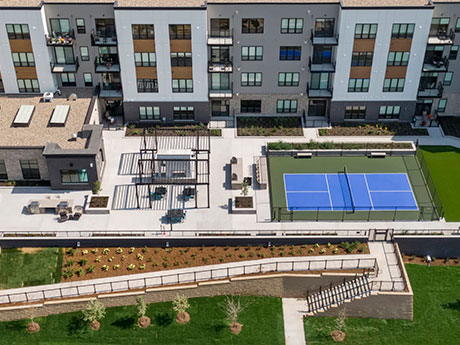

MAPLE GROVE, MINN. — JLL Capital Markets has provided a $33.2 million Fannie Mae loan for the refinancing of Risor of Maple Grove, a luxury 55+ community in the Minneapolis suburb of Maple Grove. The 169-unit property, completed in June 2023, rises four stories with a mix of studios, one- and two-bedroom units averaging 1,002 square feet. Amenities include a clubroom, golf simulator, wine bar, indoor pool and spa, pickleball court and top-floor sky lounge. Scott Loving, Scott Streiff, Gary Marchiori and Will Hintz of JLL originated the five-year, fixed-rate loan on behalf of the borrower, Roers Cos.

Seniors Housing

WACO, TEXAS — Blueprint Healthcare Real Estate Advisors has arranged the sale of a vacant, 106-unit seniors housing property in Waco. Built in 2015, the community offered assisted living and skilled nursing care before closing in 2018. Amenities at the facility include an outdoor courtyard, patio and a putting green. Amy Sitzman and Giancarlo Riso of Blueprint represented the undisclosed seller in the transaction. The buyer and sales price were also not disclosed.

JLL, HJ Sims Arrange $239.7M in Tax-Exempt, Taxable Bond Financing for Three-Property Seniors Housing Portfolio in Arizona, California

by Amy Works

BUCKEYE AND YUMA, ARIZ., AND SANTA CLARITA, CALIF. — JLL and HJ Sims have arranged $239.7 million in tax-exempt and taxable bond financing for the Integrated Senior Foundation — Ativo Portfolio, a seniors housing portfolio in Arizona and California. The portfolio includes 430 independent living, assisting living and memory care units. There are two ground-up development communities and one acquisition — Ativo of Sundance in Buckeye, Ativo of Yuma in Yuma and Ativo of Santa Clarita within the Sand Canyon Plaza master-planned community in Santa Clarita. On behalf of Integrated Senior Foundation, JLL’s Seniors Housing Capital Markets team, in collaboration with the bond underwriting team of HJ Sims and JLL Securities, secured fixed-rate financing with a final maturity of 40 years. The financing consisted of $218.2 million of publicly offered tax-exempt senior series 2025A bonds, $5.9 million of taxable senior series 2025B bonds and $15.5 million of tax-exempt subordinate 2025C bonds. Slated for completion in 2027, Ativo of Sundance will feature 102 independent living units, 75 assisted living units and 30 memory care beds, while Ativo of Santa Clarita will feature 51 independent living units, 65 assisted living units and 28 memory care beds, with completion scheduled for later this year. Ativo …

OVERLAND PARK, KAN. — Brinkmann Constructors has broken ground on a five-story building at the Tallgrass Creek Senior Living campus in the Kansas City suburb of Overland Park. Maryland-based Erickson Senior Living is the developer. The 173,000-square-foot property marks Brinkmann’s fifth residential building in Neighborhood Two at the Tallgrass Creek campus. As the final residential addition to the campus, the new building will feature 89 units built over a podium deck with below-grade parking. Lantz-Boggio Architects PC is the architect.

LOS ANGELES — Clearwater Living is currently underway on the development of a new, 100-unit senior living community in the Beverly Grove neighborhood of Los Angeles. Upon completion, the property will total 100 studio, one- and two-bedroom apartments across seven stories, including assisted living, memory care and short-term residences. Amenities at the community, dubbed The Leonard on Beverly, will include a movie theater, rooftop terrace, restaurant, private dining space and exhibition kitchen. The development will also feature 7,000 square feet of medical office space and a 6,000-square-foot synagogue. The community is scheduled to begin move-ins in fall 2025. This marks Clearwater Living’s 13th community.

