BRUNSWICK, MAINE — Jones Street Investment Partners, a private equity real estate firm, has broken ground on a 64-unit multifamily project in Brunswick, a northern suburb of Portland. The project, which will be situated on a 3.5-acre site, represents the second phase of Atlantic Pointe, the first phase of which comprised 181 units. Phase II will feature four buildings that will house one- and two-bedroom residences. Amenities at Atlantic Pointe include a fitness center, business center, dog park and package lockers. Delivery of Phase II is scheduled for summer 2025.

Maine

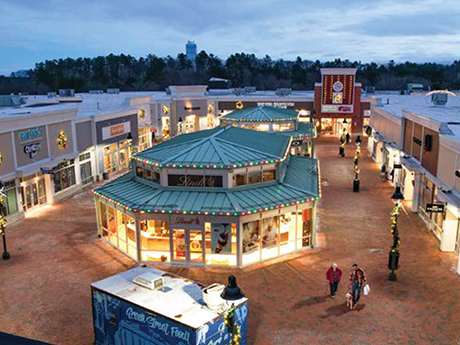

FREEPORT, MAINE — Boston-based retail owner-operator Wilder Cos. has acquired Freeport Village Station, a 122,121-square-foot shopping center located near Portland, Maine. The center is situated across from L.L. Bean’s flagship campus, and the outdoor equipment and apparel retailer’s outlet store anchors the 3.6-acre property. Other tenants include Brooks Brothers, Old Navy, Coach, Famous Footwear, Lindt, Oakley, OshKosh B’gosh and Carter’s, Sunglasses Hut, Talbots, Sketchers and Francesca’s. The seller and sales price were not disclosed.

CHELSEA, MAINE — Marcus & Millichap has brokered the sale of a portfolio of three self-storage facilities totaling 296 units in Chelsea, located just south of Augusta. The properties total 45,690 net rentable square feet of space. Luke Dawley, Nathan Coe, Brett Hatcher and Gabriel Coe of Marcus & Millichap represented the seller, an individual/personal trust, in the transaction. The buyer and sales price were not disclosed. Jim Koury of Marcus & Millichap assisted in closing the deal as the broker of record.

PORTLAND, MAINE — Locally based investment firm The Ram Cos. has acquired a 64,000-square-foot industrial property in Portland, located in the southeastern part of Maine. The complex comprises three buildings with clear heights of 18 feet that were fully leased to nine tenants at the time of sale. RAM Cos. plans to upgrade the signage, landscaping and parking lots and rebrand the property as Portland Commerce Center. The seller and sales price were not disclosed.

OGUNQUIT, MAINE — Regional hospitality owner-operator Giri Hotels has acquired Anchorage by the Sea, a 249-room waterfront resort in Ogunquit, located in southern coastal Maine. The property offers amenities such as indoor and outdoor pools, reception and meeting rooms, outdoor lounges and gathering spaces and an onsite restaurant and bar. Wason Associates Hospitality Real Estate represented the undisclosed seller in the transaction.

MAINE — Dallas-based investment firm MAG Capital Partners has acquired a 60,000-square-foot cold storage facility that is located in an undisclosed community in southern coastal Maine. MAG Capital Partners acquired the property, which primarily functions as a seafood processing facility, via a sale-leaseback in an off-market deal. Additional terms of the transaction were not disclosed.

SOUTHPORT, MAINE — The Wardman Group, a Baltimore-based boutique investment firm, has sold Ocean Gate Resort, a 65-room hotel in Southport, located in the southern coastal part of Maine. Guestrooms offer private balconies, and the amenity package consists of a pool, tennis and basketball courts, a minigolf course, fire pits and canoe/kayak rentals. Alan Suzuki, Matthew Enright, Emily Zhang and Brooks Murphy of JLL represented Wardman Group, which sold the property as part of a larger portfolio deal, in the transaction.

BRUNSWICK, MAINE — Private equity real estate firm Jones Street Investment Partners has received a $36 million construction loan for a 181-unit multifamily project in Brunswick, located in the southern coastal part of Maine. The site is located in a Qualified Opportunity Zone within Brunswick Landing, which is a commercial and industrial redevelopment of a former naval base. Bangor Savings Bank provided the loan. Completion is slated for late 2024.

KITTERY, MAINE — Private equity real estate firm Jones Street Investment Partners has received a $70 million construction loan for the development of Seacoast Residences, a 282-unit multifamily project in Kittery, located in the southern coastal part of Maine. The five-building community will offer amenities such as a pool, fitness center, dog park and nature trails. KeyBank provided the loan, and Colliers arranged a $7.9 million preferred equity investment with an undisclosed partner. Construction is slated for an early 2024 completion.

ROCKLAND, MAINE — Metro Boston-based brokerage firm Horvath & Tremblay has negotiated the $13.5 million sale of Harbor Plaza, a 169,079-square-foot shopping center in Rockland, located roughly midway between Portland and Bangor. Anchored by grocer Shaw’s, the center was roughly 93 percent leased at the time of sale to tenants such as T.J. Maxx, HomeGoods, Staples, Olympia Sports, H&R Block and The UPS Store. Bob Horvath and Todd Tremblay of Horvath & Tremblay represented the buyer and seller, both of which requested anonymity, in the deal.