ST. GEORGE AND LINDON, UTAH — 1031 Crowdfunding has acquired its first two seniors housing communities in Utah. Totaling 178 units of assisted living and memory care, the communities are in the Provo suburb of Lindon and St. George, which is located approximately 130 miles northeast of Las Vegas. Both properties total 156,473 square feet across 5.85 acres, offer seven-year leases, and are within a four-mile radius of local hospitals. “As 1031 Crowdfunding continues to grow, we plan to move into other regions of the country,” says Edward Fernandez, president and CEO of 1031 Crowdfunding. “Seniors housing facilities are needed throughout the country as the baby boomers continue to age, so we continue to look for opportunities to grow our real estate portfolio in targeted markets where we see seniors housing growth potential. The Utah market is attractive to us because the state offers an ideal environment for businesses, lower taxes and a mix of diverse and varied industries that draw people who want to live and work in the state.” The facilities, Spring Gardens St. George and Spring Gardens Lindon, were built in 2011 and 2016. Avista Senior Living is the operator.

Seniors Housing

Stellar Senior Living Acquires 103-Unit Anthology of South Jordan Seniors Housing Community in Utah

by Amy Works

SOUTH JORDAN, UTAH — Stellar Senior Living has acquired Anthology of South Jordan, a 103-unit seniors housing community in South Jordan, a suburb of Salt Lake City. The new owner has changed the name to Copper Creek Senior Living. The property offers independent living, assisted living and memory care services. Copper Creek is located near retail, entertainment, recreational and healthcare destinations. Utah-based Stellar Senior Living is a family-owned senior living provider operating 28 senior living communities in nine states in the Western United States.

HOUSTON — CBRE has negotiated the sale of The Village at River Oaks, a seniors housing community in the River Oaks neighborhood of Houston that offers independent living, assisted living and memory care services. A partnership between Harrison Street and Bridgewood Property Co. sold the asset to a fund affiliated with Blue Moon Capital Partners. The sales price and number of units were not disclosed. John Sweeny, Aron Will, Garrett Sacco and Scott Bray of CBRE brokered the deal. CBRE also arranged a seven-year, floating-rate acquisition loan that carried 48 months of interest-only payments through a regional bank.

CHICAGO — Standard Communities led a public-private partnership that acquired two affordable seniors housing properties in metro Chicago. Standard plans to make $46 million in renovations. According to Crain’s Chicago Business, Standard paid $110 million for the communities, but the total cost of the deal adds up to $192 million including the renovations, fees, reserves and other expenses. The transaction extends and preserves the affordability of the communities for 30 years. The properties include the 145-unit Commonwealth Apartments at 2757 N. Pine Grove Ave. in Chicago’s Lincoln Park neighborhood as well as the 321-unit Greenleaf Apartments at 502 Kildeer Drive in Bolingbrook. Planned renovations include updated kitchens and bathrooms, new energy-efficient appliances, flooring and communal spaces at each property. New amenities will include walking parks, pickleball courts, fitness centers, business rooms and meeting rooms. Greenleaf Apartments will receive solar panels on the roofs. Standard is financing the energy improvements in partnership with Commonwealth Edison’s Multifamily Energy Savings Program. Standard completed the acquisition in partnership with the Illinois Housing Development Authority and the U.S. Department of Housing and Urban Development, utilizing the Low-Income Housing Tax Credit program and long-term Housing Assistance Payments contracts.

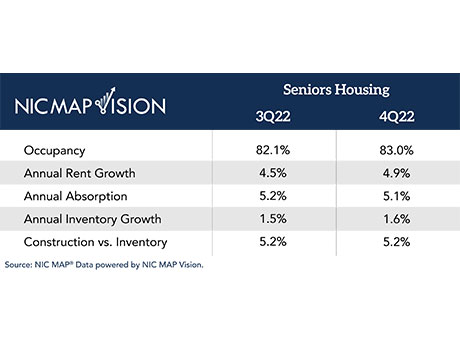

Seniors Housing Occupancy Rises 90 Basis Points in Sixth Consecutive Quarterly Increase

