FRAMINGHAM, MASS. — JLL has arranged $123.6 million in financing for a portion of Shoppers World, a 752,000-square-foot retail power center located in the western Boston suburb of Framingham. Details on the nature of the financing and the portion of the center covered by it were not disclosed. Shoppers World was 99 percent leased at the time of the loan closing to tenants such as T.J. Maxx, Marshalls, HomeSense, Sierra Trading Post, Best Buy and Dick’s Sporting Goods. Scott Aiese, Alex Staikos, Amy Lousararian and Parker Morrison of JLL arranged the four-year, fixed-rate loan on behalf of the borrower, Urban Edge Properties. The direct lender was not disclosed.

Massachusetts

WATERTOWN, MASS. — JLL has arranged the $119.2 million refinancing of 500 Forge, a 158,683-square-foot life sciences property in Watertown, located just west of Boston. The financing consists of a $94 million senior loan from Landesbank Baden-Württemberg and a $25.2 million mezzanine loan from Tishman Speyer. The property, which is located within the Arsenal Yards mixed-use development, was fully redeveloped in 2023 to feature 60 percent lab/research-and-development space and 40 percent office space. The property was fully leased at the time of the loan closings to three tenants: Mariana Oncology, Orna Therapeutics and AvenCell Therapeutics. Brett Paulsrud, Henry Schaffer and Geoff Goldstein of JLL arranged the financing on behalf of the borrower, a partnership between Boylston Properties and institutional investors advised by J.P. Morgan Asset Management.

NORTH ANDOVER, MASS. — A public-private partnership between Greystar and Merrimack College has topped off two student housing projects totaling 540 beds on the university’s campus in North Andover, a northern suburb of Boston. The first building will house 351 beds across 180 units, all of which will be traditional dormitory doubles except for the resident advisor units. The second building will house 189 beds across 54 units, the majority of which will feature three- and four-bedroom suite configurations. The properties will also feature a combined total of 12,609 square feet of academic space, a pavilion for honors students and a fitness center. Timelines for completion of the projects were not disclosed.

BOSTON — A joint venture led by locally based REIT Diversified Healthcare Trust (NASDAQ: DHC) has received $1 billion for the refinancing of the Vertex Pharmaceuticals headquarters facility in Boston. A consortium of lenders — Morgan Stanley Bank, Bank of Montreal, Goldman Sachs and J.P. Morgan — provided the financing, which was structured with a five-year term and a fixed interest rate. Local investment firm RMR Group, which provides asset and property management services for the joint venture, arranged the debt. The majority of the proceeds will be used to retire $620 million in fixed-rate debt on the property, as well as to fund leasing reserves and repatriate cash to investors. Located at 50 Northern Ave. and 11 Fan Pier Blvd. in Boston’s Seaport District, the two-building facility spans approximately 1.1 million square feet. Both buildings were constructed in 2013. Vertex, which produces medicines and therapies for genetic disorders including cystic fibrosis, renewed its lease in August 2024 and will remain the property’s sole occupant through 2044. The joint venture ownership group includes multiple institutional investment groups that were not named in the announcement. Diversified Healthcare’s stake in the property is 10 percent; the company previously sold a 10 percent …

You can be a best-in-class operator with the coolest concept on the block, or you can be a well-capitalized landlord who knows all the right people, but if rapid, sustainable growth in the Boston retail market is what you seek, you might be SOL. According to local brokers, the high-demand, low-supply dynamic that currently exists in most major U.S. retail markets does not fully encapsulate the difficulties that tenants and landlords alike face in growing their footprints in the greater Boston area. As to why growing store counts or portfolios is so challenging in this market, the answer varies depending on who you ask. But a collective recap of all wide-ranging barriers to entry and disruptive forces at play paints a picture of a market that is borderline impenetrable for many tenants and perpetually stagnating for many landlords. “Boston remains an incredibly high-barrier-to-entry market,” says Zach Nitsche, director of retail capital markets in JLL’s Boston office. “A statistic we like to share with clients and industry people that haven’t historically invested in Boston and New England is that less than 5 percent of our total retail product has been constructed after the Global Financial Crisis. So far this year, the …

WALTHAM, MASS. — Brandeis University is underway on construction of a five-story, 631-bed residence hall project on the university’s campus in Waltham, located west of Boston. The development team for the project includes William Rawn Associates and Dimeo Construction. MassDevelopment issued a $134.6 million tax-exempt bond for the development, alongside other miscellaneous projects on the university’s campus. The bond was sold through a public offering underwritten by Barclays Capital Inc. Completion is slated for spring 2027.

CAMBRIDGE, MASS. — Terrain Biosciences will open a new, 14,000-square-foot headquarters facility in Cambridge, located across the Charles River from Boston. The RNA therapeutics company will relocate from the nearby building at 400 Technology Way to Genesis 640 Memorial Drive, a 248,000-square-foot office and lab facility. CBRE represented the landlord, Phase 3 Real Estate Partners, in the lease negotiations. Colliers represented Terrain Bio. A timeline for occupancy was not announced.

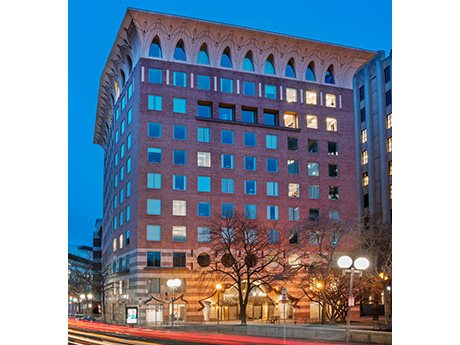

BOSTON — Newmark has brokered the $28 million sale of One Bowdoin Square, a 141,831-square-foot office building in downtown Boston. The 11-story building is home to a mix of medical and government tenants, including affiliates of Mass General Brigham and the Commonwealth of Massachusetts. Robert Griffin, Edward Maher, Matthew Pullen, James Tribble, Samantha Hallowell and William Sleeper of Newmark represented the undisclosed seller in the transaction. The team also procured the buyer, a partnership between Live Oak Real Estate Investments and Tritower Financial Group. David Douvadjian Sr., Timothy O’Donnell, David Douvadjian Jr., Bobby Alvarado and Conor Reenstierna, also with Newmark, arranged acquisition financing for the deal through Bank of New England.

MANSFIELD, MASS. — Chicago-based investment firm Logistics Property Co. has purchased an industrial building located at 572 West St. in Mansfield, a southern suburb of Boston, that according to LoopNet Inc. totals 35,000 square feet. The building, which was built in 2004, per LoopNet, is located within Cabot Business Park and was fully leased at the time of sale. Tony Coskren of Newmark brokered the deal. The seller and sales price were not disclosed.

DARTMOUTH, MASS. — Pennsylvania Real Estate Investment Trust (PREIT) has welcomed five new tenants to Dartmouth Mall, a 671,000-square-foot regional shopping and dining destination in southeast Massachusetts. Boot Barn will open a 15,000-square-foot store this fall for its first location in the area. Locker Room by Lids expects to open at the end of the month, while Chick-fil-A is planning an outparcel restaurant at the property. Cinnabon and Carvel have already opened. These additions follow the redevelopment of the former Sears space, which is now occupied by Ulta Beauty, Burlington and Aldi.