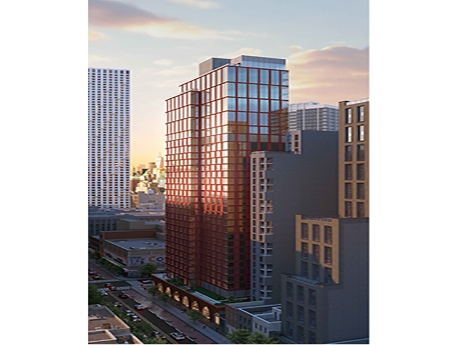

NEW YORK CITY — Cushman & Wakefield has arranged a $134 million construction loan for 15 Hanover Place, a mixed-income residential project that will be located in downtown Brooklyn. The 34-story building will house 314 units, 95 of which will be reserved as affordable housing, as well as 9,000 square feet of commercial space. Gideon Gil, Zachary Kraft and Sebastian Sanchez of Cushman & Wakefield arranged the loan through Santander Bank and City National Bank on behalf of the borrower, locally based developer Lonicera Partners. A tentative completion date has not yet been established.

New York

NEW YORK CITY — JLL has negotiated the $33.7 million sale of a portfolio of three commercial properties in Manhattan’s Lenox Hill neighborhood. The building at 1026 Third Ave. comprises a ground-level restaurant, second-floor office space, one duplex and one residential loft. The two buildings at 1020-1024 Third Ave. total 19,375 square feet and consist of 25 residential units and three commercial spaces. Clint Olsen and Stephen Godnick of JLL represented the buyer, Kahen Properties, in the transaction. JLL also represented the seller in the $24 million disposition of 1020-1024 Third Avenue. Nick Judson of Judson CRE represented the seller of 1026 Third Avenue, which fetched a price of $9.7 million.

NEW YORK CITY — Marriott has opened a 130-room hotel at 111 E. 24th St. in Midtown Manhattan under that will be operated under the hospitality giant’s SpringHill Suites brand. According to Crain’s New York, McSam Hotel Group developed the property. Gene Kaufman Architect designed the 12-story hotel, which offers amenities such as a breakfast dining room, laundry, fitness center and dry cleaning service.

NEW YORK CITY — Locally based investment and advisory firm Vanbarton Group has sold a 23,339-square-foot retail assemblage in the Morrisania neighborhood of The Bronx for $22.7 million. The sites collectively span a full block and are located at 1031-1049 Westchester Ave. and 1057 Southern Blvd. Josh Neustadter and Jonathan Squires of Cushman & Wakefield represented Vanbarton Group in the transaction. Jason Gold, Victor Sozio and Daniel Mahfar of Ariel Property Advisors represented the buyer.

NEW YORK CITY — Locally based investment firm Seavest Healthcare Properties has acquired a 57,000-square-foot medical office building located at 355 W. 52nd St. in Manhattan. NYU Langone Health anchors the eight-story building, which was fully leased at the time of sale to an array of specialty care practitioners. The seller and sales price were not disclosed.

ELMSFORD, N.Y. — Affiliates of Harbor Group International (HGI) and Azure Partners have purchased Avalon Green in Elmsford, a city in Westchester County, for $306 million. The garden-style apartment community features 617 units. The seller was AvalonBay Communities Inc. Built in three phases in 1995, 2012 and 2016, Avalon Green includes a mix of townhomes, apartments and stacked flats. Residents have access to a clubhouse, resident lounge, two saltwater pools and detached garages. The buyers plan to implement a $9.2 million capital improvement program to refresh amenities and common areas and upgrade select units. The property offers access to I-287 and is five miles from the Metro-North train station, which provides direct service to Manhattan and Stamford, Conn. Additionally, Westchester County is home to corporate campuses of IBM, PepsiCo, Mastercard, Morgan Stanley and Regeneron. “Avalon Green is an attractive fit for HGI’s multifamily portfolio given its strategic location between several employment centers and transportation options along with the significant value-add potential of the community,” says Richard Litton, president of HGI. “We see long-term demand fundamentals for the Westchester area as renters seek housing in suburban markets.” Jose Cruz, Steve Simonelli, Michael Oliver, Andrew Scandalios, Marion Jones and Josh Stein of …

NEW YORK CITY — New York City-based development and investment firm Innovo Property Group (IPG) has received a $435 million loan for the refinancing of a 900,000-square-foot industrial project in the Long Island City area of Queens. IPG acquired the site, which previously housed the warehouse of online grocer FreshDirect, in January 2019 with Atalaya Capital Management and Nan Fung Group for $75 million. Since then, the development has demolished the existing structures on the site and is targeting a 2024 completion for the new facility, which will feature elevated truck courts and a vertical parking structure. Starwood Property Trust and J.P Morgan provided the loan, and the former originally provided the $155 million in construction financing in early 2021. Eastdil Secured arranged the financing.

NEW YORK CITY — Sunrise Senior Living has opened Sunrise of New Dorp, its second seniors housing community on Staten Island. The 85,000-square-foot, four-story property features 130 units of assisted living and memory care and proximity to the Staten Island Expressway and some of the borough’s various shops, restaurants and beaches. Moseley Architects designed the project. Other partners included KBE Building Corp. and PWC Cos.

ITHACA, N.Y. — Hunter Hotel Advisors, an Atlanta-based hospitality brokerage firm, has arranged the $11.2 million sale of the 107-room Courtyard Ithaca Airport Hotel in upstate New York. The select-service property is situated adjacent to Ithaca Tompkins International Airport and Cornell University’s campus. Rochester, N.Y.-based owner-operator DelMonte Hotel Group sold the property to Skyline Investments Inc. Mayank Patel of Hunter Hotel Advisors brokered the deal.

WELLSVILLE, N.Y. — Greystone has provided a $7 million bridge loan for the refinancing of a 137-bed assisted living facility in Wellsville, located in the southwestern part of the Empire State. The financing retires the acquisition debt of the borrower, Willow Ridge Senior Living LLC, which acquired the facility in August 2021. Formerly known as Manor Hills, the property also includes 22 memory care beds in a separate wing. Greystone intends to pursue HUD-insured financing as a long-term permanent exit of the bridge financing. The nonrecourse, interest-only bridge loan includes an initial 24-month term with two six-month extensions.