Alta Senior Living Acquires 162-Unit Seniors Housing Property in Sacramento, California

by Amy Works

SACRAMENTO, CALIF.— Alta Senior Living has acquired a 162-unit seniors housing community located in Sacramento. Alta purchased the property with joint venture partner Brasa Capital Management. Formerly known as The Village at Heritage Park, the property will be rebranded as Rose Arbor Village. Built in 2017, the community features independent living, assisted living and memory care residences. Alta plans to implement a repositioning strategy that includes upgrading amenities, strategic lease-up initiatives and enhancing resident engagement. “We’re excited to add another full continuum community to our portfolio at an attractive basis well below replacement costs,” says Tomson Mukai, managing partner at Alta Senior Living.

Greysteel Brokers $5.9M Sale of Affordable Seniors Housing Community in Berryville, Virginia

by John Nelson

BERRYVILLE, VA. — Greysteel has brokered the $5.9 million sale of Mary Hardesty House, an affordable seniors housing community located in Berryville, roughly 65 miles northwest of Washington, D.C. Fletcher Hultman, Justin Mazzamaro and Henry Mathies of Greysteel represented the seller, The Wentwood Cos., in the transaction. Community Housing Partners was the buyer. Totaling 60 units, the property was developed using low-income housing tax credit (LIHTC) financing and is engaged in a long-term affordable housing use agreement. Amenities at the property include a game room, social gathering area, fitness center, outdoor patio and grill and a salon.

Gulf Coast Housing, Midtown Partners to Open Affordable Housing Property in Jackson, Mississippi

by John Nelson

JACKSON, MISS. — Gulf Coast Housing Partnership (GCHP) and local nonprofit organization Midtown Partners Inc. plan to open Noel Place, a 27-unit affordable housing community located at 144 Noel St. in Jackson. Set to officially open tomorrow in a ribbon-cutting ceremony with partners and local dignitaries, about 60 percent of Noel Place’s apartments will be reserved for special needs residents, including people with disabilities and senior citizens. Federal Home Loan Bank of Dallas and BankPlus awarded GCHP with a $499,000 grant to help fund construction of Noel Place. Other partners include Mississippi Home Corp. and Mississippi Regional Housing Authority No. VI.

USA Properties Fund, Pinyon Group Open $21M Affordable Age-Restricted Property in Carlsbad, California

by Amy Works

CARLSBAD, CALIF. — Roseville, Calif.-based USA Properties Fund and Los Angeles-based The Pinyon Group have opened Vintage at Marja Acres, an affordable age-restricted community in Carlsbad. Located at 4660 Garden Hill Loop, Vintage at Marja Acres offers 47 apartments, a community room, wellness/health center and onsite laundry. The one-bedroom apartments feature energy-efficient appliances and light fixtures, and low-flow faucets, showers and toilets. The units are designated for residents at least 55 years old who earn 30 percent to 60 percent of the area median income for San Diego County, Calif. Vintage at Marja Acres is a public-private partnership that includes the City of Carlsbad, Riverside Charitable Corp. and WNC Inc. JPMorgan Chase is the construction and permanent lender for the $21 million project. IHP Capital Partners and KB Homes are also partners on the project, which is in infill community that is named after a former longtime nursery on the property.

True Ground Housing Breaks Ground on $64M Affordable Seniors Housing Community in Metro DC

by John Nelson

CHANTILLY, VA. — True Ground Housing Partners has broken ground on a $64 million affordable seniors housing community in Chantilly, roughly 30 miles outside Washington, D.C. Dubbed Avonlea Senior, the development will be situated within the Avonlea Town Center master-planned community developed by Peterson Cos. The project team includes general contractor Bozzuto Construction, Advanced Project Management (APM), Grimm + Parker Architects, Moya Design Partners, Allen + Shariff Corp. and civil engineer Urban Ltd. Upon completion, the community will comprise 137 units for residents age 55 and older. The property will also feature a wellness suite, business center and two community rooms. Completion of the project is slated for summer 2026. Financing for the development includes low-income housing tax credits (LIHTC) from Virginia Housing; more than $6 million from Loudoun County’s affordable multifamily housing loan program; $7.5 million from Amazon REACH; $1.4 million in Virginia Housing Trust Fund financing; and $4 million from Virginia’s Housing Innovations in Energy Efficiency (HIEE) program. Additionally, Truist has purchased approximately $29 million in tax credit equity. Formerly Arlington Partnership for Affordable Housing, True Ground Housing Partners is a nonprofit affordable housing developer.