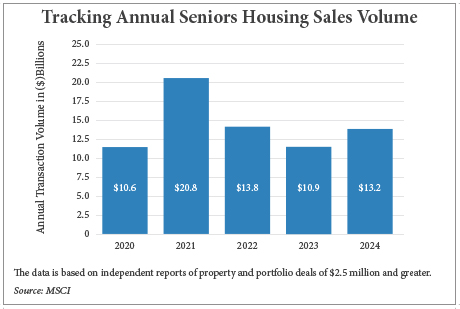

By Hayden Spiess To say that the seniors housing sector has encountered strong headwinds over the past few years would be an understatement. The property sector was uniquely impacted by the COVID-19 pandemic. It scarcely had a chance to recover and enjoy rebounding occupancy before being faced with the reality of heightened interest rates. Amid all the challenges, industry professionals adopted a motivational yet pragmatic mantra and strategy: “Stay Alive Until ’25.” Now that 2025 has arrived, the sentiment among seniors housing investors is one of growing optimism. Brokers and investors alike say that more favorable conditions are leading to an uptick in transaction activity, even as some debt difficulties linger. Azhar Jameeli, managing director of investments at IRA Capital and head of the firm’s seniors housing segment, is particularly bullish on the current prospects for the sector. “I don’t think that the opportunity has ever been better than what it is today,” asserts Jameeli, who has multiple decades of experience in seniors housing and cites the supply-demand balance as one of the main sources of his confidence. Data from MSCI supports this optimism. U.S. property and portfolio sales totaled $13.2 billion in 2024, up from $10.9 billion the prior …

Seniors Housing

CHANHASSEN, MINN. — BWE has arranged a $20 million loan to provide permanent financing for Lake Place, a 110-unit luxury active adult community in Chanhassen within metro Minneapolis. Lundat Kassa of BWE originated the financing through Freddie Mac on behalf of the borrower, Silver Creek Equity, a Minnesota-based developer. The 10-year loan features a 35-year amortization period and five years of interest-only payments. The loan replaces a high-interest rate, floating-rate construction loan. Lake Place was built in 2023 and completed lease-up during the loan underwriting. The property is reserved for residents age 55 or older, and 50 of the units are set aside for those who earn 60 percent or less of the area median income. Amenities include a clubhouse, fitness center, pickleball court, pet wash, bike room, library, creative arts studio and storage units.

By Shawn Reed of FK Architecture A focus on wellness and lifestyle is among the top 10 senior housing trends for 2025, according to the Seniors Blue Book. With an increased focus on wellness spaces, community gardens and outdoor areas that can be utilized for different activities, seniors now have more opportunities to live healthier, more satisfying lives. Landscape architects are uniquely suited to provide ways for seniors to experience the outdoors in a safe, accessible way. Ideally, this involves targeted, evidence-based design that emphasizes connection to nature while meeting seniors’ preferences for where they prefer to be and interact with others. Focusing on the important aspects of amenity design can improve health, foster a broader sense of community and increase positive interactions among seniors of all ages. Strategic Amenity Location The “attention restoration theory” research conducted by Stephen and Rachel Kaplan shows the benefits humans get from being more in touch with nature. In seniors, increased time outdoors can result in health benefits such as better sleep, decreased incontinence, pain reduction and longevity. Granting residents proper amenity access to the outdoors also promotes mental acuity and psychological wellbeing. Landscape architects have the opportunity to create amenities such as onsite …

SACRAMENTO, CALIF. — Developer and operator ONELIFE Senior Living has acquired The Woodlake Senior Living, a 137-unit community located in Sacramento. Amenities at the property, which offers assisted living and memory care residences, include a movie theater, game room, fitness center, salon, library and arts and crafts room. The acquisition marks the fourth senior living community in California for ONELIFE, which merged with Ally Senior Living earlier this year. “The Woodlake Senior Living represents a strategic expansion of our California presence,” says Dan Williams, CEO of ONELIFE. According to the company, the state’s population of individuals age 65 and older is expected to reach 9 million by 2040. Denver-based ONELIFE was founded in 2009.

ST. LOUIS PARK, MINN. — Thorofare Capital, an affiliate of asset management platform Callodine Group LLC, has provided a $42.9 million bridge loan to refinance Risor of St. Louis Park, a 170-unit active adult community in the Minneapolis suburb of St. Louis Park. The borrower, Roers Cos., will use the financing primarily to retire an existing construction loan on the Class A property at 3510 Beltline Blvd. Completed in November 2023, the community is 78 percent leased. The six-story building features an interior courtyard and 4,000 square feet of ground-floor retail space. Amenities include a coffee bar, golf simulator, pet wash, fitness center, movie theater, library lounge, clubroom, pool, spa and pickleball court. Scott Loving, William Hintz, Scott Streiff and Gary Marchiori of JLL arranged the loan.

