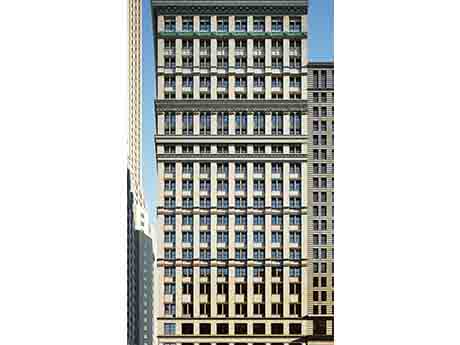

NEW YORK CITY — GFP Real Estate has received $191.5 million in financing for the office-to-residential conversion of 40 Exchange Place, a historic 300,000-square-foot building in Lower Manhattan’s Financial District. Upon completion, the 20-story converted building will include 382 affordable and market-rate apartments, as well as ground-floor retail space. In addition to the loan, the project will be backed by federal and state historic rehabilitation tax credits as well as a 35-year 457-m tax abatement, a New York City incentive designed to support office-to-residential conversions. Jordan Roeschlaub, Chris Kramer and Tim Polglase of Newmark arranged the financing through Derby Lane. A construction timeline was not announced.

New York

COPIAGUE, N.Y. — A partnership between Atlanta-based developer The Ardent Cos. and Ironwood Development Partners has completed a 950-unit self-storage facility in Copiague, located on Long Island. Extra Space Storage will operate the facility, which spans 108,201 square feet, though it is unclear if that figure refers to gross or net rentable square footage. Park East Construction served as the general contractor for the project. Michael Sudano Architect PC designed the facility, and R&M Engineering acted as the civil engineer. A formal opening took place in mid-December.

HEMPSTEAD, N.Y. — Marcus & Millichap has negotiated the sale of Jackson Terrace Apartments, a 420-unit affordable housing complex located in the Long Island community of Hempstead. The six-story building was originally constructed in 1972. Michael Tuccillo of Marcus & Millichap represented the buyer, an affiliate of Hudson Valley Property Group, in the transaction. The seller was self-represented. The new ownership plans to invest about $23 million to upgrade unit interiors, building exteriors and mechanical/utility systems as a means of preserving long-term affordability.

NEW YORK CITY — Resolution Real Estate, a member of NAI Global, has arranged the $9.4 million sale of an 18,500-square-foot office and retail building in Midtown Manhattan. The seven-story building at 5 E. 47th St. was completed in 1920 and was vacant at the time of sale. Jonata Dayan and Jeffrey Zund of Resolution Real Estate represented the buyer, Liberty Bagels, which plans to occupy about half the space, in the transaction. David Schectman, Abbe Kassin and Lipa Lieberman of Meridian Capital Group represented the seller, private investor Walter Samuels.

NEW YORK CITY — American Express (NYSE: AXP) has unveiled plans to build a new global headquarters at 2 World Trade Center in Lower Manhattan. The credit card giant will be the sole owner and occupant of the new building, which is slated for completion in 2031. Spanning nearly 2 million square feet across 55 floors, the tower will have capacity to host up to 10,000 colleagues across flexible and modern workspaces. The project will feature more than an acre of outdoor space with several greenery-filled terraces and gardens that will offer views of the Manhattan skyline. “This is an investment in our company’s future, our colleagues and the Lower Manhattan community, reaffirming our deep commitment to the neighborhood we’ve called home for nearly two centuries,” says Stephen Squeri, chairman and CEO of American Express. Silverstein Properties is the developer, and Foster + Partners is the design architect. Fried Frank advised American Express on the development agreement. The project team is pursuing LEED certification and integrating smart-building technology and fully electric, energy-efficient mechanical systems. Located at 200 Greenwich St., the building will be developed on land owned by The Port Authority of New York and New Jersey (PANYNJ) under a …

HAMBURG, N.Y. — San Francisco-based intermediary Gantry has arranged $48.3 million in acquisition financing across three Fannie Mae loans for a portfolio of four multifamily properties totaling 671 units in Hamburg, located just south of Buffalo. The unnamed properties were all built in the 1970s, and the loans were all structured with fixed interest rates. Tom Grzebinski and Zach Wagner of Gantry structured the deal, which involved one loan cross-collateralizing two adjacent properties that will be managed as one community. Walker & Dunlop provided the debt to an undisclosed borrower.

PORT CHESTER, N.Y. — Charlotte-based Truist Bank has provided a $66 million construction loan for a 203-unit multifamily project in Port Chester, located along the New York-Connecticut border. The site is located at 70 Abendroth Road in the downtown area. The six-story building will include roughly 20 affordable housing units that will be reserved for households earning 60 percent or less of the area median income, as well as 10,000 square feet of retail space, a community facility and structured parking. John Alascio and Chuck Kohaut of Cushman & Wakefield arranged the loan on behalf of the developer, Hudson Cos.

BUFFALO, N.Y. — Locally based financial intermediary Largo Capital has arranged a $43.5 million CMBS loan for the refinancing of a 323,260-square-foot industrial building in Buffalo. The address was not disclosed. Completed in 2022, the rail-served building features a clear height of 40 feet and was fully leased at the time of the loan closing. Jack Phillips led the transaction for Largo Capital. The borrower and direct lender were also not disclosed.

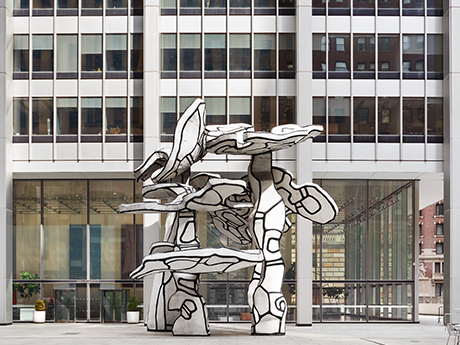

NEW YORK CITY — The New York State Office of the Attorney General (NYS AG) has signed a 378,438-square-foot office lease expansion and extension at 28 Liberty Street, a 60-story, 2.1 million-square-foot building in Lower Manhattan. The deal comprises an extension of the existing 342,484 square feet across floors 13 through 21 and 23, as well as a 35,954-square-foot expansion for the entire 22nd floor. Peter Riguardi, John Wheeler, Mitchell Konsker and Michael Berman of JLL represented the undisclosed landlord in the lease negotiations. The tenant was self-represented.

WEST NYACK, N.Y. — Black Diamond Capital Management, a Connecticut-based alternative investment firm, has purchased Palisades Center, a 2.3 million-square-foot mall in West Nyack, about 35 miles north of New York City. According to the Rockland County Business Journal, Palisades Center sold for $175 million at auction after being originally listed for $463.4 million. According to Wikipedia, the shopping, dining and entertainment destination is the 12th largest U.S. mall by gross leasable area and was first developed by Pyramid Cos., ultimately opening in March 1998. Black Diamond plans to be a long-term owner of Palisades Center and to invest in various capital improvements to attract new users; the Rockland County Business Journal also reports that Palisades Center currently has two vacant anchor spaces that were previously occupied by Lord & Taylor and J.C. Penney. Spinoso Real Estate will operate the property as it has since fall 2024.

Newer Posts