by Jeff Shaw

ANNAPOLIS, Md. — The national occupancy rate for private-pay seniors housing increased 90 basis points from 82.1 percent in the third quarter of 2022 to 83 percent in the fourth quarter of 2022, according to data from NIC MAP Vision. The occupancy rate has increased 520 basis points from a pandemic low of 77.8 percent in the second quarter of 2021. NIC MAP Vision is a product of the National Investment Center for Seniors Housing & Care (NIC), an Annapolis-based nonprofit firm that tracks industry data gathered from 31 primary metropolitan markets. Private-pay seniors housing comprises independent living, assisted living and memory care. The seniors housing occupancy rate increased for the sixth consecutive quarter due to continued strong demand that outpaced inventory growth. Because new inventory has been added during the pandemic, however, the occupancy rate has not yet reached pre-pandemic levels, according to NIC. On the inventory side, about 3,300 units were added within the 31 NIC MAP Primary Markets during this quarter, while more than 8,600 units were absorbed on a net basis. This robust demand led to a new record high total number of occupied units: within the NIC MAP Primary Markets, the total number of occupied …

SHERMAN, TEXAS — Senior Living Investment Brokerage (SLIB) has negotiated the sale of Homestead of Sherman, a 132-bed skilled nursing facility in Sherman, approximately 65 miles north of Dallas. The community spans 39,211 square feet and sits on five acres. A Dallas-based private partnership sold the property to a Fort Worth-based owner-operator for an undisclosed price. Matthew Alley and Ryan Saul of SLIB brokered the deal.

Blueprint Brokers Sale of 150-Bed Rehabilitation Centre of Beverly Hills in Los Angeles

by Amy Works

LOS ANGELES — Blueprint Healthcare Real Estate Advisors has negotiated the sale of The Rehabilitation Centre of Beverly Hills, a 150-bed skilled nursing facility in Los Angeles. The Rehabilitation Centre of Beverly Hills is a premier, state-of-the-art, all-Medicare nursing facility located near Cedars-Sinai Medical Center, one of the most prestigious hospitals in the United States. A private, high-net-worth owner-operator based in Los Angeles was the buyer. The seller and price were not disclosed.

WOODBRIDGE, VA. — CBRE National Senior Housing’s investment properties team has arranged the sale of HarborChase of Prince William Commons, a Class A seniors housing community in Woodbridge, a suburb of Washington D.C. Built in 2018, HarborChase of Prince William Commons is a three-story building with 127 units of assisted living, transitional memory care and memory care units. John Sweeny, Aron Will, Garrett Sacco and Scott Bray of CBRE represented the sellers, Silverstone Senior Living and Lionstone Investments. Although the price was not disclosed, CBRE National Senior Housing’s debt and structured finance team consisting of Aron Will, Tim Root, and Michael Cregan arranged acquisition financing on behalf of the buyer, Artemis Real Estate Partners. CBRE secured a five-year, $31.3 million, fixed-rate loan from a regional bank with 24 months of interest-only payments. The Arbor Co. will operate the community following the acquisition.

JLL Arranges $51.8M Construction Financing for Ativo Seniors Housing Community in Albuquerque

by Amy Works

ALBUQUERQUE — JLL Capital Markets has arranged $51.8 million in construction financing for the development of Ativo of Albuquerque, a three-story, 144-unit senior living community in Albuquerque. JLL represented the borrower, Link Senior Development LLC, in securing the financing through an undisclosed lender. Once completed, Ativo of Albuquerque will offer a mix of independent living, assisted living and memory care units ranging from studio to two-bedroom units. Situated on 6.5 acres, the community will be adjacent to a new ambulatory urgent care center and a medical office building. The community will benefit from the nearby Rio Grande River and Recreation Area, which offers an expansive network of walking trails and various parks along with the Petroglyph National Monument and an 18-hole golf course. Alanna Ellis led the JLL Capital Markets debt advisory team.

MEDFORD, MASS. — MassHousing has provided $13.5 million in financing for Riverside Towers, a 199-unit affordable seniors housing complex in Medford, located north of Boston. Built in 1979, Riverside Towers consists of 161 one-bedroom and 38 two-bedroom units in a 14-story building. The borrower, a partnership between metro Boston-based Schochet Cos. and Jonathan Rose Cos., will use the proceeds to fund capital improvements, enhance resident services and preserve the property’s affordability status.