BRIDGEWATER, N.J. — Colliers has negotiated the sale of CenterPointe I, a 66,500-square-foot vacant office building in the Northern New Jersey community of Bridgewater. Allstate Insurance previously occupied the building, which according to LoopNet Inc. is part of a larger campus known as CenterPointe at Bridgewater. Jacklene Chesler, Patrick Norris and Brittany Leventoff of Colliers represented the seller, Signature Acquisitions, in the transaction. The buyer was an undisclosed nonprofit organization.

New Jersey

TRENTON AND EWING, N.J. — General contractor and construction management firm Torcon Inc. has completed the Paul Robeson Charter School, a $35 million academic project in Central New Jersey. The site is a formerly vacant lot that lies at the nexus of the communities of Trenton and Ewing. The school, which spans 55,000 square feet and can support about 750 students in kindergarten through eighth grade, features 38 classrooms, science labs, elective spaces, administrative offices and academic support areas. Project partners included Atkin Olshin Schade Architects Inc., Aegis Property Group, Bala Consulting Engineers and structural engineer O’Donnell & Naccarato.

BRICK, N.J. — Marcus & Millichap has brokered the $7.2 million sale of Yorketown Plaza, a 41,219-square-foot shopping center in Brick, located near the Jersey Shore. The center sits on 5.8 acres and is home to tenants such as Domino’s, Mariner Finance, Crown Fried Chicken, Nova Games and Community Medical Center. Brent Hyldahl, Alan Cafiero and Seth Goldberg of Marcus & Millichap represented the seller, Ocean County Equities LLC, in the transaction. The buyer was not disclosed.

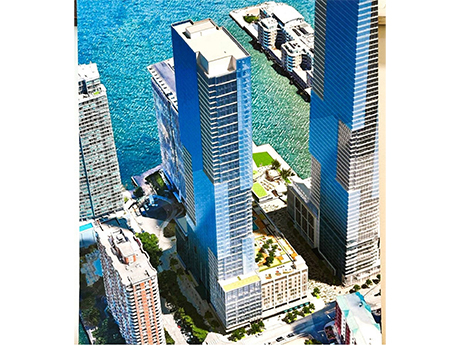

JERSEY CITY — Locally based investment and development firm GN Management has acquired a multifamily development site in Jersey City with plans to construct a 57-story tower. The waterfront site is known as Harborside 9 and is approved for the development of 579 units, as well as 14,800 square feet of retail space and a 555-space parking garage. Fifteen percent (87 residences) will be set aside as affordable housing. Information on floor plans and amenities was not disclosed. Jim Pompa of Coldwell Banker brokered the sale of the site from Panepinto Properties, which recently closed on financing for a 678-unit multifamily project at Harborside, to GN Management. Construction is targeted for a 2027 commencement.

JERSEY CITY, N.J. — JLL has arranged $384 million in financing for the land purchase and vertical construction of Harborside 8, a 678-unit multifamily project in Jersey City. The borrower is a partnership between Panepinto Properties and AJD Construction. The financing consists of a $306 million, floating-rate senior loan from Kennedy Wilson and a $78 million preferred equity investment from Affinius Capital. Harborside 8 will be a 65-story waterfront building with studio, one-, two- and three-bedroom apartments. Amenities will include a fitness center, indoor pool, golf simulator, rooftop terraces, coworking rooms and a wine bar. Thomas Didio, Thomas Didio Jr., Ryan Robertson, Gerard Quinn and John Cumming led the transaction for JLL. Construction is scheduled to begin early next year, with stabilization targeted for early 2030.

MAHWAH AND FAIRFIELD, N.J. — Cushman & Wakefield has brokered the sale of a portfolio of two industrial buildings totaling 123,821 square feet in Northern New Jersey. The first building is a 67,170-square-foot structure in Mahwah that was fully leased at the time of sale to Beacon Roofing Supply. The second building is a 56,651-square-foot facility in Fairfield that houses the headquarters of Precision Textiles. Gary Gabriel, Kyle Schmidt, Ryan Larkin and Seth Zuidema of Cushman & Wakefield represented the seller, Alexander Properties Group, in the transaction. The buyer was Faropoint.

BLOOMFIELD, N.J. — Local brokerage firm The Kislak Co. Inc. has negotiated the $11 million sale of Franklin Towers, a 63-unit apartment complex located in the Northern New Jersey community of Bloomfield. The six-story historic building was originally constructed in 1928 and offers 56 one-bedroom units, five two-bedroom apartments and two three-bedroom residences. Robert Holland and Tom Scatuorchio of Kislak represented the seller and procured the buyer, both of which were limited liability companies, in the transaction.

WASHINGTON, N.J. — Marcus & Millichap has brokered the $7.3 million sale of the Apple Montessori School in Washington, about 60 miles west of New York City. The newly constructed, 10,000-square-foot school features an outdoor pool, approximately 5,000 square feet of dedicated playground space and a covered drop-off area. Alan Cafiero, David Cafiero and John Moroz of Marcus & Millichap represented the seller and procured the buyer, both of which requested anonymity, in the transaction.

EWING, N.J. — JLL has brokered the sale of 100 and 200 Princeton South Corporate Center, a pair of office buildings totaling 267,830 square feet in Ewing, located just outside of Trenton. The four-story buildings were completed between 2007-2008 as part of a larger, six-building campus and were 52 percent leased at the time of sale to tenants in industries such as finance, insurance, accounting, pharmaceutical and healthcare. Jose Cruz, Jeremy Neuer, Michael Kavaler and Tom Romano of JLL represented the undisclosed, institutional seller in the transaction. The buyer was Hilton Realty Co.

PISCATAWAY, N.J. — PPM America Inc. has provided a $27.1 million bridge loan for a 147,210-square-foot warehouse in the Northern New Jersey community of Piscataway. The borrower is Bridge Industrial, and the facility is known as Bridge Point Piscataway. Situated on a 12.8-acre site at 10 Constitution Road, the building features a clear height of 36 feet, 41 dock-high doors, two drive-in doors, 3,000 square feet of office space and parking for 118 cars and 57 trailers. Michael Klein, Jon Mikula and Kevin Badger of JLL arranged the loan.