HARTFORD, CONN. — Blueprint Healthcare Real Estate Advisors has brokered the sale of three skilled nursing facilities in Connecticut. Totaling 380 beds, the properties are all located in the northeastern suburbs of Hartford. A joint venture owner sold the assets to a regional buyer for an undisclosed price, with both parties requesting anonymity. The new ownership plans to focus on operational efficiencies, including staffing, and to invest in capital projects at the facilities.

Connecticut

BRISTOL, CONN. — Newmark has arranged the $79.2 million sale of Bristol Logistics Center, a 1.1 million-square-foot industrial property in Connecticut. The rail-served site spans 179 acres and formerly housed a General Motors manufacturing plant. Treetop Development acquired the property from an entity doing business as Bristol Center LLC. Jeff Fishman, Cory Gubner and Alex Haendler of Newmark brokered the deal. At the time of sale, Bristol Logistics Center was 93 percent leased to three tenants: Firestone, Clark Dietrich and Arett Sales.

GREENWICH, CONN. — A subsidiary of Chicago-based investment and advisory firm Bradford Allen has acquired a portfolio of two office buildings totaling 90,268 square feet in Greenwich, located in the southern coastal part of Connecticut. Jeffrey Dunne, Steven Bardsley and Travis Langer of CBRE represented the seller, a joint venture between international investment firm Global Gate Capital and Dallas-based Lincoln Property Co., in the transaction. The portfolio was 100 percent leased at the time of sale.

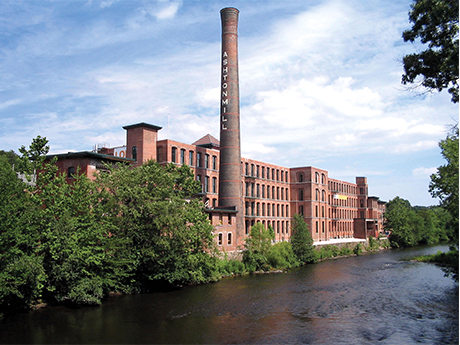

NEW HAVEN AND STRATFORD, CONN. — Illinois-based investment firm B3 Holdings LLC has acquired three multifamily properties in Connecticut and Rhode Island totaling 481 units units for $117 million. Winchester Lofts is a 158-unit complex in New Haven, and the second property is a 128-unit asset in Stratford, both of which are located in the southern coastal part of Connecticut. The third asset is River Lofts at Ashton Mills, a 195-unit community in Cumberland, R.I. Victor Nolletti, Eric Pentore and Wes Klockner of Institutional Property Advisors (IPA), a division of Marcus & Millichap, represented the seller, Brookfield Asset Management, in the transaction. The trio also procured B3 Holdings as the buyer.

WILTON, CONN. — CBRE has brokered the sale of a 161,222-square-foot office building in Wilton, located in Fairfield County. The property, which is located within a larger, four-building office park, was 42 percent leased at the time of sale. Amenities include a fitness center, basketball and tennis courts, café and a conference center. Jeffrey Dunne, Steven Bardsley and Travis Langer of CBRE represented the seller, an entity doing business as Wilton 40/60 LLC, in the transaction. The team also procured the buyer, an entity managed by Northpath Investments, which acquired the asset for an undisclosed price.

GLASTONBURY, CONN. — Poag Shopping Centers has acquired The Shops at Somerset Square, a 113,422-square-foot retail center in Glastonbury, roughly 10 miles southeast of Hartford. The Tennessee-based investment firm has partnered with JLL to lease and manage the open-air center, which houses tenants such as Chipotle Mexican Grill, AT&T, Edward Jones, Francesca’s and Jos. A Bank. The seller and sales price were not disclosed.

ENFIELD, CONN. — Colliers has negotiated the $15.2 million sale of a 235,000-square-foot distribution center in Enfield, a northern suburb of Hartford. The property sits on a 19-acre site near I-91 and was fully leased at the time of sale. Nicholas Morizio of Colliers represented the seller, an entity doing business as Enfield Distribution Center LLC, and the buyer, Massachusetts-based AIS Development, in the transaction.

SUFFIELD, CONN. — Locally based brokerage firm Chozick Realty has negotiated the $13 million sale of Suffield West, an 84-unit multifamily property located in Hartford County. The property was built on 10 acres in 1968. Tess Cullen and Jordan Pinto of Chozick Realty represented the seller, an entity doing business as Suffield West Apartments LLC, in the transaction, and procured the undisclosed buyer.

MANCHESTER, CONN. — Colliers has brokered the sale-leaseback of a 21,940-square-foot office building located at 160 Chapel Road in Manchester, an eastern suburb of Hartford. The property traded for $1.4 million. Bob Pagani and Christian Dietz of Colliers represented the seller, MMNT Certified Public Accountants, in the transaction. Nick Morizio of Colliers represented the buyer, private investor Dan Sullivan.

GREENWICH, CONN. — An affiliate of Hawaii-based Trinity Real Estate Investments has acquired the Hyatt Regency Greenwich, a 373-room hotel in southern coastal Connecticut. The building served as a printing press for Condé Nast from 1921 to 1967 before being redeveloped into a hotel. Today, the Hyatt Regency Greenwich features an indoor pool, fitness center, salon and 35,000 square feet of meeting and event space. The new ownership plans to implement a value-add program. The seller was not disclosed. Hodges Ward Elliott brokered the transaction.