NEW YORK CITY — Katz & Associates has negotiated two retail leases in Queens. Japanese grocery store Teso Life signed a 6,000-square-foot lease in the Bayside neighborhood, and Filipino fast casual restaurant Jollibee committed to 3,614 square feet at 91-23 Queens Blvd. Daniel DePasquale of Katz & Associates represented the landlords, Paulipark Associates LLC and Midwood, respectively, in both deals. Both concepts will open in 2023.

New York

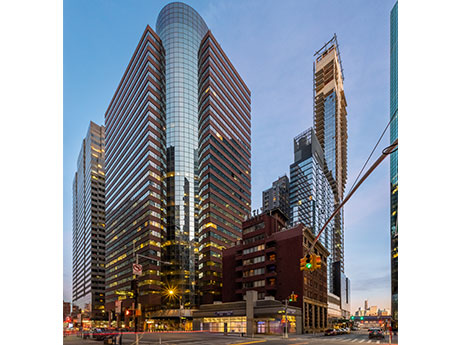

NEW YORK CITY — 1-800Accountant, which provides virtual accounting software for small businesses, has signed a 12,344-square-foot office lease at 260 Madison Avenue, a 570,000-square-foot building in Midtown Manhattan. Peter Turchin, Gregg Rothkin, Tim Freydberg, Hayden Pascal and Jared London of CBRE represented the landlord, The Sapir Organization, in the lease negotiations. The representative of the tenant was not disclosed.

NEW YORK CITY — MGM Studios has signed a 50,462-square-foot office lease at 260 Madison Avenue, a 570,000-square-foot building in Midtown Manhattan. Peter Turchin, Gregg Rothkin, Tim Freydberg, Hayden Pascal and Jared London of CBRE represented the landlord, The Sapir Organization, in the lease negotiations. The representative of the tenant was not disclosed.

Bellwether Enterprise Provides $6.5M Refinancing of Affordable Seniors Housing Property Near Buffalo

KENMORE, N.Y. — Bellwether Enterprise has provided a $6.5 million HUD-insured loan for the refinancing of Ken-Ton Presbyterian Village, a 150-unit affordable seniors housing property located near Buffalo in the upstate New York community of Kenmore. The borrower was Beechwood Continuing Care. Lundat Kassa and Anthea Martin led the transaction for Bellwether Enterprise.

NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has negotiated the $5.5 million sale of an eight-unit apartment building located in the Park Slope area of Brooklyn. According to StreetEasy.com, the four-story building was originally built in 1920. Benjamin Vago, Stephen Vorvolakos and Sean Kelly of Ariel Property Advisors brokered the deal. Both the buyer and seller requested anonymity. The deal traded at a cap rate of 4.8 percent.

NEW YORK CITY — JLL has arranged the $252 million sale of the former AIG global headquarters to 99c LLC, a real estate firm specializing in adaptive reuse development in urban markets. The 31-story property is located at 175 Water St. in Lower Manhattan’s Seaport submarket and comprises 684,500 square feet of rentable space. Vanbarton Group was the seller. The purchase represents 99c’s entry into the New York market following a focus on London, where it acquired millions of square feet of commercial office space. The firm is currently one year into a four-year plan to do the same in New York. 175 Water St. features 12-foot ceilings, 24,000-square-foot floor plates, center-core configuration and an efficient design. The building’s flexibility also includes an unused ground floor, which is being primed for a reimagined lobby along with two usable rooftop terraces with amenities. The building is completely vacant, following AIG’s move to a new location in 2021. Andrew Scandalios, David Giancola, Vickram Jambu, Marion Jones, Steven Rutman and Alexander Riguardi led JLL’s capital markets investment sales advisory team representing the seller. “175 Water St. received a generous amount of investor interest given the nature of the building, which provided a blank canvas …

NEW YORK CITY — Locally based investment firm Regal Ventures has acquired a 37,165-square-foot retail and parking condo located at 897 Eighth Ave. in Manhattan’s Hell’s Kitchen neighborhood. The sales price was $35.2 million. The property’s retail component is 15,893 square feet, and the parking space spans 21,272 square feet. Regal Ventures acquired the property in partnership with Morrison Street Capital from Prudential Financial.

NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has arranged the $5.7 million sale of a 35-unit apartment building located in the Bay Ridge area of Brooklyn. The four-story building houses four studios, 30 one-bedroom units and one three-bedroom residence. Stephen Vorvolakos, Sean Kelly and Lawrence Sarn of Ariel Property Advisors brokered the deal. Both the buyer and seller requested anonymity.

NEW YORK CITY — CBRE has negotiated five office leases totaling 17,687 square feet at 424 Madison Avenue in Midtown Manhattan. The new tenants are Japanese Medical Care, Alignage Fertility, Vaerstandig & Sons, Yehuda Diamond Co. and JKB2 Medical Management. Paul Walker and Jordan Donohue represented the landlord, BLDG Management, in the lease negotiations. The tenant representatives were not disclosed.

NEW YORK CITY — The Jewish Board of Family & Children’s Services Inc. has signed a 12,230-square-foot office sublease at 463 Seventh Avenue in Manhattan. The 22-story building was originally constructed in 1925. David Levy of Adams & Co. represented the landlord, The Arsenal Co., in the lease negotiations. David Lebenstein of Cushman & Wakefield represented the tenant.