BREVARD, N.C. — UNC Health Pardee, a health system managed by UNC Health that operates hospitals and clinics in Western North Carolina, has broken ground on a 39,000-square-foot adaptive reuse project in downtown Brevard. The developers behind the project include Riddle Development LLC, Layr LL and Osprey Capital. The team acquired the property, a 1960s-era retail strip center, for $2.6 million. Medalist Capital and United Community Bank are providing construction financing for the redevelopment, which is anticipated to cost $15 million in renovations. Upon completion, the new medical office building will feature 48 exam rooms for primary care services, a retail pharmacy, specialty rotation services, a 50-person conference and community room and a 300-person waiting room and event space. UNC Health Pardee plans to take occupancy in January.

North Carolina

CHARLOTTE, N.C. — CenterSquare Investment Management has acquired Gold Hill Commerce Park, an 11,835-square-foot retail strip center located in Charlotte. Built in 2000, the center is situated roughly 11 miles from the Charlotte Douglas International Airport. The property was fully leased to tenants including Marco’s Pizza, UrgentVet, Select Physical Therapy and Allen Tate Realty at the time of sale. This transaction marks CenterSquare’s 20th acquisition in the Southeast. The seller and sales price were not disclosed.

Berkadia Brokers $43.8M Sale of Highline North Apartments in Asheville, North Carolina

by John Nelson

ASHEVILLE, N.C. — Berkadia has brokered the $43.8 million sale of Highline North, a 168-unit apartment community located at 602 Highline Drive in Asheville. The seller, North Carolina-based Carlisle Residential Properties, delivered the property in 2023. Caleb Troop, Thomas Colaiezzi and Matt Robertson of Berkadia represented the seller in the transaction. Jeremy Lynch and Jake Adoni of Berkadia’s Philadelphia office originated a Freddie Mac acquisition loan on behalf of the buyer, Greenville-based Graycliff Capital. Highline North features one-, two- and three-bedroom apartments, as well as three-bedroom townhomes, with units ranging in size from 822 to more than 1,500 square feet. Amenities include a fitness center with cardio and weight lifting equipment; clubhouse featuring a TV lounge, wet bar and shuffleboard; pet spa and park; salt-water swimming pool; Amazon package lockers; detached garages; and electric vehicle charging stations.

NEWTON, N.C. — JLL Capital Markets has arranged the sale of Corning Hickory, a 265,000-square-foot manufacturing facility located within the Trivium Corporate Center in Newton, about 43 miles northwest of Charlotte. Constructed in 2022, the build-to-suit facility is fully leased to Corning Inc., a multinational technology company that specializes in glass and ceramics science and optical physics. Pete Pittroff, Jason DeWitt, Dave Andrews, Michael Scarnato, Zach Lloyd and Allan Parrott of JLL’s Capital Markets team represented the seller, Atlanta-based Stonemont Financial Group, in the transaction. PRP Real Estate Investment Management purchased the property for an undisclosed price. Situated on 30 acres, the facility features 32-foot clear heights, ESPR fire suppression, LED lighting, a climate-controlled interior, two 4,000-amp switchboards, 83 car parking spaces and 56 trailer parking spaces. The property also offers an additional 83,000 square feet for options to expand.

INDIAN TRAIL, N.C. — Berkadia has brokered the sale of Poplin Trace, a 99-unit build-to-rent community in Indian Trail, a city about 15 miles southeast of Charlotte. The sales price was not disclosed, but the Charlotte Business Journal reported the asset traded for $31 million. The seller was Arizona-based Belleview. The buyer was not disclosed. Caleb Troop, Matt Robertson, Mark Forrester and Andrew Curtis of Berkadia led the transaction on behalf of Belleview. Built in 2021, Poplin Trace offers three-bedroom townhomes with attached two-car garages. The property was 93 percent occupied at the time of sale.

CHARLOTTE, N.C. — Florida-based SouthState Bank has signed a 40,000-square-foot office lease at 110 East, a 23-story office tower located at the intersection of East and South boulevards in Charlotte’s South End district. Chris Schaaf and Jim Thorpe of JLL represented SouthState in the lease transaction. Rhea Greene, Jennifer Kurz and John Hannon of Trinity Partners represented the landlord, a partnership between Stiles and Shorenstein Properties. Other committed tenants at the 370,000-square-foot office tower include Humana, Patterson Pope and Iberian Pig, a Spanish tapas dining concept by Castellucci Hospitality that will occupy a 4,600-square-foot restaurant on the ground level. SouthState Bank plans to take occupancy at 110 East in second-quarter 2026 and staff around 100 employees for its regional office hub. Hastings Architecture designed the office tower, which opened last year.