Colliers Mortgage Arranges $10.4M HUD-Insured Loan for Seniors Housing Community in Parkville, Maryland

by John Nelson

PARKVILLE, MD. — Colliers Mortgage has arranged a $10.4 million HUD-insured loan for the refinancing of The Cottages of Perry Hall, a 64-unit seniors housing community in Parkville. Situated on 3.2 acres about seven miles northeast of Baltimore, the property features four cottages that provide assisted living and memory care living arrangements. Services and amenities at The Cottages of Perry Hall include 24-hour care, full-service dining, housekeeping, community and activities rooms, beauty salon, fully landscaped courtyards and secure outdoor space. Christopher Fenton and Catherine Eby of the Lenox, Mass., office of Colliers Mortgage, in partnership with Health Financing Consultants, arranged the financing on behalf of Charter Senior Living. The loan carries a 35-year term and amortization schedule.

Colliers Mortgage Provides $19.3M HUD-Insured Loan for Seniors Housing Project in Erie, Colorado

by Amy Works

ERIE, COLO. — The Minneapolis office of Colliers Mortgage has provided a $19.3 million HUD 213 loan for the construction of Village Cooperative of Erie, an age-restricted cooperative residential property in Erie. The borrower is Village Cooperative of Erie. The property will feature 64 one-, two- and two-bedroom plus den units with stainless steel appliances, nine-foot ceilings and in-unit washers/dryers. Community amenities will include underground heated parking, a fitness center, community room with serving kitchen and private meeting room, hobby room, parcel/mail room, on-site management, an elevator, community deck and garden plots.

WYOMING, MICH. — Walker & Dunlop has arranged $25.9 million in permanent financing for Rivertown Ridge, a 152-unit seniors housing community in Wyoming near Grand Rapids. Built in 2019, the Class A property is part of a larger 120-acre master-planned community. Rivertown Ridge features units for independent living, assisted living and memory care. Amenities include a library, bar and entertainment space, theater, fitness center, coffee bar, lounge, activity areas and underground parking. Mary Stuart Hurst and Russell Dey of Walker & Dunlop partnered with Inner Circle Holdings to arrange the 10-year, fixed-rate Fannie Mae loan, which features three years of interest-only payments. The borrower was Redstone Group Management Inc.

WELLINGTON, FLA. — JLL Capital Markets has arranged the sale of Wellington Bay, a 283-unit senior living campus located in Wellington, approximately 16 miles west of West Palm Beach. The 45-acre property features a 159-unit independent living community and The Lisbet Health Center, which comprises 124 assisted living and memory care residences. Amenities at the campus include a 65,000-square-foot clubhouse with dining, outdoor and indoor swimming pools, a hot tub, putting green, bocce ball court, pickleball court and fitness, wellness, concierge, arts and entertainment programming. AEW Capital Management acquired the property from an undisclosed buyer. JLL’s Seniors Housing Capital Markets team represented the seller in the transaction and secured a three-year acquisition loan through Capital One Bank on behalf of the buyer.

PHILADELPHIA — Andrew Carle believes that university retirement communities (URCs) represent a potential game-changing opportunity not only for the seniors housing industry but also for universities and retirees, if executed properly. Yet, URCs are also extraordinarily complicated to operate, cautions the founder of UniversityRetirementCommunities.com, the first directory and information resource of its kind, which lists more than 85 such communities nationwide. “It doesn’t get more difficult than trying to merge big, large, bureaucratic state universities that move very slowly and who live in a bubble of 20-year-olds with the senior living industry that’s very fast-paced, investor-oriented and focused on 80-year-olds. If you had to think of an odd couple, that would be it,” said Carle, an adjunct faculty member at Georgetown University and president of Carle Consulting. His comments came at the InterFace Seniors Housing Northeast conference on Dec. 5. at the Live! Casino & Hotel Philadelphia, where he was the keynote speaker. Up until the last 15 years, there were only a handful of URCs nationwide, but today it’s among the fastest growing segments in the senior living industry, said Carle. While the vast majority of URCs are loosely connected to institutions of higher learning, the top dozen or so …