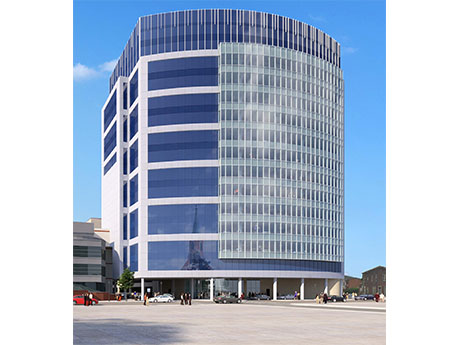

BASKING RIDGE, N.J. — Locally based investment and development firm Edgewood Properties has purchased Westgate, a 250,000-square-foot office building in the Northern New Jersey community of Basking Ridge. The building was constructed in 1991 to house the headquarters of Everest Reinsurance Co. That company relocated to Warren Corporate Center in summer 2019. Amenities include a full-service cafeteria, fitness center, outdoor terrace and landscaped gathering spaces and a conference room. Jose Cruz, Kevin O’Hearn, Sean Ryan, Steve Simonelli, Michael Oliver and Grace Braverman of JLL represented the undisclosed seller in the transaction.

New Jersey

BASKING RIDGE, N.J. — Locally based investment and development firm Edgewood Properties has purchased Westgate, a 250,000-square-foot office building in the Northern New Jersey community of Basking Ridge. The vacant building was constructed in 1991 to house the headquarters of Everest Reinsurance Co. That company relocated to Warren Corporate Center in summer 2019. Amenities include a full-service cafeteria, fitness center, outdoor terrace and landscaped gathering spaces and a conference room. Jose Cruz, Kevin O’Hearn, Sean Ryan, Steve Simonelli, Michael Oliver and Grace Braverman of JLL represented the undisclosed seller in the transaction.

BORDENTOWN, N.J. — Penwood Real Estate has acquired a 275,631-square-foot warehouse in Bordentown, a suburb of Trenton, for $60 million. Building features include a clear height of 24 feet, 16 tailgate doors, 9,108 square feet office space and parking for 80 cars and 120 trailers. In addition, the 39-acre site at 201 Elizabeth St. features four acres of outdoor storage space and can support an additional 140,767 square feet of new construction. Steven Schultz, Steve Tolkach, Kyle Eaton and Tony Georgiev of Newmark represented the seller, O’Donnell Group, in the transaction.

BORDENTOWN, N.J. — Penwood Real Estate has acquired a 275,631-square-foot warehouse in Bordentown, a suburb of Trenton, for $60 million. Building features include a clear height of 24 feet, 16 tailgate doors, 9,108 square feet office space and parking for 80 cars and 120 trailers. In addition, the 39-acre site at 201 Elizabeth St. features four acres of outdoor storage space and can support an additional 140,767 square feet of new construction. Steven Schultz, Steve Tolkach, Kyle Eaton and Tony Georgiev of Newmark represented the seller, O’Donnell Group, in the transaction.

HOBOKEN, N.J. — Locally based brokerage firm The Kislak Co. Inc. has negotiated the sale of a portfolio of three contiguous multifamily properties totaling 21 units in the Northern New Jersey community of Hoboken. Two of the buildings were recently renovated, and the third has value-add potential. Robert Squires and Scott Davidovic of Kislak represented the seller, Skylight Real Estate Partners, in the transaction. The duo also procured the buyer, an entity doing business as 510 Observer LLC.

HOBOKEN, N.J. — Locally based brokerage firm The Kislak Co. Inc. has negotiated the sale of a portfolio of three contiguous multifamily properties totaling 21 units in the Northern New Jersey community of Hoboken. Two of the buildings were recently renovated, and the third has value-add potential. Robert Squires and Scott Davidovic of Kislak represented the seller, Skylight Real Estate Partners, in the transaction. The duo also procured the buyer, an entity doing business as 510 Observer LLC.

PATERSON, N.J. — New York-based investment firm Timberline Real Estate Ventures has purchased a 66,000-square-foot light industrial building in the Northern New Jersey community of Paterson. At the time of sale, the property, which includes nearly a full acre of outdoor storage space, was fully leased to building materials provider Kamco Supply. Michael Klein, Alex Staikos and Michael Lachs of JLL arranged an undisclosed amount of nonrecourse, fixed-rate acquisition financing for the deal through Blue Foundry Bank. The seller was not disclosed.

PARSIPPANY, N.J. — Siemens Corp. has signed a 43,138-square-foot office lease in the Northern New Jersey community of Parsippany. The German conglomerate and industrial manufacturer will occupy space at Two Gatehall Plaza, a 389,298-square-foot building that was originally constructed in 1985 and recently renovated. Jeff Schotz, Kevin Murphy, Sumner Putnam and Peter Kasparian of Newmark represented the landlord, New York-based Silverman Realty Group Inc., in the lease negotiations. Jeff Babikian and Conor Dolan of CBRE represented the tenant.

SOMERSET AND WARREN, N.J. — Newmark has negotiated the approximately $100 million sale of a portfolio of light industrial properties totaling 650,000 square feet in Northern New Jersey. An institutional investor acquired 50 & 100 Randolph Road, two assets in Somerset totaling 236,000 square feet that were 91 percent leased at the time of sale. The buyer(s) of the other four properties in Warren were not disclosed. Kevin Welsh, Brian Schulz, Maria Betancourt, Steven Schultz, Dan Reider, Kyle Eaton and Chris Koeck of Newmark represented the seller, a joint venture between Ivy Realty and Waterfall Asset Management, in the deal.

NEW BRUNSWICK, N.J. — New Jersey-based developer AST has topped out a 229,000-square-foot healthcare project in the Central New Jersey community of New Brunswick. The 15-story ambulatory medical pavilion is situated within the Robert Wood Johnson University Hospital campus. Upon completion, which is scheduled for the second quarter of 2023, the facility’s outpatient access to care and clinical experts supporting existing RWJBarnabas Health hospital services will be expanded.