CHARLOTTE, N.C. — Deriva Energy, formerly known as Duke Energy Renewables, has relocated to a 33,606-square-foot office space at One South on the Plaza, a 40-story office tower located in Uptown Charlotte. The new office will serve as the headquarters for Deriva, which plans to move in by late fall. Chris Schaaf and Jamie Boast of JLL represented Deriva Energy in the lease negotiations, while Rhea Greene of Trinity Partners represented the undisclosed landlord. One South on the Plaza totals 850,000 square feet and features a 22,000-square-foot tenant amenity level on the third floor, street-level retail space housing tenants such as Tupelo Honey and Eddie V’s and a connection to the Overstreet Mall. Since 2015, ownership has invested $100 million to renovate the building’s lobby, plaza and exterior. More than 92,000 square feet of office leases have been executed at One South on the Plaza, including Dole Food’s U.S. headquarters, Shumaker, Robert Half, Protiviti, Huntington National Bank, The Siegfried Group, Krazy Curry, Ace No. 3 and Pet Wants.

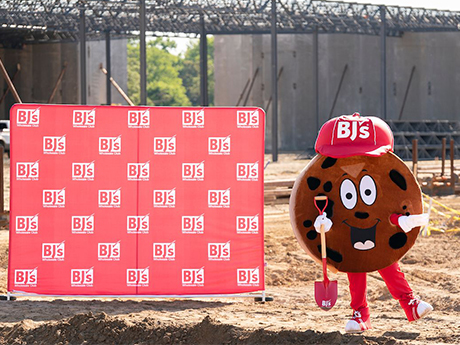

AdVenture Development Breaks Ground on 100,000 SF BJ’s Wholesale Club in Selma, North Carolina

by John Nelson

SELMA, N.C. — AdVenture Development LLC has broken ground on a BJ’s Wholesale Club located within the 400-acre master-planned community of Eastfield Crossing in Selma, about 30 miles southwest of Raleigh. The new store, which will feature an onsite BJ’s gas station, will total 100,000 square feet. Additional tenants at the 3 million-square-foot mixed-use development include Academy Sports + Outdoors, Hobby Lobby, Old Navy, Ulta Beauty, Marshalls, Ross Dress for Less, Burlington, Five Below and Chase Bank. Target is also under construction at Eastfield Crossing and anticipates opening in spring 2026. Eastfield Crossing includes a business park, retail and entertainment space, medical and office space, a hospitality component, senior living and multifamily units and single-family residences. Locally based AdVenture Development is the owner and master developer of Eastfield Crossing.

Roche, Genentech to Develop $700M Pharmaceutical Manufacturing Facility in Holly Springs, North Carolina

by John Nelson

HOLLY SPRINGS, N.C. — Genentech, a Bay Area-based biotech firm and member of the Switzerland-based Roche Group, plans to develop a $700 million pharmaceutical manufacturing facility in Holly Springs, approximately 20 miles southwest of Raleigh. The new 700,000-square-foot facility will create 400 high-wage manufacturing jobs and 1,500 construction jobs. The new facility will support Roche and Genentech’s portfolio of next-generation obesity medicines. The construction timeline for the new factory was not disclosed. Roche and Genentech’s current U.S. footprint includes 13 manufacturing and 15 R&D sites across the company’s pharmaceutical and diagnostics divisions. The companies have 25,000 employees in 24 sites across eight U.S. states.

CHARLOTTE, N.C. — McShane Construction Co., working on behalf of developer Flournoy Development Group, has completed Ellison Mallard Creek, a 397-unit apartment community located at 930 W. Mallard Creek Church Road in Charlotte. Situated on 24.6 acres, the wood-frame property features five apartment buildings and 10 townhome-style buildings that house one-, two- and three-bedroom units. Additionally, 10 units come with a downstairs workspace that allows residents to have an office or small storefront. Monthly rental rates range from $1,411 to $2,800, according to Apartments.com. Designed by Dynamik Design, amenities at Ellison Mallard Creek include a resident lounge with gaming and entertainment areas, a fitness and wellness center, coworking lounge, hobby and art studio, market, heated resort-style pool, courtyards with fire pits, green space, dog park, pet spa and electric vehicle charging stations. McShane Construction is currently building three other apartment communities on behalf of Flournoy.