WILMINGTON, DEL. — New Jersey-based investment firm First National Realty Partners has acquired Christina Crossing, a 119,446-square-foot shopping center in Wilmington. A 70,000-square-foot ShopRite grocery store anchors the property, which was originally constructed in the late 2000s. Christopher Munley, Jim Galbally, Chris Angelone, Colin Behr, James Graf, Zach Nitsche, Patrick Higgins and Blaise Fletcher of JLL represented the seller, a partnership between DRA Advisors and KPR Centers, in the transaction. The sales price was not disclosed.

Delaware

WILMINGTON AND NEWARK, DEL. —Life Care Services (LCS) has completed renovations at three seniors housing communities in Delaware: Foulk Living and Shipley Living in Wilmington and Millcroft Living in Newark. Renovations at Foulk Living included upgrades to the lobby, corridors, fitness center and dining room. In addition, Foulk Living’s independent living cottages are being updated as they become available with new kitchen cabinets, countertops, appliances, flooring, paint, blinds and carpeting. Shipley Living received a new roof, updated exterior, porte-cochère and grand entrance. Inside, the lobby, corridors, communal living room, dining room, bistro and bar were all updated. Millcroft Living’s entrance received a new concierge desk and lobby, as well as a new bar/lounge space, renovated dining room and card room and beautified corridors.

CLAYMONT, DEL. — Georgia-based owner-operator Agile Cold Storage will open a 275,000-square-foot facility in Claymont, Del., about 25 miles southwest of Philadelphia. The site is located within First State Crossing, an industrial park that is a redevelopment of a former steel mill. Agile Cold Claymont is expected to create 130 new jobs and involve capital investment of more than $170 million over the next five years.

CLAYMONT, DEL. — JLL has arranged a $56.3 million construction loan for Tri-State Industrial, a 525,000-square-foot project that will be located about 25 miles outside of Philadelphia in Claymont, Delaware. The property will feature 40-foot clear heights, an ESFR sprinkler system, 130-foot truck court depths, four drive-in ramps with overhead doors and ample trailer and car parking. Chris Drew, Mike Pagniucci and Michael DiCosimo of JLL arranged the loan through Principal Asset Management on behalf of the borrower, a partnership between New York City-based KPR Centers and Los Angeles-based PCCP LLC.

WILMINGTON, DEL. — Pennsylvania-based developer MRA Group has received $63 million for the redevelopment of Chestnut Run Innovation & Science Park, a 164-acre, 14-building development in Wilmington. MRA Group will use the funds to continue renovations of the campus’ 14 buildings to support lab, R&D and advanced manufacturing uses. Additional plans for the campus include a hotel, fitness center, conference facilities, an outdoor amphitheater and accommodations for food services. Fulton Bank, in conjunction with Nuveen Green Capital through C-PACE, financed $50 million of the funds, while WSFS Bank provided the remaining $13 million.

NEWPORT, DEL. — Agilent Technologies, a provider of lab instruments and software, will undertake a $22 million expansion of its manufacturing facility in Newport, located just outside of Wilmington. Agilent is leasing 12,000 square feet of new space in a building that is adjacent to the existing facility and fitting out 9,900 square feet as lab space with new infrastructure, equipment and instrumentation. Over half of the remaining square footage will become a warehouse, storage and shipping/receiving area. The remaining balance will be used for offices. Agilent currently employs more than 100 people at its Newport facility and more than 900 throughout Delaware.

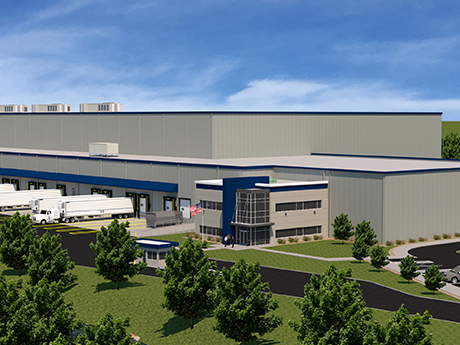

CLAYMONT, DEL. — Chicago-based REIT First Industrial Realty Trust (NYSE: FR) is underway on construction of a 358,000-square-foot facility in the greater Philadelphia area. The site is located within the 425-acre First State Crossing mixed-use development. The rear-load facility will offer a clear height of 40 feet, 68 dock positions and 241 trailer parking stalls. Completion is slated for October. Blue Rock is the general contractor for the project, and Joseph V. Belluccia is the architect. CBRE is the leasing agent. Delivery is slated for the first quarter of next year.

NEW CASTLE, DEL. — Colliers has brokered the sale of a 100,000-square-foot industrial building in New Castle, located south of Wilmington in Delaware. The building sits on 6.6 acres and offers 80 car parking spaces, 30 trailer parking spaces, one drive-in door and 5,000 square feet of office space. Charles Brown and Carl Neilson of Colliers represented the seller and procured the buyer, both of which were limited liability companies that requested anonymity, in the transaction.

BRIDGEVILLE, DEL. — New York City-based Dwight Capital has provided a $38.3 million HUD-insured construction loan for Villas at Bridgeville, a 152-unit multifamily project in Delaware. The project will consist of 34 townhome and duplex buildings and one amenity building on a 23-acre site. Units will have private patios/balconies and two-car garages, and amenities will include a pool, fitness center, playground and walking trails. Daniel Malka and Jacob Gauptman of Dwight Capital originated the financing on behalf of the borrower, Allen & Rocks Inc. A construction timeline was not disclosed.

MIDDLETOWN, DEL. — Regional grocer Weis Markets will open a 64,000-square-foot store and serve as the anchor tenant at Bayberry Town Center, a 280,000-square-foot development in Middletown. The site is located within the 1,500-acre Village of Bayberry master-planned community and will also house 31,000 square feet of office space and multiple open green spaces, as well as 145 townhomes. Construction is slated to begin this fall and to be complete by 2025. Blenheim Group is the master developer of Village of Bayberry.