CLIFTON, N.J. — Cushman & Wakefield has brokered the sale ofthe 97,145-square-foot Route 3 Industrial Park in the Northern New Jersey community of Clifton. The property consists of two shallow bay buildings on a 4.5-acre site that were fully leased at the time of sale. Gary Gabriel, Kyle Schmidt, Ryan Larkin and Seth Zuidema of Cushman & Wakefield represented the seller, Longpoint Partners, in the transaction. The buyer was The Silverman Group.

New Jersey

MORRISTOWN, N.J. — JLL has arranged a $176 million loan for the refinancing of a portfolio of six industrial properties totaling approximately 1.2 million square feet. Four of the properties are located in the Northern New Jersey communities of Carlstadt, Lyndhurst, Carteret and North Brunswick and feature clear heights of 16 to 25 feet. The other two properties are located in South Florida. Jim Cadranell, Gregory Nalbandian, Michael Lachs and Kevin Badger of JLL arranged the eight-year, fixed-rate loan through insurance giant Nationwide on behalf of the borrower, Seagis Property Group. The portfolio was 96 percent leased at the time of the loan closing.

RUTHERFORD, N.J. — Marcus & Millichap has brokered the $7.3 million sale of a 21,897-square-foot retail strip center in the Northern New Jersey community of Rutherford. The property at 308–314 Union Ave. was originally built in 1925 and most recently renovated in 2019. Tenants include Dunkin’, Kiddie Academy, Three Star News Stand, Next Big Coder, Master Park’s and Laundry Guy’s. Alan Cafiero, David Cafiero and John Moroz of Marcus & Millichap represented the seller and procured the buyer, both of which requested anonymity, in the transaction.

PENNINGTON, N.J. — Locally based brokerage firm The Kislak Co. Inc. has negotiated the $3.3 million sale of a 30,375-square-foot industrial facility in Pennington, located just north of Trenton. The multi-building facility is known as Hopewell Valley Industrial Park and was originally built on 8.2 acres in 1988. Daniel Lanni of Kislak represented the seller and procured the buyer, both of which requested anonymity, in the transaction.

UNION, N.J. — Brookfield Properties has completed a 151,676-square-foot industrial project in the Northern New Jersey community of Union. Known as Union Distribution Center, the development features a clear height of 36 feet, 28 dock doors, two drive-in doors, 4,000 square feet of office space and parking for 16 trailers and 123 cars. PREMIER Design + Build Group handled both the architectural and general contracting aspects of the project.

BRIDGEWATER, N.J. — Colliers has negotiated the sale of CenterPointe I, a 66,500-square-foot vacant office building in the Northern New Jersey community of Bridgewater. Allstate Insurance previously occupied the building, which according to LoopNet Inc. is part of a larger campus known as CenterPointe at Bridgewater. Jacklene Chesler, Patrick Norris and Brittany Leventoff of Colliers represented the seller, Signature Acquisitions, in the transaction. The buyer was an undisclosed nonprofit organization.

TRENTON AND EWING, N.J. — General contractor and construction management firm Torcon Inc. has completed the Paul Robeson Charter School, a $35 million academic project in Central New Jersey. The site is a formerly vacant lot that lies at the nexus of the communities of Trenton and Ewing. The school, which spans 55,000 square feet and can support about 750 students in kindergarten through eighth grade, features 38 classrooms, science labs, elective spaces, administrative offices and academic support areas. Project partners included Atkin Olshin Schade Architects Inc., Aegis Property Group, Bala Consulting Engineers and structural engineer O’Donnell & Naccarato.

BRICK, N.J. — Marcus & Millichap has brokered the $7.2 million sale of Yorketown Plaza, a 41,219-square-foot shopping center in Brick, located near the Jersey Shore. The center sits on 5.8 acres and is home to tenants such as Domino’s, Mariner Finance, Crown Fried Chicken, Nova Games and Community Medical Center. Brent Hyldahl, Alan Cafiero and Seth Goldberg of Marcus & Millichap represented the seller, Ocean County Equities LLC, in the transaction. The buyer was not disclosed.

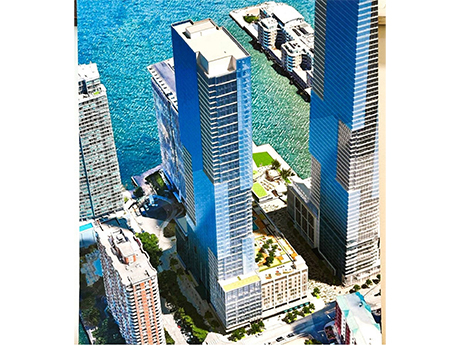

JERSEY CITY — Locally based investment and development firm GN Management has acquired a multifamily development site in Jersey City with plans to construct a 57-story tower. The waterfront site is known as Harborside 9 and is approved for the development of 579 units, as well as 14,800 square feet of retail space and a 555-space parking garage. Fifteen percent (87 residences) will be set aside as affordable housing. Information on floor plans and amenities was not disclosed. Jim Pompa of Coldwell Banker brokered the sale of the site from Panepinto Properties, which recently closed on financing for a 678-unit multifamily project at Harborside, to GN Management. Construction is targeted for a 2027 commencement.

JERSEY CITY, N.J. — JLL has arranged $384 million in financing for the land purchase and vertical construction of Harborside 8, a 678-unit multifamily project in Jersey City. The borrower is a partnership between Panepinto Properties and AJD Construction. The financing consists of a $306 million, floating-rate senior loan from Kennedy Wilson and a $78 million preferred equity investment from Affinius Capital. Harborside 8 will be a 65-story waterfront building with studio, one-, two- and three-bedroom apartments. Amenities will include a fitness center, indoor pool, golf simulator, rooftop terraces, coworking rooms and a wine bar. Thomas Didio, Thomas Didio Jr., Ryan Robertson, Gerard Quinn and John Cumming led the transaction for JLL. Construction is scheduled to begin early next year, with stabilization targeted for early 2030.