STATE COLLEGE, PA. — Franklin Street has brokered the $30 million sale of The Villas at Happy Valley, a 435-bed student housing property located near the Penn State University campus in State College. Developed in 2013, the community offers 145 three-bedroom units. Franklin Street represented the seller, Keystone Real Estate Group, in the sale of the property to Reliant Group Management. The new ownership plans to begin renovations imminently on the community’s fitness center, clubhouse and unit interiors. Additional shared amenities include a pool, study room, sand volleyball court, game tables, outdoor grills and a fire pit. The Villas at Happy Valley was 93 percent leased at the time of sale.

Student Housing

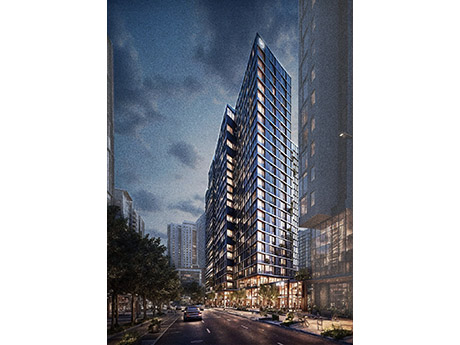

Core Spaces, Capstone to Break Ground on 1,600-Bed Student Housing Development Near Georgia Tech

by Abby Cox

ATLANTA — A joint venture between Core Spaces and Capstone Communities is set to break ground on a multi-phase mixed-use project located near the Georgia Tech campus in Midtown Atlanta. The first phase of the development — which is being led by Core Spaces — will include 1,600 beds of student housing and 5,000 square feet of ground floor retail. The community will also feature a third-floor amenity deck. Dwell Design Studio has been selected as the architect for Phase I, which is scheduled for completion in 2029. Capstone Communities will lead Phase II of the project, a timeline for which was not released.

SAN MARCOS, TEXAS — Walker & Dunlop has brokered the sale of The Edge, a 553-bed student housing property located near the Texas State University campus in San Marcos. The community offers 173 units in a mix of one-, two-, three-, four- and five-bedroom configurations. Shared amenities include a 24-hour fitness center, study rooms, a gaming room, resort-style pool, basketball and volleyball courts and a dog park. Chris Epp, Matthew Chase, Craig Miller, Holden Penn, Ben Sarna and Sarah Foronda of Walker & Dunlop represented the seller, 29th Street Capital, in the transaction. Campus Realty Advisors acquired the property for an undisclosed price. BWE arranged acquisition financing for the deal.

WEST LAFAYETTE, IND. — Subtext has opened EVER West Lafayette, a six-story, 449-bed student housing community located steps from Purdue University. The project at 147 W. Wood St. marks Subtext’s second development in West Lafayette and the first to launch under its new EVER brand. The 245,649-square-foot development includes 143 units ranging from studio to four-bedroom layouts, including three- and four-bedroom townhomes. Amenities include a resort-style courtyard with a pool, hot tub and jumbotron, along with a fitness center, yoga studio, coffee bar, open study lounges, outdoor kitchen, pet spa and bike storage. Subtext developed the project in partnership with Kayne Anderson Real Estate. First Mid Bank & Trust provided financing. ESG Architecture & Design served as architect and interior designer, and Brinkmann Constructors was the general contractor.

AUSTIN, TEXAS — Core Spaces has acquired Villas on 24th, a 670-bed student housing community located at 2313 Rio Grande St. in the West Campus neighborhood of Austin. The development opens this month and offers 199 units in studio through six-bedroom configurations with bed-to-bath parity for students attending the University of Texas at Austin. Shared amenities include a rooftop pool and hot tub with lounge seating and grills; a fitness center with an indoor basketball court; outdoor fitness spaces and saunas; and private meeting rooms and coworking spaces. Villas Student Housing developed the property. TSB Capital Advisors consulted on financing for the acquisition.

MINNEAPOLIS — Landmark Properties has opened The Standard at Dinkytown, a 17-story student housing project comprising 1,021 beds in Minneapolis. The 17-story community marks the first student housing development in Minnesota for Athens, Ga.-based Landmark. BKV Group served as the architect, and Landmark Construction was the general contractor. The property’s 323 units range from studios to five bedrooms. Each apartment is fully furnished and wired for high-speed internet and cable. Amenities include an outdoor pool area with a jumbotron, sun deck, cabanas, grilling stations and rooftop hot tub. Students also have access to an interior courtyard area, fitness center, clubhouse with computer lab, gaming lounge, study lounge with café and Amazon package lockers.

Deven Group Breaks Ground on 386-Bed Student Housing Community Near University of Virginia

by John Nelson

CHARLOTTESVILLE, VA. — Development Ventures Group (Deven Group) has broken ground on a 386-bed, on-campus student housing community situated adjacent to Scott Stadium, home arena of the University of Virginia football team. Located at 2005 Jefferson Park Ave. in Charlottesville, the seven-story, $63 million community will offer 119 units with a mix of one-, two-, three- and four-bedroom layouts. Each unit will include walk-in closets, keyless entry and smart TVs, with select units offering private terraces. Amenities at the 240,000-square-foot property will include an elevated amenity deck with mountain views; a heated plunge pool; firepit, grilling stations and hammock and game lawns; clubroom with a coffee bar and event kitchen; group and private study rooms; fitness center with yoga and spin studios; EV chargers; and bike and parcel storage. Deven Group plans to deliver the unnamed community in summer 2027. Capital partners on the project include Marble Capital, BOK Financial and Clairmont Capital Group. Breeden Construction is the general contractor and is currently constructing a project within University of Virginia’s Fontaine Research Park. Deven Group, the U.S. development arm of Kajima Corp., a 180-year-old Japanese construction company, has approximately $300 million of projects set to break ground this year.

Joint Venture Acquires 381-Bed Student Housing Community Near Louisiana State University

by John Nelson

BATON ROUGE, LA. — A joint venture between affiliates of Monument Square Investment Group and a New York-based single-family office has acquired University Grove, a 381-bed student housing community located 2.7 miles south of the Louisiana State University (LSU) campus in Baton Rouge. Developed in 2024, the property offers 127 cottage-style units in three-bedroom configurations with bed-to-bath parity. Capital improvements are planned for the property, including upgrades to landscaping and amenity spaces. The community was 98.5 percent leased at the time of sale. The seller and terms of the transaction were not released.

NORTH ANDOVER, MASS. — A public-private partnership between Greystar and Merrimack College has topped off two student housing projects totaling 540 beds on the university’s campus in North Andover, a northern suburb of Boston. The first building will house 351 beds across 180 units, all of which will be traditional dormitory doubles except for the resident advisor units. The second building will house 189 beds across 54 units, the majority of which will feature three- and four-bedroom suite configurations. The properties will also feature a combined total of 12,609 square feet of academic space, a pavilion for honors students and a fitness center. Timelines for completion of the projects were not disclosed.

TSB Realty Arranges Sale of 221-Bed Student Housing Community Near Oregon State University

by Amy Works

CORVALLIS, ORE. — TSB Realty has arranged the sale of The Union Corvallis, a 221-bed student housing community located near the Oregon State University campus in Corvallis. Delivered in 2013, the property offers 68 units in a mix of one-, two- and four-bedroom configurations. Shared amenities include a clubhouse with pool and ping pong tables, an outdoor sundeck and grilling area, a resident lounge with a television, study lounge with private study spaces, a computer station and library area. Cardinal Group Cos. acquired the property for an undisclosed price. The seller was not released.