EAST FISHKILL, N.Y. — A global automotive manufacturer has preleased the entirety of Hudson Valley Logistics Center, a 540,688-square-foot industrial project that is under construction in East Fishkill, about 60 miles north of New York City. The name of the tenant was not disclosed, but local publication Mid Hudson News reports that the company is Stellantis, a multinational manufacturer based in The Netherlands. The building, which is slated for a third-quarter delivery, features a clear height of 36 feet, 120 dock positions, three drive-in doors and parking for 134 trailers and 212 cars. A joint venture between Bluewater Property Group and Affinius Capital owns Hudson Valley Logistics Center. Rob Kossar, David Knee, James Panczykowski, Dave MacDonald and Charlotte Belling of JLL negotiated the deal on behalf of both parties.

New York

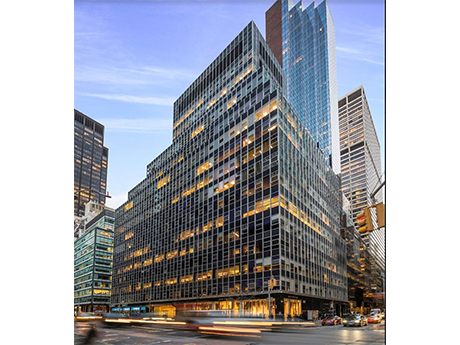

NEW YORK CITY — A partnership between locally based investment firm Waterman Interests and global asset manager HPS Investment Partners will redevelop 850 Third Avenue, a 605,000-square-foot office building in Midtown Manhattan. The 21-story building was originally constructed in 1961. According to the partnership, 850 Third Avenue offers the largest block of available space in Midtown East — more than 400,000 square feet — and will be repositioned to support build-to-suit headquarters deals. A construction timeline was not disclosed.

NEW YORK CITY — First Citizens Bank has provided a $74 million loan for the refinancing of a 160-unit apartment building in downtown Brooklyn. The 23-story building at 310 Livingston St. features one- and two-bedroom units and amenities such as a fitness center, outdoor grilling and dining stations, a recreation room, speakeasy, library, private dining room and a sky lounge. The property also includes ground-floor retail and restaurant space. The borrower was locally based developer Lonicera Partners.

NEW YORK CITY — Cushman & Wakefield has negotiated a 12,847-square-foot office lease renewal in Manhattan’s Plaza District. The building at 600 Lexington Ave. rises 36 stories and spans 305,472 square feet. Harry Blair, Connor Daugstrup and Bianca DiMauro of Cushman & Wakefield represented the landlord, Lex NY Equities LLC, in the lease negotiations. Daniel Posy and Jason Roberts of JLL represented the tenant, GLC Advisors, an independent investment advisory firm.

NEW YORK CITY — New Museum, an institution devoted to contemporary art, has signed a 5,850-square-foot office lease at 250 Bowery in Lower Manhattan. The space will house the museum’s administrative offices during its temporary closure, which stems from a 60,000-square-foot expansion project that began in November 2022 and is slated for an early 2025 completion. A joint venture of Taconic Partners, L+M Development Partners, BFC Partners, The Prusik Group and Goldman Sachs Asset Management owns the building.

NEW YORK CITY — Stuf Storage has opened a 110-unit self-storage facility in Brooklyn. The facility is located at 550 Fifth Ave. in the Park Slope neighborhood and consists of gross 9,000 net rentable square feet of space. Units range in size from 20 square feet to 250 square feet. The owner of the building was not disclosed. Stuf Storage now operates about 30 facilities across seven states.

NEW YORK CITY — Stuf Storage has opened a 180-unit self-storage facility in Brooklyn. The facility is located at 485 Clermont Ave. at the nexus of the Clinton Hill and Prospect Heights neighborhoods and consists of 15,000 gross square feet. Units range in size from 12 square feet to 240 square feet. Locally based developer RXR owns the property. Stuf Storage now operates about 30 facilities across seven states.

NEW YORK CITY — Bernhardt Furniture has signed a 20,000-square-foot office lease renewal in Midtown Manhattan. The company’s flagship office and showroom are located at 136 Madison Avenue, a 17-story, 300,000-square-foot building. Mac Roos, Andrew Roos, Michael Cohen and Jessica Verdi of Colliers represented the landlord, Williams Equities, in the lease negotiations. Peter Sabesan and Matthew Feigen of Cresa represented the tenant.

J.P. Morgan Real Estate Income Trust Acquires Majority Interest in 99,837 SF Retail Center in Queens

NEW YORK CITY — J.P. Morgan Real Estate Income Trust (JPMREIT) has acquired a 95 percent interest in Shops at Grand Avenue, a 99,837-square-foot retail center in Queens. Acadia Realty Trust sold the interest for $48 million. Grocer Stop & Shop anchors the property, which was fully leased at the time of the acquisition. Other tenants include Party City, Five Below, Sally Beauty Supply, Starbucks and Burger King.

NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has arranged the $7.7 million sale of a multifamily development site in the Far Rockaway area of Queens. The site at 60-14 Beach Channel Drive can support 74,000 square feet of buildable space and is subject to a 421a tax incentive for adding affordable housing. Jason Gold and Gabriel Elyaszadeh of Ariel represented the undisclosed seller in the transaction. The buyer was also not disclosed.