NEW YORK CITY — Accounting firm Marcum Asia has signed an 8,851-square-foot office lease expansion at 7 Penn Plaza in Midtown Manhattan. The tenant now occupies a total of 14,870 square feet on the eighth floor at the 18-story, 357,000-square-foot building. Steve Kaplan of Norman Bobrow & Co. represented Marcum Asia in the lease negotiations. Andrew Wiener and David Turino represented the landlord, The Feil Organization, on an internal basis.

New York

NEW YORK CITY — Capalino, a business development consulting firm, has signed an 8,424-square-foot office lease at 730 Third Avenue in Midtown Manhattan. The tenant will occupy the entire 24th floor of the 665,110-square-foot building. David Hoffman, Robert Billingsley and Sam Hoffman of Cushman & Wakefield represented the tenant in the lease negotiations. Nuveen Real Estate owns the building.

By Pam Knudsen, senior director of tax compliance services, Avalara While the dust has scarcely settled from a landmark ruling in New York City resulting in a massive crackdown on short-term rentals (STRs), the full extent of the fallout from the decision has yet to be fully grasped by many — and perhaps even by the city itself. Under the terms of Local Law 18, a resolution that passed earlier this year, hosts and owners of short-term rentals, including Airbnb, are now subject to tighter and stricter regulations. These include limits on numbers of guests, requirements to register with the city and obligations to more closely monitor guest behavior, among other regulations. The effective ban on short-term rentals will have considerable consequences on local economies, and more than anyone, it’s small lodging businesses that stand to be impacted by the resulting wave. But to fully understand the major impact this ban has on small businesses, we must first acknowledge that STRs should rightly be considered small businesses themselves. Much like any other small business, STRs are required by most communities to be licensed, registered and compliant with tax collection and remittance. Furthermore, the hosts and managers behind STRs operate in …

Cushman & Wakefield: Manhattan’s Fifth Avenue Remains Most Expensive Street in the World for Retailers

by John Nelson

NEW YORK CITY — Fifth Avenue in Manhattan has retained its No. 1 ranking as the world’s most expensive retail destination at approximately $2,000 per square foot, which is unchanged from last year. That’s according to the 33rd edition of the Cushman & Wakefield (NYSE: CWK) Main Streets Across the World, an annual report that examines retail rental rates around the world in “high street” locations, referring to bustling, high-end retail districts. Fifth Avenue is world-renowned for its luxury offerings, including Bergdorf Goodman, Prada, Saks and Tiffany, among others. Additions to Fifth Avenue’s retail store count this year include a new store for Harry Winston and newcomers to the corridor Asics, Dyson, Skechers, Johnston & Murphy and Bandier, according to online directory Visit 5th Avenue. While on par with the rents charged last year, Fifth Avenue’s average retail rate is up 14 percent from pre-pandemic levels, making it only one of three high streets in the top 10 that have increased rates since that time span. The No. 2 retail destination in Main Streets Across the World is Milan’s Via Montenapoleone at $1,766 per square foot. The district jumped a spot into second from last year’s report by pushing rental …

NEW YORK CITY — JLL has arranged the $10.2 million sale of a 62-unit apartment building located at 788 Riverside Drive in the Washington Heights area of Manhattan. The 11-story building primarily houses two- and three-bedroom units that have an average size of 1,025 square feet. Of the 62 apartments, 53 of which are rent-stabilized, five are rent-controlled and four are rented at market rates. The buyer and seller were both family offices that requested anonymity. Paul Smadbeck and Hall Oster of JLL brokered the deal.

NEW YORK CITY — Law firm Scott + Scott LLP has signed a 21,365-square-foot office lease at 230 Park Avenue in Manhattan. The firm will relocate from a subleased space on the 17th floor to the entire 24th floor next summer. Erik Schmall and Scott Weiss of Savills represented the tenant in the lease negotiations. Scott Klau, Brian Waterman, Erik Harris, Zach Weil and Cole Gendels of Newmark, along with internal agents William Elder, Andrew Ackerman and Walt Rooney, represented the landlord, RXR.

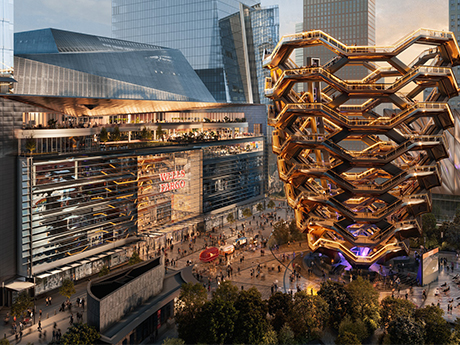

Wells Fargo Plans 400,000 SF Adaptive Reuse Office Project at Hudson Yards in Manhattan

by John Nelson

NEW YORK CITY — Wells Fargo & Co. (NYSE: WFC) has announced formal plans to expand its office footprint within Hudson Yards, a mixed-use district on Manhattan’s west side. The San Francisco-based banking giant, which already occupies space within the $25 billion Hudson Yards campus, has purchased additional space from Related Cos., the master developer behind Hudson Yards along with Oxford Properties Group. Multiple media outlets have reported that Wells Fargo purchased the space at 20 Hudson Yards, which formally housed a Neiman Marcus store, for $550 million. The bank plans to convert the 400,000 square feet of space to offices in synergy with its current 500,000-square-foot footprint at 30 Hudson Yards, according to Bloomberg News. Forbes reported that the Neiman Marcus location closed in summer 2020. Wells Fargo plans to begin moving employees from its existing office space at 150 E. 42nd St. to the new Hudson Yards office beginning in late 2026. The property is expected to house 2,300 Wells Fargo employees at full operation. The 11-story building will also include a dedicated entrance on 10th Avenue and naming rights to Wells Fargo for signage on the exterior of the property. “This investment further solidifies our longstanding commitment …

NEW YORK CITY — Locally based brokerage firm Rosewood Realty Group has negotiated the $8.9 million sale of a portfolio of three multifamily buildings totaling 28 units in Brooklyn’s Williamsburg neighborhood. The four-story building at 313 S. Fourth St. was built in 1915 and totals 12 units, and the two-building complex at 431-433 Wythe Ave. was constructed in 1920 and totals 16 units. Ben Khakshoor, Reoven Elharar and Alex Fuchs of Rosewood Realty represented the seller, a private investor, in the transaction and procured the buyer, Edifice Management.

NEW YORK CITY — Marcus & Millichap has brokered the $3.4 million sale of an eight-unit apartment building located at 923 Bedford Ave. in Brooklyn’s Clinton Hill neighborhood. The four-story building was originally constructed in 1901 and offers studio, one- and two-bedroom units. Daniel Greenblatt and Shaun Riney of Marcus & Millichap represented the seller, a family office, in the transaction and procured the buyer, an individual/personal trust.

NEW YORK CITY — IMA New York, a division of insurance brokerage firm IMA Financial Group, has signed a 10,000-square-foot office lease at 1155 Avenue of the Americas in Midtown Manhattan. The lease term is 10 years. The tenant will occupy space on the 33rd floor of the 42-story building. Howard Hersch and Brett Harvey of JLL represented the tenant in the lease negotiations. Tom Bow, Rocco Romeo and Nora Caliban internally represented the landlord, The Durst Organization, which recently completed a $130 million capital improvement program at the property.