SAN DIEGO — Wells Fargo’s Community Lending and Investment (CLI) group has provided a total of $57.9 million in financing for construction of La Sabila, an affordable housing community for seniors in San Diego. The borrower is Wakeland. CLI provided a $30.5 million construction loan and $27.4 million equity investment. The project will consist of 85 residential units reserved for low-income residents over age 55. Further details were not disclosed. Timothy McCann, Terence Cordero and Jessica Gonzalez of CLI arranged the financing.

Seniors Housing

Kraus-Anderson Begins $41.5M Expansion of Trillium Woods Retirement Community in Plymouth, Minnesota

PLYMOUTH, MINN. — Kraus-Anderson has begun a $41.5 million expansion of Trillium Woods, an independent retirement community in Plymouth, a western suburb of Minneapolis. Trillium Woods is a Life Plan Community that provides wellness services and levels of senior healthcare, including memory care, skilled nursing and rehabilitation. The 160,321-square-foot, five-story expansion calls for 18 assisted living units, 16 assisted living memory care units, 52 independent living units and 67 underground parking spaces. Construction is slated for completion in fall 2025. Pope Design Group was the architect.

At first blush, 2023 looks like a bad year for seniors housing property sales. Total transaction volume fell 23 percent to $10.6 billion, the sector’s lowest mark in over a decade, according to data from MSCI Real Assets. “I’m not surprised to see transaction volume down from 2022,” says Kelly Sheehy, senior managing director of Artemis Real Estate Partners. “The combined impact of declining asset values, scarcity of financing for new acquisitions and lender extensions for underperforming assets has kept sellers from listing assets and have prevented levered buyers from acquiring.” MSCI’s data is based on independent reports of property and portfolio sales of $2.5 million and above. The numbers include both private-pay seniors housing and skilled nursing care, but not active adult properties. The factors limiting seniors housing transaction volume have affected all real estate asset classes. As far as property acquisitions go, seniors housing was one of the most consistent property sectors in the United States in 2023. Commercial real estate sales across the country were down 51 percent last year, and the two hardest hit sectors were office (sales fell 56 percent) and multifamily (sales fell 61 percent), according to MSCI. What’s more, seniors housing was the …

ST. PAUL, MINN. — Helios has arranged a $7.5 million loan and revolving line of credit on behalf of a Minnesota-based provider of specialty memory care services. Helios arranged the 18-month financing for the borrower’s acquisition of a specialty memory care community in suburban St. Paul. The community was stabilized at the time of acquisition and was originally developed by the borrower in partnership with a Chicago-based private equity firm. Prior to the financing, the borrower leased the community from the seller. A Minnesota-based community bank provided the financing.

FLORENCE, KY. — Berkadia has arranged the sale of a 104-unit assisted living and memory care community in Florence, approximately 10 miles southwest of Cincinnati. Mike Garbers, Cody Tremper, Dave Fasano and Ross Sanders of Berkadia represented the seller, a publicly traded REIT, in the transaction. A private equity group purchased the asset for an undisclosed price.

CareTrust REIT Acquires Three Seniors Housing Communities in Southern California for $60M

by Jeff Shaw

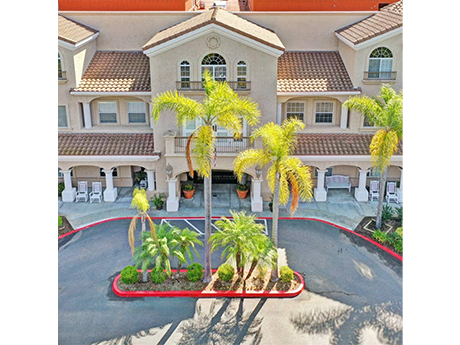

SAN CLEMENTE, Calif. — CareTrust REIT Inc. (NYSE:CTRE), a San Clemente-based seniors housing investor, has acquired three continuing care retirement communities (CCRCs) located in Los Angeles, Orange, and San Diego counties. The portfolio totals 475 assisted living, skilled nursing and memory care beds/units. Bayshire Senior Communities, an existing CareTrust tenant based in Southern California, has taken over management of all three properties. The highest profile property of the three is Torrey Pines Senior Living in San Diego. CareTrust paid $32.3 million for the asset, including transaction costs. Annual cash rent for the first year is approximately $2.6 million, increasing to approximately $3 million in the second year with CPI-based annual escalators thereafter. CareTrust completed the acquisition of the other two CCRCs through a joint-venture arrangement with a third-party regional healthcare investor. Pursuant to the arrangement, CareTrust is the managing member of the joint-venture entity. CareTrust provided a combined common equity and preferred equity investment amount totaling approximately $28 million. The joint-venture landlord has leased these facilities to Bayshire pursuant to a new, triple-net master lease agreement with an initial term of 15 years with two five-year extension options. CareTrust’s initial contractual yield on its combined preferred and common equity investments …

WELDON SPRING, MO. — New Perspective is nearing completion of a new senior living community in Weldon Spring, about 30 miles west of St. Louis. A leasing office is now open at the property, which is scheduled for completion this summer. The community will offer independent living, assisted living and memory care services. The number of units was not provided.

COLUMBUS, OHIO — United Church Homes Management (UCHM) will manage two seniors housing properties in Columbus. Alongside its current management of Wexner Heritage Village, UCHM will now provide management services for Bexley Heritage Apartments and Village Shalom Apartments. UCHM, an affiliate of United Church Homes, is headquartered in Marion, Ohio, and operates more than 90 senior living communities.

CHICAGO — Blueprint Healthcare Real Estate Advisors has arranged the sale of three value-add seniors housing properties in the western suburbs of Chicago for an undisclosed price. Opened between 1994 and 2000, the portfolio comprises approximately 290 assisted living and memory care units and roughly 40 Medicare-only skilled nursing units. According to Blueprint, the communities struggled post COVID and presented a meaningful value-add opportunity, despite some recent capital improvements. Ultimately, the seller elected to divest the properties to preserve liquidity. The buyer was a regional owner-operator looking to expand into Illinois. The seller was a national developer and investor. Ryan Kelly, Connor Doherty, Alex Florea, Lauren Nagle and Brooks Blackmon led the Blueprint team.

ILLINOIS — CFG, a subsidiary of CFG Bank, has provided two HUD loans totaling $13.6 million to refinance debt on two skilled nursing facilities in Illinois. The specific properties were not disclosed, but they total 173 beds. Tim Eberhardt and Ava Julio of CFG originated the loans.