TEMPE AND GLENDALE, ARIZ. — Harrison Street has formed a joint venture with American Campus Communities (ACC) for the ownership of ACC’s existing eight-property Arizona State University on-campus student housing portfolio. Under the terms of the transaction, Harrison Street, as part of its social infrastructure platform, has acquired a 45 percent interest in the joint venture, with ACC owning the remaining interest. ACC will continue to manage the day-to-day operations in collaboration with ASU under the terms of the existing P3 (public-private partnership) contracts. The portfolio includes 8,187 beds across eight assets, which include seven buildings at ASU Tempe and one building at ASU’s West Campus in Glendale. The facilities feature core campus amenities including retail, cafés, fitness centers, dining halls, academic halls and outdoor recreation spaces. The communities provide a broad range of products including first-year residence halls, honors college housing, Greek housing and upper division apartment-style housing.

Student Housing

Yardi Matrix: Student Housing Leasing Surpasses Pre-Pandemic Levels, Outlook Bright for 2022

by Katie Sloan

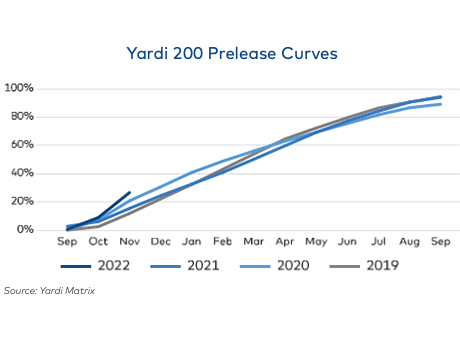

Often lauded as a recession-resistant asset class, the student housing sector was able to add another feather to its cap over the course of the past year, proving that it is also pandemic-resistant. The fall 2021 pre-leasing period ended in September at an occupancy rate of 94 percent, up from 89 percent in 2020 and 0.4 percent from levels seen prior to the start of the COVID-19 pandemic in fall 2019, according to the Yardi Matrix National Student Housing Report January 2022. These numbers were seen within the company’s ‘Yardi 200’ markets, which include the top 200 investment-grade universities across all major collegiate conferences. Pre-leasing for the fall 2022 term is already underway with levels at 27 percent as of November — an 11 percent increase over the same time in 2020, and a 6 percent increase over levels seen in 2019. Yardi reports that the top five universities with the greatest year-over-year growth in percentage of beds pre-leased are the University of Wisconsin-Madison with 66 percent growth; the University of Nevada-Las Vegas with 48 percent growth; Purdue University with 43 percent growth; the University of Pittsburgh with 31 percent growth; and the University of North Carolina at Chapel Hill …

MJW, Artisan Capital Acquire 508-Bed Student Housing Community Near the University of Nevada, Reno

by Amy Works

RENO, NEV. — A joint venture between MJW Investments and Artisan Capital has acquired a 508-bed student housing community located near the University of Nevada, Reno. Built in 2020, the property offers units with bed-to-bath parity alongside shared amenities including study rooms, a fitness center, lounge, game room, pet care station, rooftop courtyard and indoor bike and ski storage. Barings provided financing for the acquisition. “The property’s close proximity to the new developments on campus as well as the City of Reno’s economic development plan for the area are just a few reasons we’re excited to own this property,” says Mark Weinstein, president and founder of MJW investments.

ALLENDALE, MICH. — Northmarq has arranged a $4.2 million loan for the refinancing of Conifer Creek and Conifer Creek West Townhomes, two student housing properties serving Grand Valley State University in Allendale near Grand Rapids. The communities, constructed in 2006 and 2016, total 186 beds. Both properties were fully leased at the time of loan closing. Robert Hernandez of Northmarq arranged the 10-year loan, which features a 25-year amortization schedule. A life insurance company provided the loan. The borrower was undisclosed.

InterFace Panel Names What’s Hot for Social Media Marketing in the Student Housing Sector

by Katie Sloan

DALLAS — It comes as no surprise that digital marketing — and chiefly, marketing via social media — is one of the best ways to reach potential new renters in the student housing space. Students spend a massive amount of their downtime scrolling through various social media platforms, from TikTok to Instagram. And while a focus on digital marketing within the sector has been seen for some time, the COVID-19 pandemic brought an even greater emphasis on the space by eradicating opportunities for traditional marketing methods such as in-person events and tours. In December, a panel of marketing specialists discussed what’s hot and what’s not for social media marketing at InterFace Conference Group’s third annual LeaseCon/TurnCon conference in Dallas. According to a 2021 survey noted by panel moderator Alison Slager, national business development executive for LeaseLabs by RealPage, 79 percent of marketers used paid ads across social media platforms. With marketing budgets tightening, it’s important to know what resonates with today’s students to ensure all marketing dollars are well spent. Instagram Panelists agreed that the most dominant social media marketing platform is currently Instagram, particularly with its recent addition of Reels, a tool which allows users to post short-form videos. “Instagram …

