BAY SHORE, N.Y. — New York City-based investment and development firm Rockefeller Group is nearing completion of a 172,622-square-foot speculative industrial project located at 55 Paradise Lane in the Long Island community of Bay Shore. Building features include a clear height of 36 feet, 40 dock doors, two overhead doors and parking for 270 vehicles. Completion is slated for spring 2023. KSS Architects designed the project, and Aurora Contractors is serving as the general contractor. Huntington is the civil engineer. JLL has been tapped to lease the development.

New York

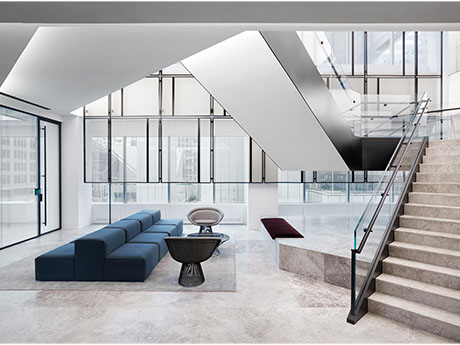

NEW YORK CITY — Global law firm Shearman & Sterling has completed the renovation of its 340,000-square-foot office headquarters space at 599 Lexington Avenue in Midtown Manhattan. The redesigned workspace houses apportioned offices, improved boardroom acoustics, new artwork and various health and wellness features. Perkins & Will served as the architect of the project, which was conceived in advance of the pandemic and took approximately two years to complete. L&K Partners served as the construction manager, and MEP provided engineering services.

NEW YORK CITY — Locally based brokerage firm Alpha Realty has negotiated the $24 million sale of an 82-unit apartment building in the Crown Heights area of Brooklyn. The five-story building at 792 Sterling Place houses 30 studios, 34 one-bedroom units and 18 two-bedroom residences. Lev Mavashev of Alpha Realty represented the buyer and seller, both of which requested anonymity, in the off-market transaction. The deal traded at a cap rate of 6.4 percent.

NEW YORK CITY — The New York City School Construction Authority (SCA) has acquired a 21,870-square-foot parcel across from Van Cortlandt Park in The Bronx for the development of a 100,000-square-foot elementary school. Known as PS X515, the school will support approximately 700 students in grades pre-K through 5 and will feature a gym, library, occupational and speech therapy rooms and art, science and music rooms. DIGroup Architecture is designing the school, which is scheduled to open in fall 2027.

NEW YORK CITY — Cushman & Wakefield has brokered the $17.5 million sale of a mixed-use building located at 833 Madison Ave. on Manhattan’s Upper East Side. The five-story, 9,302-square-foot building comprises two retail spaces, one office space, two galleries and six residential units. Hunter Moss of Cushman & Wakefield represented the seller, A. L. Holdings Inc., in the transaction. Daniel Kaplan of CBRE led the team that represented the buyer, Myles Madison Inc.

WEBSTER, N.Y. — Metro Boston-based brokerage firm Horvath & Tremblay has arranged the $18.6 million sale of Webster Plaza, a 154,991-square-foot shopping center located outside of Rochester in upstate New York. Tenants at Webster Plaza include Savers, the Town of Webster Public Library, Pet Supplies, Starbucks, Subway and FedEx. Jeremy Black, Bob Horvath and Todd Tremblay of Horvath & Tremblay represented the seller, a private investor, in the transaction. The buyer was also a private investor.

NEW YORK CITY — Locally based brokerage firm Rosewood Realty Group has negotiated the $4.4 million sale of an apartment building located at 337 E. Ninth St. in Manhattan’s East Village area. The five-story building was constructed in 1900 and comprises nine residential units and two commercial spaces. Aaron Jungreis, Ben Khakshoor and Alex Fuchs of Rosewood represented the seller, a limited liability company, in the transaction and procured the buyer, a private investor. Both parties requested anonymity.

JERICHO, N.Y. — Kimco Realty (NYSE: KIM), a retail and mixed-use real estate REIT based in Jericho, has acquired a portfolio of eight shopping centers on Long Island. Kabro Associates, a privately held owner based in Woodbury, N.Y., sold the portfolio to Kimco for $375.8 million. Each of the eight retail centers, five of which are grocery-anchored, are located within a 15-minute drive of the Kimco corporate headquarters in Jericho. The centers in the sold portfolio include: • The Gardens at Great Neck • Woodbury Common • The Market Place • Stop & Shop Shopping Center • Southgate Shopping Center • Green Cove Plaza • Syosset Corners and • Sequams Shopping Center The portfolio was 94.4 percent leased at the time of sale. Tenants at the centers include TJ Maxx, GoHealth Urgent Care, Rite Aid, Starbucks, Dunkin’ and Chipotle Mexican Grill, among others. Jose Cruz, Christopher Munley, Andrew Scandalios, James Galbally, Steve Simonelli, Colin Behr and J.B. Bruno of JLL represented Kabro Associates in the transaction. “This acquisition was a rare chance to expand our presence in one of Kimco’s most highly desired markets, with a portfolio of irreplaceable real estate located in one of the most heavily trafficked, densely …

NEW YORK CITY — Hyatt Hotels Corp. (NYSE: H) has opened The Grayson, a 296-room hotel located at 30 W. 39th St. in Midtown Manhattan that is part of The Unbound Collection by Hyatt family of brands. Guestrooms feature exposed concrete ceilings, bathrooms with subway tiles and mini-fridges with craft cocktails. In addition, the hotel houses multiple food-and-beverage concepts, as well as a fitness center. Italian architect Marcello Pozzi designed The Grayson, and Fortune Hotel Collection developed and manages the property. Opening preview rates start at $409 per night.

NEW YORK CITY — Locally based investment firm Bayrock Capital has acquired a 27-room hotel located at 2101 Needham Ave. in The Bronx for $4.2 million. The property is located in the Edenwald neighborhood and includes 27 parking spaces. Jonathan Squires, Josh Neustadter and Austin Weiner of Cushman & Wakefield represented the seller, RMJ Motel Corp., in the transaction.