TEMPE, ARIZ. — Invesco Real Estate Income Trust Inc. (INREIT) has acquired an 833-bed student housing community located near Arizona State University in Tempe. Developed in 2017, the 13-story property offers 384 units. The community was fully leased at the time of sale. Further details on the property and the seller were undisclosed. “We are excited to acquire a high-quality, 100 percent-occupied student housing property at one of the nation’s largest universities and in a high-growth market like Tempe,” says R. Scott Dennis, president and CEO of INREIT. “There continues to be strong demand for the student housing sector and we are seeing an increase in undergraduate enrollment at top universities, resulting in student housing occupancy reaching pre-COVID levels.”

TEMPE, ARIZ. — San Francisco-based Tara Investment Group, a division of Meier-Shefflin Multi-Family, has acquired The Mark, an off-campus student housing community located at 1115 E. Lemon St. in Tempe. San Clemente, Calif.-based Nelson Partners sold the asset for $36.1 million. Located along the Valley Metro Rail line on the edge of Arizona State University’s Tempe campus, The Mark features 153 units with a total of 229 beds. The units offer furnished and unfurnished studio, one- and two-bedroom floor plans with new appliances, quartz countertops and finished concrete flooring. Community amenities include a resort-style pool and sun deck, double-decker hot tubs, a water slide, gas grills, two elevators and a 24-hour fitness center. The property was built in 1970 and remodeled by Nelson Partners in 2014. At the time of sale, the community was 97 percent occupied.

The COVID-19 pandemic changed the ways schools operate, how classes were taught, and how students learned and socialized in 2020. Life still hasn’t returned to normal for anyone, including students away at college. Interior design may seem like a lower priority in the wake of such a health crisis, but these professionals would argue the exact opposite — that it’s more important than ever. That’s because leasing, retention, and making students and parents feel safe and secure as they return to their college experiences is more important than ever. The pandemic shifted higher education from in-person classes to online learning in 2020. This gave students and parents an entire year to reassess whether going away to school was the right decision going forward. This has been compounded by a focus on increasing education costs, as well as many colleges announcing that the 2021 to 2022 school year would emphasize hybrid learning, with lots of classes remaining online as the Delta variant took hold. The cumulative result of all this was a 4 percent decrease in undergraduate enrollment in 2021, per the National Student Clearinghouse Research Center. Freshman enrollment for the fall 2021 semester start sank by 13 percent when compared to …

ORLANDO, FLA. — Berkadia has secured a $70.8 million bridge loan for UnionWest at Creative Village, a 640-bed, 15-story student housing complex located in downtown Orlando. Michael Weinberg, Rebecca Van Reken and Alec Fox of Berkadia secured the financing on behalf of the sponsors, Development Ventures Group, Ustler Development and Naples, Fla.-based Halstatt Real Estate Partners. Bank of America provided the loan, which will be used to take out the existing construction loan that Michael Weinberg of Berkadia arranged in 2017. UnionWest at Creative Village offers four-bedroom floor plans with skyline views of Orlando, high-speed Wi-Fi and cable TV. Community amenities include a skydeck, study areas and kitchen and laundry services on each floor. UnionWest also includes approximately 12,000 square feet of ground floor commercial space leased to Subway, Dunkin’, Vera Asian, Qdoba and Addition Financial. The property’s parking garage contains 602 spaces. The student housing asset was more than 95 percent occupied as of the loan closing. Built in 2019, UnionWest at Creative Village serves the student population at the University of Central Florida (UCF) at the UCF and Valencia Downtown Campus. The development cost for the project was $105 million. Both Valencia College and UCF lease education space …

HOUSTON — New York City-based investment firm Vesper Holdings has purchased Tower 5040, a 405-bed student housing property located near the University of Houston. Built in 2020, the midrise building features 147 units in a mix of studio, one-, two- and four-bedroom floor plans, all with bed-to-bath parity. Units are furnished with stainless steel appliances, quartz countertops, individual washers and dryers and private balconies. Communal amenities include a pool with a hot tub and sundeck, computer lab, TV lounge, outdoor kitchen and grilling area and study rooms. The seller and sales price were not disclosed.